Insurtech Industry Overview

The global insurtech market size was valued at USD 3.85 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 51.7% from 2022 to 2030. The increasing number of insurance claims worldwide is one of the major factors accentuating the market growth. Auto, life, and home are the most common insurance claims secured by people worldwide. According to a 2021 study by the Insurance Barometer, 36% of American respondents planned to purchase life insurance in 2021. Insurance companies are increasingly investing in digital technologies to reduce operational costs and to improve operational efficiency and the entire customer experience.

Digital technologies are used to understand customer needs and to enhance their offerings based on the changing customer needs. According to a survey conducted by EIS Group, a software company, 59% of the insurance companies surveyed increased their investment in digital infrastructure in 2021. Benefits offered by blockchain technology, such as cost savings, faster payments, and fraud mitigation, are driving its demand among insurance companies worldwide. Blockchain technology is used in insurance companies for applications such as Know Your Customer (KYC), Anti-money Laundering (AML) procedures, claim handling, and creating peer-to-peer models.

Gather more insights about the market drivers, restraints, and growth of the Global Insurtech Market

Several insurtech companies are entering into partnerships with insurance companies to offer blockchain technology-based solutions. For instance, in December 2020, Amodo, an insurtech company, announced its partnership with Galileo Platforms Limited, a technology company. Through this partnership, the companies would use blockchain technologies to help insurance companies offer new insurance solutions and transform their customer experience. Insurance companies are increasingly accepting cryptocurrency-based payments. For instance, in December 2021, Metromile, an auto insurance company, announced its plan to allow policyholders to pay premiums and claim payments using cryptocurrency. This initiative is expected to help the company strengthen its market position.

Additionally, in June 2021, Universal Fire & Casualty Insurance Company focused on offering traditional property and casualty insurance to small businesses started accepting cryptocurrency for premium payments. This trend is expected to favor the growth of the insurtech market. The demand for on-demand insurance is growing among consumers as it enables them to purchase insurance coverage on their smartphones at their convenience. Businesses in the on-demand insurance space are increasingly using innovative technologies such as the internet of things, artificial intelligence, big data, and predictive maintenance to reinvent the way on-demand insurance products are underwritten, created, and distributed.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Blockchain Technology Market - The global blockchain technology market size was valued at USD 10.02 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 87.7% from 2023 to 2030.

Artificial Intelligence Market - The global artificial intelligence market size was valued at USD 93.5 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

Insurtech Industry Segmentation

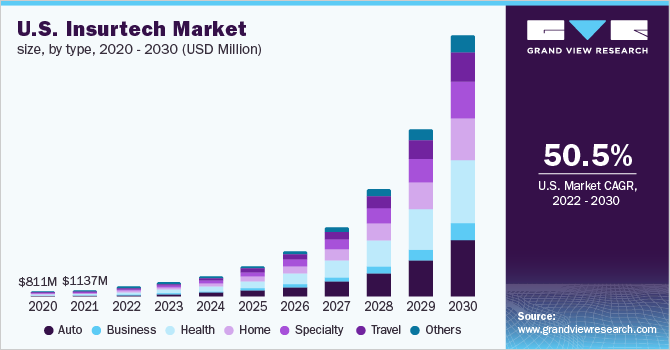

Grand View Research has segmented the global insurtech market based on type, service, technology, end-use, and region:

Insurtech Type Outlook (Revenue, USD Million, 2017 - 2030)

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Insurtech Service Outlook (Revenue, USD Million, 2017 - 2030)

- Consulting

- Support & Maintenance

- Managed Services

Insurtech Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Insurtech End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Automotive

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Transportation

- Others

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

November 2021: Heritage Insurance Holdings Inc., a property and casualty insurance company, announced its partnership with Slide, an insurtech P&C carrier. Through this partnership, the former company would leverage Slide’s capabilities to improve underwriting and rating decisions.

Key Companies profiled:

Some prominent players in the global Insurtech Industry include

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco

- Oscar Insurance

- Quantemplate

- Shift Technology

- Wipro Limited

- ZhongAn Insurance

Order a free sample PDF of the Insurtech Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment