Livestock Monitoring Industry Overview

The global livestock monitoring market size was valued at USD 4.62 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 17.63% from 2022 to 2030. The growth of the market can be attributed to the upsurge in cattle population, coupled with the growing adoption of livestock monitoring technology. Furthermore, these monitoring systems are gaining popularity as there is substantial cost-saving associated with livestock monitoring management.

The COVID-19 outbreak caused due to SARS-CoV-2 has affected millions of people globally. The contagious coronavirus is also having an economic impact and implications on most of the sectors, including the animal health industry. Nationwide lockdown and social distancing have suspended or delayed veterinary visits, which is expected to increase the demand for livestock monitoring. Despite the disruptions brought by the pandemic, market players managed to support customers in various ways to minimize disruption in their operations. They adapted ways of working by growing remote digital services to their customers, including virtual solutions for activities such as product trials and equipment installation.

Gather more insights about the market drivers, restraints, and growth of the Global Livestock Monitoring Market

The global livestock population has been increasing rapidly over the past few decades. In 2021, India, Brazil, and China accounted for around 65% of the world's cattle inventory. In developing economies, the demand for livestock products is increasing. The livestock population in India has increased by 4.6%, from 512 million in 2012 to nearly 536 million in 2019. Growing concerns over food security and increasing animal husbandry occupations are boosting the demand for livestock monitoring systems.

Rapid innovation and increasing research and technology are likely to positively impact the market growth. The emergence of livestock monitoring systems in developed economies has enabled the real-time monitoring of livestock. Sensors have enabled farmers to monitor pulse rate, temperature, blood pressure, rate of respiration, and other functions. Moreover, GPS-enabled devices assist the farmers to trace and locate the grazing herd. Moreover, the IoT sensors track sick animals among the herd and optimize grazing patterns.

An increase in the incidence of zoonotic diseases is driving the market for animal monitoring devices. Almost 60% of the emerging infectious diseases in humans are zoonotic. The ongoing COVID-19 pandemic is the most recent instance of how hazardous animal viruses can be on a global scale. Outbreaks in the livestock can be major socioeconomic threats, resulting in production loss and disruption of local markets, rural economy, and international trade. Additionally, some of the bacteria that cause livestock diseases can be transmitted to humans, such as E. coli and salmonella.

Global meat production has increased rapidly over the past 50 years due to the increasing demand, which is fueling the market growth. Asia held around 40% to 50% of the share in the global meat production market as of 2019. Other major producers include the U.S., China, Brazil, Australia, and Argentina. Increasing disposable income in developing economies is further boosting market growth. According to a report by the Australian Bureau of Agriculture and Resources Economics and Sciences, China will represent around a 40% increase in meat demand by 2050.

Browse through Grand View Research's Animal Health Industry Related Reports

Veterinary Medicine Market - The global veterinary medicine market size was estimated at USD 44.59 billion in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 8.2% over the forecast period.

Rabies Veterinary Vaccines Market - The global rabies veterinary vaccines market size was valued at USD 584.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030.

Livestock Monitoring Industry Segmentation

Grand View Research has segmented the global livestock monitoring market on the basis of animal type, component, application, and region:

Livestock Monitoring Animal Type Outlook (Revenue, USD Million, 2017 - 2030)

- Cattle

- Poultry

- Swine

- Equine

- Others

Livestock Monitoring Component Outlook (Revenue, USD Million, 2017 - 2030)

- Hardware

- Software

- Services

Livestock Monitoring Application Outlook (Revenue, USD Million, 2017 - 2030)

- Milk Harvesting

- Breeding Management

- Feeding Management

- Animal Health Monitoring & Comfort

- Heat Stress

- Behavior Monitoring

- Other

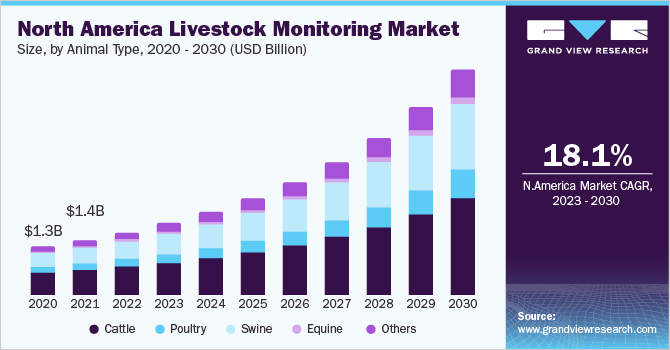

Livestock Monitoring Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

March 2021: GEA launched DairyNet, which is a new herd and farm management solution. It would be accessible for use with the GEA DairyRobot R9500.

February 2021: MSD Animal Health announced the acquisition of PrognostiX Poultry Limited, a provider of health and environmental monitoring solutions for the poultry business, which expanded its product portfolio.

Key Companies profiled:

Some prominent players in the global Livestock Monitoring Industry include

- GEA Group Aktiengesellschaft

- Afimilk Ltd.

- DeLaval

- Sensaphone

- Intervet Inc., a subsidiary of Merck & Co. Inc.

- BouMatic

- Dairymaster

- Lely

- Fancom BV

- Fullwood Packo

Order a free sample PDF of the Livestock Monitoring Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment