U.S. Electric Vehicle Charging Infrastructure Industry Overview

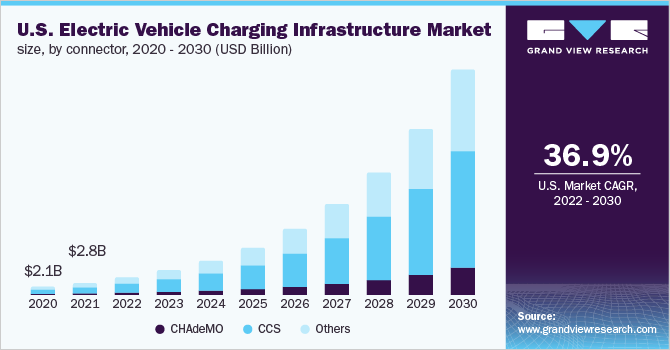

The U.S. electric vehicle charging infrastructure market size was valued at USD 2.85 billion in 2021 and is expected to advance at a compound annual growth rate (CAGR) of 36.9% from 2022 to 2030. The market growth can be attributed to the growing initiatives taken by both public as well as private sectors to encourage the population to switch to Electric Vehicles (EVs). These initiatives have promoted the sale of electric vehicles and have also spread consumers’ awareness about the benefits of using these vehicles. Moreover, the development of technologies like portable charging stations, smart charging with load management, automated payment technology, and bi-directional charging is further expected to create new growth opportunities for the market during the forecast period.

Numerous electric vehicle charging station providers are focusing on developing new products that provide customers with better-charging infrastructures. For instance, in September 2021, SemaConnect Inc. announced the launch of the new Series 8 retail EV charging station. Series 8 is a level 2 charging station that features SemaConnect's slim design, an easy-to-use network platform, and interactive LED lights. Such initiatives are expected to create more growth opportunities for the market during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the U.S. Electric Vehicle Charging Infrastructure Market

The U.S. is adopting aggressive emission reduction measures by implementing regulatory policies and regional initiatives to reduce atmospheric CO2 concentrations. Many metropolitan cities such as New York City, Los Angeles, and Houston, among others, have been facing air quality issues, which have caused respiratory diseases. Such conditions are making it difficult to survive in the existing environment. In 2016, the EPA approved new rules (National Emissions Ceilings (NEC) Directive) for its member states to cut down air pollution levels. All these factors together are propelling the need for an eco-friendly and low residual mode of transportation. Thus, promoting the adoption of electric vehicles, along with the increasing need for supporting electric vehicle charging infrastructure.

Many Original Equipment Manufacturers (OEMs) of electric vehicles, such as Tesla, Ford, and General Motors, offer a wide range of electric vehicles that have attracted many consumers, resulting in an increased market for electric vehicles. For instance, in June 2021, General Motors announced its plans to invest USD 35 billion to develop and increase its EV production capacity to more than one million by 2025. Moreover, in January 2022, General Motors said that it had planned to invest roughly USD 6.6 billion in its home state of Michigan by 2024 to increase its electric pickup truck production and build a new EV battery cell plant. Such investments are expected to boost the U.S. electric vehicle charging infrastructure market in the forecast period.

Technological advancements such as fast charging and increased vehicle range are anticipated to transform the U.S. automotive industry during the forecast period. The major trends driving the adoption of Electric Vehicles (EVs) are the emergence of self-driving vehicles and the growth of shared mobility. Both of these factors have a significant impact on U.S. EV vehicle sales. The growth of ride-hailing and ridesharing services will enable users to increase the utilization rate, which in turn will provide economical transportation facilities to commuters. The growing popularity of the mobility-as-a-service (MaaS) model is also anticipated to lead to increased adoption of electric vehicles. However, high costs of infrastructure and the initial setup are emerging as major factors hampering the market growth.

Costs incurred for research & development activities are highly significant since they require a dedicated workforce. Overall, the need for financial and human resources to develop innovative charging equipment is expected to restrain the market growth during the forecast period. Moreover, the outbreak of the COVID-19 pandemic has resulted in the slowdown of the automotive sector in numerous countries, which is expected to hinder market growth in the near future.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Electric Bus Market - The global electric bus market size was valued at USD 40.1 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.5% from 2022 to 2030.

Electric Three Wheeler Market - The global electric three wheeler market size was valued at USD 829.5 million in 2021 and is anticipated to register a compound annual growth rate (CAGR)of 7.5 % during the forecast period.

U.S. Electric Vehicle Charging Infrastructure Market Segmentation

Grand View Research has segmented the U.S. electric vehicle charging infrastructure market based on charger type, connector, and application:

Charger Type Outlook (Revenue, USD Million; Volume, Units, 2017 - 2030)

- Slow Charger

- Fast Charger

Connector Outlook (Revenue, USD Million; Volume, Units, 2017 - 2030)

- CHAdeMO

- Combined Charging System

- Others

Application Outlook (Revenue, USD Million; Volume, Units, 2017 - 2030)

- Residential

- Commercial

Market Share Insights:

November 2020: ChargePoint, Inc. announced its partnership with Volvo Car USA LLC to provide a seamless charging experience to Volvo car drivers.

August 2020: Venture Port District announced the installation of five new SemaConnect Inc. charging stations for visitors to Venture Harbor. At the same time, the Series 6 charging stations are designed to replace the old pair of charging stations at Island Packers, which will be opened for all plug-in EV drivers at the harbor.

Key Companies profiled:

Some prominent players in the U.S. Electric Vehicle Charging Infrastructure market include

- ABB

- Bp pulse

- Delta Electronics, Inc

- Webasto Group

- ChargePoint, Inc.

- General Electric Company

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Tesla, Inc.

- ClipperCreek, Inc.

Order a free sample PDF of the U.S. Electric Vehicle Charging Infrastructure Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment