U.S. Care Services Industry Overview

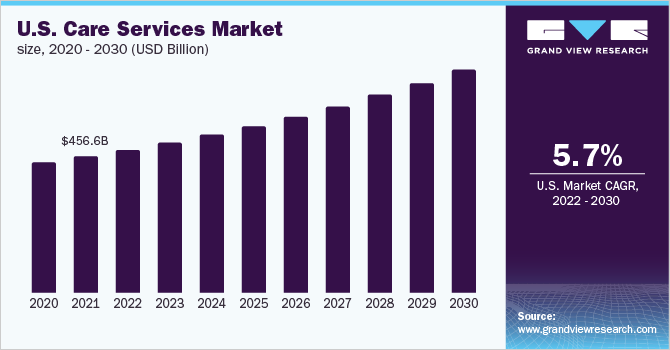

The U.S. care services market size was valued at USD 456.6 billion in 2021 and is expected to exhibit a CAGR of 5.76% during the forecast period. The growing prevalence of chronic diseases, government initiatives, the increasing requirement for nursing homes among the younger population, and the rising elder population are some of the key factors driving the U.S. care services market growth over the years. Moreover, rapid advancement and use of technology-based care services such as app-based teleconsultation, remote patient monitoring, and AI-based therapeutic & monitoring devices are further driving the service demand.

According to the Department of Health & Human Services, 14% of the residents at nursing homes are between the ages of 31 and 64. Around 40% of the adolescents in the U.S. suffer from a chronic disease and are expected to require care services at a younger age. The younger population in the U.S. with disabilities is constantly rising. According to CDC, one in seven young adults suffers from a chronic disorder.

Gather more insights about the market drivers, restraints, and growth of the U.S. Care Services market

Unnecessary hospitalization often results in higher expenditure and degrades the quality of life. Thus, increasing preference for care settings such as home care, nursing homes, hospice, and assisted living facilities among baby boomers in the U.S. is driving the industry size.

The increasing geriatric population, rising prevalence of chronic conditions, cost-effective treatment, and rising need for wireless and portable systems are some of the major factors driving the remote patient monitoring market growth. The growing incidence of chronic diseases demands disease management and continuous patient monitoring tools are boosting the need for connected care devices. These devices are connected to electronic patient health records and provide access to the required health information during the course of treatment.

Government programs, such as Medicare and Medicaid, along with private health insurance companies and managed care organizations have a significant impact on the care services industry.

The federal and state governments in the U.S. are undertaking initiatives for enhancing the reach & quality of care services across the country. The federal government-initiated training & development programs for the workforce at care facilities, ensuring that the best services were provided at the facilities during the pandemic and in the future as well.

State governments are also actively undertaking initiatives for care services. For Instance, Washington State Legislature established a public insurance program, providing coverage for SNF, assisted living, hospice, and other care services, which would be applicable from 2025.

Browse through Grand View Research's Medical Devices Industry Related Reports

Home Healthcare Market - The global home healthcare market size was valued at USD 336.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.93% from 2022 to 2030.

U.S. Assisted Living Facility Market - The U.S. assisted living facility market size was valued at USD 87.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.48% from 2022 to 2030.

U.S. Care Services Industry Segmentation

Grand View Research has segmented the U.S. care services market based on type:

U.S. Care Services Type Outlook (Revenue, USD Billion, 2017 - 2030)

- Skilled Nursing Facility

- Assisted Living Facility

- Hospice and Palliative Care

- Post-Acute Care

- Remote Patient Monitoring

- Home-based Primary Care/House Calls

Market Share Insights:

November 2021: LHC Group acquired home health, hospice, & therapy assets from HCA healthcare.

August 2021: Humana acquired Kindred at Home, which includes services such as personal care, hospice, and home health.

Key Companies profiled:

Some prominent players in the U.S. Care Services Industry include

- Kindred Healthcare, LLC

- Amedisys, Inc

- Sunrise Senior Living, LLC

- National Healthcare Corporation

- Brookdale Senior Living, Inc

- Capital Senior Living Corporation

- Home Instead, Inc

- Genesis Healthcare, Inc

- Diversicare Healthcare Services, Inc

- LHC group, Inc

Order a free sample PDF of the U.S. Care Services Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment