Food Service Equipment Industry Overview

The global food service equipment market size was valued at USD 34.49 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. Changing food consumption patterns, increased demand for takeaways and the expanding hospitality sector are some of the key factors driving the market. Furthermore, factors such as increasing digitalization, the need for sustainable & eco-friendly equipment, and stringent consumer safety norms are expected to create promising growth opportunities for the market in the near future.

The market has rapidly evolved following the changing needs of clients for outfitting their kitchen spaces. Changing social customs coupled with technological progressions, have created a dynamic marketplace for the equipment used in the end-use sector. From the discovery of equipment for preparing and storing food, such as cooking stoves, ranges, and electrical refrigerators, to the availability of custom foodservice appliances to cook different cuisines, the range of technologically-advanced and innovative products has entered the market over the years and is expected to favor the market growth in the longer run. Furthermore, rapid technological advancements achieved with the help of continual Research & Development (R&D) activities have helped appliance manufacturers to offer technology-driven efficiencies to their clients.

Gather more insights about the market drivers, restraints, and growth of the Global Food Service Equipment Market

The market demand has significantly increased in response to the emergence of several casual restaurant chains in North America and Europe. Companies are mandated to sell certified and tested commercial kitchen appliances according to the safety rules laid by several regulatory bodies worldwide. These safety standards aim to create a guarded environment for both the restaurant operators and consumers. National Sanitation Foundation (NSF), an American product testing, inspection, and certification non-profit organization, has developed equipment safety standards to ensure food safety requirements and sanitation protocols are maintained by the end-use sector. With food safety being the utmost priority, standards have been set for the material used, design, and equipment architecture.

The growing awareness about energy consumption and eco-friendly initiatives facilitates consumers to adopt energy-efficient appliances, thereby creating opportunities for this market. Energy consumption norms across the globe emphasize reducing the Green House Gas (GHG) emissions to mitigate the rising impact of climate change. End customers are increasingly preferring appliances holding the ENERGY STAR symbol, a mark of energy efficiency of the equipment, which helps restaurants, institutional kitchens, and cafes save energy while also reducing maintenance and utility costs. As reported in 2018 by the Energy Star program of the U.S, Environmental Protection Agency (EPA), food service equipment with the ENERGY STAR symbol helps the end-use operators to save USD 5,300 or around 340 MMBTU per year.

The COVID-19 pandemic resulted in the temporary shutdown of food service operations owing to stringent social distancing and shelter-in-place norms imposed by governments worldwide. This resulted in negative growth of the industry as both production and sales were negligible during 2020. Nevertheless, as governments announce relaxations to lockdowns and the first vaccines arrive, the food service industry is expected to bounce back over the forecast period. While the dine-in restaurant traffic is expected to take longer to come to normalcy, end customers are expected to recover through off-premise, takeaways, and online delivery services. On account of the subsequent rise in footfall in food service restaurants and institutional kitchens, the beleaguered market is expected to flourish over the years to come.

Browse through Grand View Research's Food Safety & Processing Industry Related Reports

Packaging Machinery Market - The global packaging machinery market size was estimated at USD 44.17 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030.

Food Preservatives Market - The global food preservatives market size was valued at USD 2.77 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030.

Food Service Equipment Market Segmentation

Grand View Research has segmented the global food service equipment market based on product, end-user, and region:

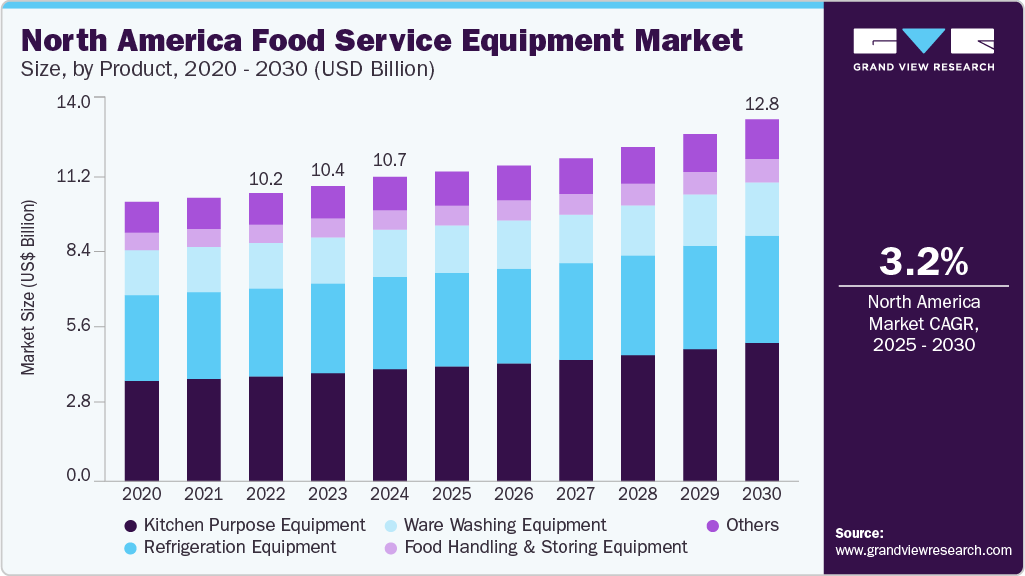

Food Service Equipment Product Outlook (Revenue, USD Billion, 2017 - 2030)

- Kitchen Purpose Equipment

- Refrigeration Equipment

- Ware Washing Equipment

- Food Holding & Storing Equipment

- Others

Food Service Equipment End-user Outlook (Revenue, USD Billion, 2017 - 2030)

- Full Service Restaurant (FSR)

- Quick Service Restaurant (QSR)

- Institutional

- Others

Food Service Equipment Regional Outlook (Revenue, USD Billion, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Key Companies profiled:

Some prominent players in the global Food Service Equipment market include

- AB Electrolux

- Ali Group S.r.l. a Socio Unico

- Dover Corporation

- Duke Manufacturing

- Haier Group

- SMEG S.p.A.

- The Middleby Corporation

Order a free sample PDF of the Food Service Equipment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment