Armored Vehicle Industry Overview

The global armored vehicle market size was valued at USD 16.68 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.9% from 2022 to 2030. The rising focus on protecting soldiers from external and internal threats is expected to propel market growth. The rising awareness about commercial security is expected to drive the demand for personnel armored vehicles. In January 2022, Oshkosh Defense, LLC; military vehicles, mobility systems, and technology solutions designing company; launched its first hybrid-electric Joint Light Tactical Vehicle (JLTV).

The electric JLTV, launched by Oshkosh Defense, LLC, helped in protecting soldiers from physical threats, increased fuel efficiency, and offered a battery capacity of 30kWh. Multilateral collaboration between countries such as North Atlantic Treaty Organization (NATO) and the African Union (AU) to counter terrorism and maintain peace is expected to favor the market growth. Moreover, various governments are opting for the latest machinery to counter emergencies such as insurgencies and militant attacks, which is propelling the demand for armored vehicles.

Gather more insights about the market drivers, restraints, and growth of the Global Armored Vehicle Market

Increasing communal riots and organized crimes in regions such as MEA and the Asia Pacific is another factor driving the growth of the market. For instance, in April 2021, INKAS Armored Vehicle Manufacturing, a Canadian privately held firm specializing in manufacturing, security, and development of armored vehicles, announced its procurement of vehicles to the U.S. government. The company has expanded its capacity and expertise to provide high-quality armored vehicles and fleets, which are available through the United States General Services Administration's (GSA) Advantage program.

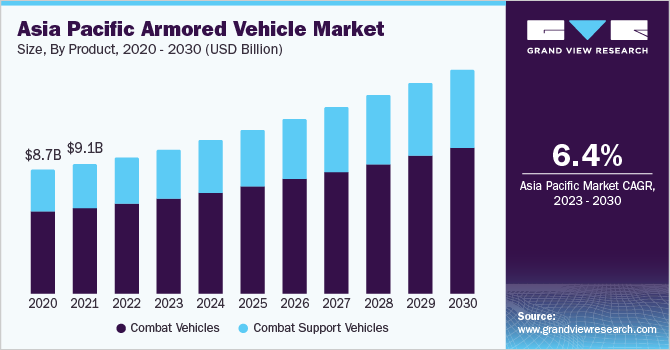

Increasing defense budgets, particularly in the Asia Pacific region, is anticipated to drive market growth. Advancements such as increased fuel efficiency and the use of high-tech sensors in armored vehicles are expected to drive market growth over the forecast period. For instance, in November 2021, HENSOLDT, a German multinational company focusing on sensor technologies for protection and surveillance missions in the security, defense, and aerospace sectors, announced the upgrade of its Multifunctional Self-Protection System (MSFS), a sensor-based system to counter threats.

MSFS helps fight threats such as anti-tank guided missiles and laser-directed ammunition and makes vehicles to identify and ward off newly emerging dangers. The Multifunctional Self-Protection System 2.0 is to optimize the size, weight, and quantity of assemblies. The new laser rider improves directional resolution and threat detecting capability. The increased computer power of the central unit also aids in the detection of missile and projectile threats.

Increasing cross-border criminal activities and terrorism have triggered asymmetric warfare between nations, which is expected to further increase the demand for armored vehicles. The development of lightweight, robust, highly efficient, and compact armored vehicles suitable for defense operations is further expected to propel the growth of the market. In February 2021, Arquus, an automotive firm that provides a variety of light and medium-sized wheeled armored vehicles for military services and internal security forces, introduced Scarabee, a lightweight rugged vehicle to spot, lock, acquire, and hit.

Scarabee is fast, compact, robust, and exceptionally well-defended for its class vehicle. It has been meticulously designed to combine protection, stealth, and agility to safeguard soldiers. However, a limited budget for military spending, particularly in North America and Europe, may pose a challenge to the armored vehicle industry over the forecast period. Additionally, the increasing prices of raw materials, components, vehicle assembly, and machining equipment are expected to hinder the growth of the armored vehicle market.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Commercial Vehicles Market - The global commercial vehicles market size was estimated at USD 1.35 trillion in 2022 and is projected to register a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030.

Intelligent Transportation System Market - The global intelligent transportation system market was valued at USD 26.75 billion in 2021 and is expected to expand at a significant compound annual growth rate (CAGR) of 7.7% from 2022 to 2030.

Armored Vehicle Market Segmentation

Grand View Research has segmented the global armored vehicle market based on product and region:

Armored Vehicle Product Outlook (Revenue, USD Million, 2017 - 2030)

- Defense Armored Vehicle

- Commercial Armored Vehicle

Armored Vehicle Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

February 2021: American Rheinmetall Vehicles, LLC, a subsidiary of Rheinmetall AG, and L3Harris Technologies, an American technology company, defense contractor, and information technology services provider signed a partnership agreement.

February 2021: Bharat Forge, an engineering and technology company, collaborated with the international aerospace and technology conglomerate Paramount Group to combine skills, technologies, and expertise to develop armored vehicles in India.

Key Companies profiled:

Some prominent players in the global Armored Vehicle market include

- BAE Systems

- BMW AG

- Daimler AG (Mercedes Benz)

- Elbit Systems

- Ford Motor Company

- General Dynamics Corporation

- INKAS Armored Vehicle Manufacturing

- International Armored Group

- IVECO

- Krauss-Maffei Wegmann GmbH & Co. (KMW)

- Lenco Industries, Inc.

Order a free sample PDF of the Armored Vehicle Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment