Real-Time Payments Industry Overview

The global real-time payments market size was valued at USD 13.55 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 34.9% from 2022 to 2030. The market growth can be attributed to the high proliferation of smartphones and the adoption of cloud-based solutions for faster payments. In addition, the increasing demand from customers for quicker payment settlements and growing investments from financial institutes and governments to boost the adoption of real-time payment solutions are expected to accelerate the market growth. The incorporation of innovative technologies, such as Artificial Intelligence (AI) and IoT, in digital payment platforms, is also expected to contribute to the demand for real-time payment solutions.

Digitization has resulted in the increased adoption of real-time payment solutions. Governments across the globe are taking initiatives to promote digital payments with an aim to increase the number of digital transactions in their respective countries. For instance, in December 2019, the Japanese government announced plans to carry out the Cashless Japan initiative to double the number of digital transactions by 2025. The continuous rollout of 5G network and high-speed broadband services worldwide bodes well for the market growth. Governments globally are investing in 5G infrastructure and subsidies to accelerate the adoption of digital payments.

Gather more insights about the market drivers, restraints, and growth of the Global Real-Time Payments Market

For instance, in July 2020, the U.K. government announced an investment of USD 237.4 million in the 5G Testbeds and Trials program (5GTT), which aims to explore new ways to boost business growth in the country. In December 2019, the Federal Communication Commission announced plans to launch a USD 9 billion 5G subsidy program for rural America. Numerous fintech companies across the globe are developing real-time payment solutions to enable corporate clients to send payment requests to bank clients using mobile apps and websites. For instance, JPMorgan Chase & Co. announced the launch of Request for Pay, which enables corporate clients to send a payment request to 57 million retail clients using their mobile app and website.

The demand for real-time payment solutions has particularly increased in the wake of the COVID-19 outbreak. A myriad of unexpected issues, such as payment systems that involve physical touch, have prompted merchants and consumers to consider contactless payment solutions, such as smartphone-based apps designed to make contactless and real-time payments. According to the global report of ACI Worldwide, Inc., a software company, more than 70.3 billion real-time payment transactions were processed globally in 2020, and a surge of 41% for real-time payments was observed during the COVID-19 pandemic.

Browse through Grand View Research's Next Generation Technologies Industry Related Reports

Contactless Payment Market - The global contactless payment market size was valued at USD 34.55 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.1% from 2022 to 2030.

Digital Payment Market - The global digital payment market size was valued at USD 68.61 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.5% from 2022 to 2030.

Real-Time Payments Market Segmentation

Grand View Research has segmented the global real-time payments market on the basis of payment type, component, deployment, enterprise size, end-use industry, and region:

Real-Time Payments Type Outlook (Revenue, USD Million, 2017 - 2030)

- P2B

- B2B

- P2P

- Others

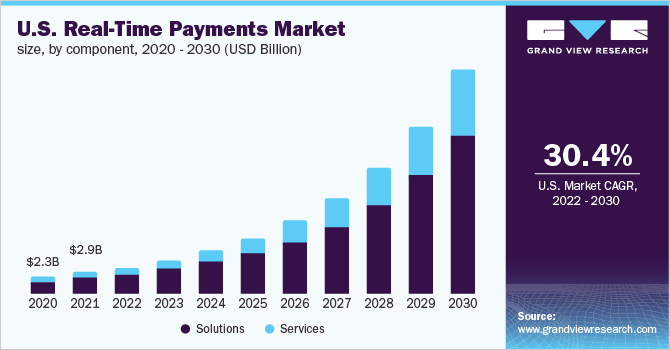

Real-Time Payments Component Outlook (Revenue, USD Million, 2017 - 2030)

- Solutions

- Services

Real-Time Payments Deployment Outlook (Revenue, USD Million, 2017 - 2030)

- Cloud

- On-premise

Real-Time Payments Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

- Large Enterprises

- Small & Medium Enterprises

Real-Time Payments End-use Industry Outlook (Revenue, USD Million, 2017 - 2030)

- Retail & E-commerce

- BFSI

- IT & Telecom

- Travel & Tourism

- Government

- Healthcare

- Energy & Utilities

- Others

Real-Time Payments Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- South America

- MEA

Market Share Insights:

June 2021: Mastercard Incorporated announced the launch of PayPort+, a next-generation real-time payment gateway service, to provide payment service providers and financial institutions with flexible access to the U.K.’s real-time payment infrastructure. The PayPort+ solution is powered by Vocalink, a Mastercard company, and Form3, a technology partner.

Key Companies profiled:

Some prominent players in the global Real-Time Payments market include

- ACI Worldwide, Inc.

- Fidelity National Information Services, Inc. (FIS Inc.)

- Finastra

- Fiserv, Inc.

- Mastercard, Inc.

- Montran Corp.

- PayPal Holdings, Inc.

- Temenos AG

- Visa Inc.

- Volante Technologies, Inc.

- Wirecard AG

- Worldpay, Inc.

Order a free sample PDF of the Real-Time Payments Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment