U.S. Mechanical Ventilators Industry Overview

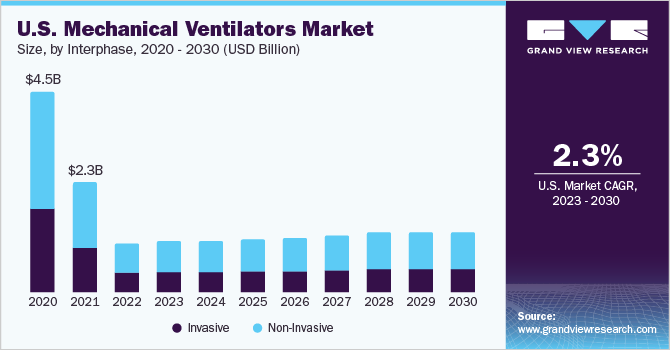

The U.S. mechanical ventilator market size was valued at USD 2.28 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 2.5% from 2022 to 2030. An unusually high incidence of COVID-19 cases has led to a large gap between demand and supply of mechanical ventilators to an extent that automotive and other industrial equipment manufacturers had to step in to increase the supply of this life-saving device. Mechanical ventilators-the life support equipment-are crucial in the management of chronic conditions, such as COPD, respiratory failure, and post-operative care that requires mechanical support for respiration. The COVID-19 pandemic has contributed to the growth of the market.

In 2021 the demand for ventilators is normalized and manufacturers registered a gradual decrease in their sales due to the loaded acquisition of ventilators in the COVID-19 crisis. Moreover, the termination of HHS’ contract with Philips, Hamilton, and Vyaire for ventilator production adds up to the declining growth of the ventilator market. The introduction of alternative treatment solutions such as makeshift ventilators, manual resuscitators, PAP devices, anesthesia gas machines, etc. along with the declining COVID-19 critically ill population and vaccine launch would lower the market growth.

Gather more insights about the market drivers, restraints, and growth of the U.S. Mechanical Ventilators Market

The market is moving toward saturation as various manufacturers have speeded up their production capacities to meet the existing demand. However, as the prevalence of chronic diseases is on the rise, the demand for critical care units, like ventilators, is expected to be high in the coming years. Moreover, with technological advancements, the demand for low-cost and advanced feature ventilators is anticipated to increase in the years to come.

Export bans on critical care equipment implemented by various governments during the pandemic have resulted in encouraging local manufacturers to focus on increasing their production capacities. For instance, in India, AgVa Healthcare, a local manufacturer is helping the government by increasing the supply and production of ventilators. These types of initiatives undertaken by developing countries resulted in the decreasing demand from the U.S. manufacturers thereby responsible for declining market growth in 2022.

Browse through Grand View Research's Medical Devices Industry Related Reports

Therapeutic Respiratory Devices Market - The global therapeutic respiratory devices market size was valued at USD 18.0 billion in 2022 and is expected to witness a compound annual growth rate (CAGR) of 6.10% from 2023 to 2030.

Smart Inhalers Market - The global smart inhalers market size was valued at USD 10.9 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 19.3% from 2022 to 2030.

U.S. Mechanical Ventilators Market Segmentation

Grand View Research has segmented the U.S. mechanical ventilator market based on product and end use:

U.S. Mechanical Ventilator Product Outlook (Revenue, USD Million, 2017 - 2030)

- Ventilators

- Accessories

U.S. Mechanical Ventilator End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospital

- Home care

- Others

Market Share Insights:

October 2021: U.S. based company named Movair announced the launch of the Luisa ventilator to be used in homes, hospitals, or potable settings. It has added benefit of high flow oxygen therapy.

Key Companies profiled:

Some prominent players in the U.S. Mechanical Ventilators market include

- Getinge AB

- Vyaire Medical Inc.

- Medtronic

- Drägerwerk AG & Co. KGaA

- GE Healthcare

- Koninklijke Philips N.V.

- Smiths Group plc

- Hamilton Medical

- ResMed Inc.

- Ventec Life Systems

Order a free sample PDF of the U.S. Mechanical Ventilators Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment