Facial Fat Transfer Industry Overview

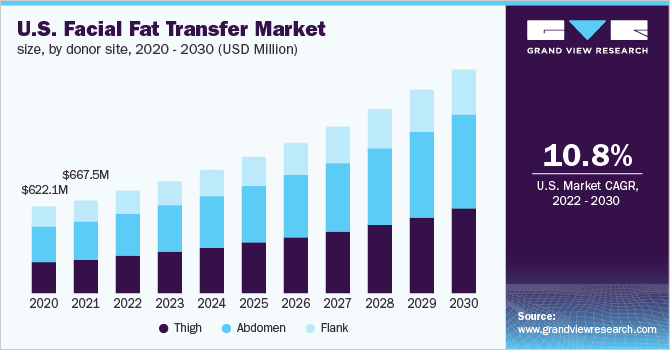

The global facial fat transfer market size was valued at USD 1.9 billion in 2021 and is expected to expand at a CAGR of 10.8% from 2022 to 2030. The rising geriatric population and the growing demand for cosmetic procedures are anticipated to fuel the demand for facial fat transfer. The advent of the COVID-19 pandemic has hugely affected the global market. But many aesthetic professionals believe that the pandemic might propel the overall aesthetic industry. Many dermatology clinics have witnessed a boost in the number of future appointments and consultations for skin treatments, implying that facial fat transfer treatments that can assist with treating signs of aging may witness growth. Facial fat transfers have also been used to correct facial scarring and can be injected into areas such as temples, forehead, upper and lower orbit, cheeks, perioral region, nasolabial fold, jawline, and chin. Plastic surgeons are increasingly suggesting fat grafting for facial volume augmentation surgery, owing to its various advantages over traditional dermal fillers.

As compared to conventional dermal fillers, the results of facial fat transfer last longer, have zero/minimal adverse reactions and are cost-effective from a long-term perspective. Fat transfer, also known as autologous fat transfer or fat grafting, is mainly performed to enhance the aesthetic appeal of the face by reducing crow’s feet, smile lines, or frown lines. An increase in the incidences of such conditions due to aging & pollution is propelling the demand for facelifts, thus driving the market for facial fat transfer. In such treatments, fat is harvested generally from the abdomen or thigh, which is then processed and carefully injected into the lines, hollows, and depressions of the face to rejuvenate and recontour the facial features.

Gather more insights about the market drivers, restraints, and growth of the Global Facial Fat Transfer Market

For instance, since the fat used for grafting is obtained from the patient’s own body, it has almost zero probability of causing an adverse reaction, whereas the hyaluronic acid-based dermal filler has a potential risk of causing multiple allergic reactions. Such advantages are expected to drive the market for facial fat transfer during the forecast period.

In 2020, nearly 24,529,875 cosmetic procedures (including both minimally invasive & surgical) were performed as per a report by the International Society of Aesthetic Plastic Surgery. Two of the top five surgical procedures were liposuction and tummy tuck. The increasing demand for these procedures is anticipated to drive the market for facial fat transfers. The report also stated that fat transfer procedures on the face witnessed a 10.4% increase from 2018 to 2019, indicating that the treatment adoption is rising. This can be attributed to the cost-effectiveness of the combination of these procedures along with the fat transfer process.

Despite the COVID-19 pandemic negatively impacting several industries, the aesthetic treatment market has witnessed an increase in procedures by the end of 2020. In 2021, the market has witnessed high demand due to the backlog of 2020 and increased interest from people related to dermatological procedures. The market witnessed a decline of 13.0% in 2020 as compared to 2019. This was majorly due to the fact that such treatments are high contact services that increased the chances of virus transmissions. Therefore, many clinics witnessed a drop in patient footfall, as patients were hesitant to undergo such treatments.

However, the International Society of Plastic Surgery stated that the demand for invasive as well as non-invasive aesthetic treatments has increased significantly in the latter months of 2020 and the beginning of 2021, indicating that treatments like facial fat transfer might witness a significant recovery post-pandemic.

Browse through Grand View Research's Medical Devices Industry Related Reports

Non-invasive Fat Reduction Market - The global non-invasive fat reduction market size was valued at USD 1.1 billion in 2021 and is anticipated to register a compound annual growth rate (CAGR) of 16.1% from 2022 to 2030.

Mesotherapy Market - The global mesotherapy market size was valued at USD 98.9 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 14.4% from 2021 to 2028.

Facial Fat Transfer Industry Segmentation

Grand View Research has segmented the global facial fat transfer market based on donor site, end-use, and region:

Facial Fat Transfer Donor Site Outlook (Revenue, USD Million, 2018 - 2030)

- Thigh

- Abdomen

- Flank

Facial Fat Transfer End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital

- Clinics & surgery centers

Facial Fat Transfer Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

June 2021: Sihuan Pharmaceutical Holdings Group Ltd. obtained the exclusive distribution right for its LipiVage fat collection system, manufactured by the U.S-based Genesis Biosystems, in Greater China and South Korea, which will expand the pipeline for medical aesthetic products for the company.

September 2016: Alma Lasers announced the launch of LipoLife 3G, a liposuction device used for various applications such as fat grafting, liposuction, and skin tightening. This device is a third-generation product in the company’s already existing brand called LipoLife.

Key Companies profiled:

Some prominent players in the global Facial Fat Transfer Industry include

- Ranfac Corp

- Alma Lasers.

- Allergan Plc.

- Medikan International Inc

- Genesis Biosystems

- Emory Healthcare

- Stanford Health Care

Order a free sample PDF of the Facial Fat Transfer Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment