Content Delivery Network Industry Overview

The global content delivery network market size was valued at USD 15.47 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 23.0% from 2022 to 2030. The COVID-19 pandemic has directly affected the market as the content delivery network vendors rely on several economic factors, such as vibrant financial markets, the flow of liquidity, and capital from financial institutes, for their revenue. Despite these factors, the CDN market is expected to witness steady growth over the forecast period due to the increasing volumes of data being exchanged on the internet in line with the continuous rollout of high-speed networks.

Numerous organizations globally are not renewing their on-premise CDN service subscriptions as they have shifted to working remotely due to the pandemic. Content delivery network solutions are extensively used in the media and entertainment industry to boost audio and video content delivery. The continuous evolvement of content consumption and the need for high-quality and original content has catered to the need for efficient CDN solutions that can improve network performance and enhance content delivery. The growing demand for Over the Top (OTT) and Video-on-Demand (VOD) services will ensure continuous content delivery over a high-speed data network and is expected to boost the growth of the market over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Global Content Delivery Network Market

The global e-commerce industry is continuously evolving in line with the evolving consumer behavior. CDN solutions are effectively deployed in e-commerce industries to ensure that the industries operate efficiently at full capacity and that customers have access to all the necessary data to make an informed buying choice. Customers are shifting from traditional television to video content delivery over a cellular network, as CDN solutions are also being deployed in that domain to improve content delivery. Simultaneously, the application of digital solutions based on IoT networks and artificial intelligence across various industries is driving market players to develop and promote customized industry-specific CDN solutions.

The growing adoption of OTT and VOD services involves broadcasters offering latency-free data over the network and enhancing the quality of video delivery. The continuous investments in network infrastructure worldwide, especially in emerging economies such as India, have improved the overall network connectivity, bandwidth, and coverage. These developments have been instrumental in ensuring consumers can stay connected, get instant updates, and retrieve readymade media data. This is a driving factor for broadcasters to enhance content delivery while delivering diversified data for consumption across several applications.

Additionally, digital marketing preferences and online gaming are growing considerably, particularly in countries, such as India and China. The advancements in technology coupled with the smart city initiatives and impending rollout of 5G networks are also key driving factors for the growth opportunities for the content delivery network market in the forthcoming years. At this juncture, major platform providers and companies are increasingly pursuing vertical and horizontal integration initiatives to withstand the intense competition. As such, organizations that are commonly known for offering technology solutions are shifting towards content market space.

Browse through Grand View Research's Communications Infrastructure Industry Related Reports

Network Automation Market - The global network automation market size was valued at USD 2.58 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 22.9% from 2022 to 2030.

Network Equipment Market - The global network equipment market size was valued at USD 142.70 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2022 to 2030.

Content Delivery Network Industry Segmentation

Grand View Research has segmented the global content delivery network market based on content-type, solutions, service provider, end use, and region:

CDN Content-type Outlook (Revenue, USD Million, 2017 - 2030)

- Static

- Dynamic

CDN Solutions Outlook (Revenue, USD Million, 2017 - 2030)

- Web Performance Optimization

- Media Delivery

- Cloud Security

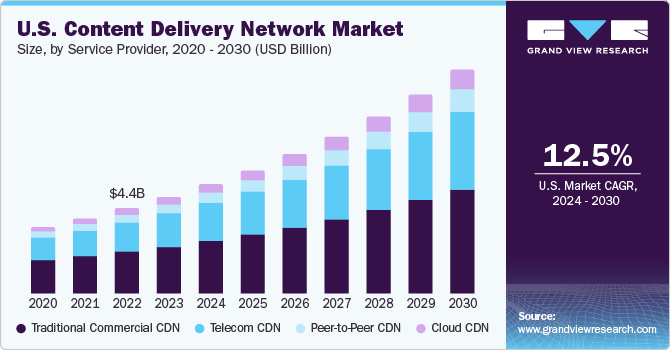

CDN Service Provider Outlook (Revenue, USD Million, 2017 - 2030)

- Traditional Commercial

- Cloud

- Peer-to-Peer

- Telecom

CDN End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Advertising

- E-commerce

- Media & Entertainment

- Gaming

- Others

Content Delivery Network Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

December 2021: Limelight Networks, Inc., a leading provider of CDN services, announced the availability of GraphQL functionality for its Layer0 by Limelight web application CDN. This new functionality enhances Limelight’s presence in the web application CDN market, especially for web builders.

Key Companies profiled:

Some prominent players in the global Content Delivery Network Industry include

- Akamai Technologies

- Amazon Web Services, Inc.

- International Business Machines Corp.

- Limelight Networks

- Verizon

- AT&T Intellectual Property

- Google LLC

- Microsoft

- CenturyLink

- Deutsche Telekom AG

- Tata Communications

- Fastly, Inc.

- Tencent Cloud

- Kingsoft Corporation, Ltd.

- Alibaba

Order a free sample PDF of the Content Delivery Network Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment