Physical Security Industry Overview

The global physical security market size was valued at USD 116.91 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% during the forecast period. The need to secure the physical environment from activities, such as crime, vandalism, potential burglaries, theft, and fire incidences, is one of the crucial factors expected to drive the market. Moreover, factors, such as increased spending on the security to protect an organization’s critical assets, adoption of cloud-based data storage, advanced analytics, as well as technological developments in access control and video surveillance are some of the key trends expected to drive the market growth.

In addition, the shifting focus from legacy solutions, such as badge readers, alarm systems, and door locks to advanced logical security, which encompasses breach detection, threat management, and intrusion prevention among others, has helped organizations and government agencies to deter crime incidences and breaches at a higher success rate. For instance, in December 2021, Honeywell International Inc., a control system and automation company acquired U.S. Digital, an engineering firm that designs and develops alerting stations and dispatches communication solution providers.

Gather more insights about the market drivers, restraints, and growth of the Global Physical Security Market

This acquisition will be incorporated into Honeywell International Inc.’s life safety systems and fire division, expanding their range of public safety solutions, and giving first responders increased awareness of building crises and improved life safety. This will help securely communicate precise information about the emergency, such as the kind of danger, severity, and position within the affected building, all before the first rescuers arrive. Governments across different countries and regions are taking up smart city initiatives to enhance their infrastructure and are hence deploying improved security systems.

In addition, modernizing the existing infrastructure with robust security measures and strengthening the security of government agencies have been some of the top priorities for governments across developed countries. Organizations are increasingly concerned about employee safety and are hence setting up systems to prevent unauthorized access, further driving the demand for physical security solutions. The physical security environment continues to evolve globally. Over the past few years, numerous sectors and leading industries, such as BFSI, residential, government, and transport, among others have witnessed a swift growth in the number of security breaches.

Furthermore, growing concerns regarding ensuring the safety of resources, people, and vital assets, against physical threats and unique vulnerabilities are anticipated to become major factors driving the need for a robust security environment. Moreover, rising threat incidents have augmented the need to strengthen efforts to maintain a highly secured physical infrastructure at residential as well as business premises. For instance, in September 2021, Johnson Controls, a leading company in security solutions for buildings, launched its autonomous robots and body-worn cameras for its physical security and screening technology.

These smart technologies add to Johnson Controls’ complete building security offering business and residential premises, allowing clients to extend the power of their systems well beyond video surveillance capabilities and typical access control. Governments across major regions are continuously involved in strengthening their physical security infrastructure to curb the growing threats. For instance, in December 2021, Axis Communications, AB, a Sweden-based company that provides services to private sectors and governments around the world, launched its body-worn camera for the private security of government officials. The body-worn cameras have advantages of multiple benefits for liability protection, personal safety, and operational efficiency.

The advent of technology, such as the Internet of Things (IoT), has potentially created vulnerabilities with additional entry points into the data systems through the connectivity of physical objects. However, IoT has also widened the scope of opportunities for the consumer by enabling data protection through the advanced connected networks of the physical security system. Furthermore, innovations and technological advancements in integrated sensors, video, and access systems for IoT-enabled devices are anticipated to spur market growth. For instance, in September 2021, Intel Corp. stated that it uses a software-based IoT platform to manage its physical security & virtual device access. Furthermore, this also ensures that only authorized workers have physical access to the devices through keys or access credentials.

Browse through Grand View Research's Electronic Security Industry Related Reports

Perimeter Security Market - The global perimeter security market size was valued at USD 59.21 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 9.4% from 2022 to 2030.

Contactless Biometrics Technology Market - The global contactless biometrics technology market size was valued at USD 6.92 billion in 2019 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 20.3% from 2020 to 2027.

Physical Security Market Segmentation

Grand View Research has segmented the global physical security market report on the basis of component, organizational size, end-user and region:

Physical Security Component Outlook (Revenue, USD Billion, 2017 - 2030)

- Systems

- Services

Physical Security Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

- SMEs

- Large Enterprises

Physical Security End-user Outlook (Revenue, USD Billion, 2017 - 2030)

- Transportation

- Government

- Banking & Finance

- Utility & Energy

- Residential

- Industrial

- Retail

- Commercial

- Hospitality

- Others

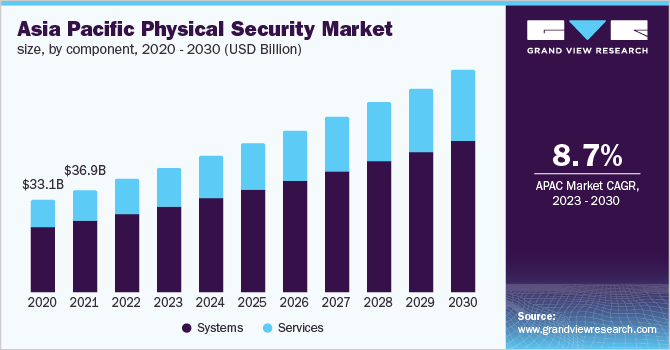

Physical Security Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- South America

- MEA

Market Share Insights:

July 2021: Hexagon AB., which produces and manufactures security systems, acquired Immersal-Part of Hexagon., a visual positioning and spatial mapping systems company.

May 2021: Johnson Controls partnered with DigiCert, Inc., a leading service provider of PKI solutions, to bring advanced digital, physical security solutions to buildings.

Key Companies profiled:

Some prominent players in the global Physical Security market include

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Honeywell International, Inc.

- Genetec, Inc.

- Cisco Systems, Inc.

- Axis Communications AB

- Pelco

- Robert Bosch GmbH

- Johnson Controls

- ADT LLC

Order a free sample PDF of the Physical Security Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment