U.S. Companion Animal Health Industry Overview

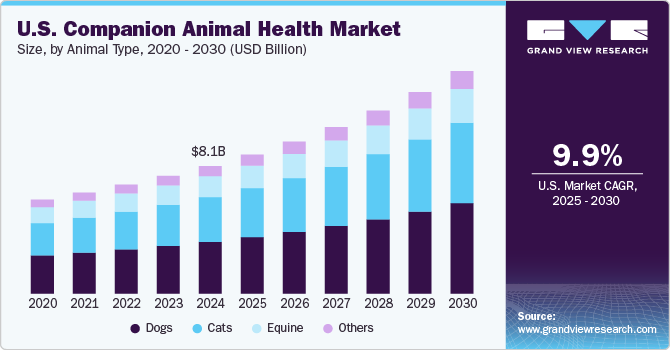

The U.S. companion animal health market size was valued at USD 4.83 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030. The market is primarily driven by the growing adoption of companion animals in the country, coupled with the increasing awareness among pet owners regarding animal diagnostics.

Dogs are the most commonly owned companion animals, followed by cats. According to the U.S. Census Bureau’s American Housing Survey, in 2020, around 67% of households have at least one pet. Growing pet ownership has upped concerns regarding their health, thereby driving the market. The advent of artificial intelligence (AI) has enabled early and accurate diagnosis, thus providing promising growth opportunities in the coming years.

Gather more insights about the market drivers, restraints, and growth of the U.S. Companion Animal Health market

The market is positively impacted by the COVID-19 pandemic as there is an increase in pet adoption. During the first half of 2020, pet adoption in the U.S. alone reported a year-on-year increase of 50%. This has resulted in the increased number of households with pets and significant expenditure on them. Animal health companies as well registered the growth during the pandemic. For instance, Zoetis reported a 7% higher revenue in 2020 compared to the previous year. This performance was driven by the newly launched companion animal parasiticide product as well as Zoetis’ key dermatology portfolio.

Increasing availability and adoption of insurance for companion animals with widening coverage for accidents and illnesses is also anticipated to boost the market growth. As per the North American Pet Health Insurance Association in 2019, the average monthly charge of pet insurance is USD 27.9 for cats and USD 44.7 for dogs, covering both accidents and illnesses. The association also states that dogs accounted for around 83% of insurance premiums while cats held a 17% share. As the cost of surgeries and diagnostics continues to increase, the inclination of pet owners toward insurance is also on a rise.

The rising incidence of cancer, especially in dogs, is anticipated to provide a growth platform for the market. As per the Animal Cancer Foundation, 65 million dogs and 32 million cats are suffering from cancer in the U.S. Dogs are more prone to suffer from malignant neoplasia (tumor) and lymphoma, as per the American Veterinary Medical Association. The market is supported by numerous health initiatives, especially for cancer treatment, by government and private organizations.

Browse through Grand View Research's Animal Health Industry Related Reports

Animal Health Market - The global animal health market size was valued at USD 39.9 billion in 2021 and is expected to witness a compound annual growth rate (CAGR) of 10.0% from 2022 to 2030.

Veterinary Telemetry Systems Market - The global veterinary telemetry systems market size was estimated at USD 271.9 million in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.59% from 2022 to 2030.

U.S. Companion Animal Health Industry Segmentation

Grand View Research has segmented the U.S. companion animal health market on the basis of animal type, product, distribution channel, and end use:

U.S. Companion Animal Health Animal Type Outlook (Revenue, USD Million, 2017 - 2030)

- Dog

- Cat

- Equine

- Others

U.S. Companion Animal Health Product Outlook (Revenue, USD Million, 2017 - 2030)

- Vaccines

- Pharmaceuticals

- OTC

- Prescription

- Feed Additives

- Diagnostics

- Others

U.S. Companion Animal Health Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- Retail

- E-commerce

- Hospital Pharmacy

U.S. Companion Animal Health End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Point-of-care testing/In-house testing

- Veterinary Hospitals & Clinics

- Others

Market Share Insights:

July 2019: Zoetis and Colorado State University entered into an agreement to establish a research lab to develop new immunotherapies for veterinary patients.

April 2019: Merck acquired Antelliq Corporation in order to increase its foothold in animal health monitoring and smart data management for both companion and livestock animals.

Key Companies profiled:

Some prominent players in the U.S. Companion Animal Health Industry include

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Ceva Santé Animale

- Merck Animal Health

- Vetiquinol S.A.

- Virbac, Inc.

- Norbrook Inc.

- Dechra Pharmaceuticals

- Patterson Companies, Inc.

- Vedco Inc.

- Covetrus

- MWI Animal Health

- Nutramax Laboratories Veterinary Sciences, Inc.

- Ellevet Sciences

Order a free sample PDF of the U.S. Companion Animal Health Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment