Poultry Vaccines Industry Overview

The global poultry vaccines market size was valued at USD 1.86 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2022 to 2030. Growing product R&D, rising incidence of diseases in poultry, demand to secure food sources, and awareness and initiatives to curb antimicrobial resistance are some of the key drivers of this market. In 2019, HIPRA extended its coccidiosis vaccine lineup with the launch of EVANT - an attenuated vaccine for broilers.

The COVID-19 pandemic adversely impacted the poultry industry with dampened demand, low sales, unsold inventories, and a drop in prices of poultry meat and eggs. The impact was more pronounced in countries with large poultry populations such as India. Although egg production, dairy production, meat production was included in essential services, the lockdown and movement restrictions disrupted the supply chain. These hurdles combined with the emergence and fear of other avian diseases such as Bird flu in India exacerbated the adverse impact of the pandemic.

Gather more insights about the market drivers, restraints, and growth of the Global Poultry Vaccines Market

However, the COVID-19 pandemic has created opportunities for vaccine manufacturers that can be leveraged to gain market share. This is owing to the growing awareness regarding animal diseases, demand for safe food stock and products, and concerns over zoonoses. Venkys India, for instance, is a key market player involved in the production of SPF eggs, broiler and layer breeding, chicken and eggs processing, poultry feed and equipment, vaccine production, biosecurity products, and many more. The company offers a wide portfolio of poultry vaccines, which together with other poultry products contributed to a 45% revenue share in 2019.

The growing poultry population combined with the rising prevalence of avian diseases is expected to drive the demand for poultry vaccines. Infected meat consumption risks human health, thereby making it imperative that the birds be vaccinated before usage. The main obstacles faced by poultry farms are the rapid spread of diseases and the lack of treatment options. To prevent such situations, vaccination becomes mandatory. In 2019, the U.S. had 19.72 million livestock units of chicken, while Brazil had 14.6 million livestock units of chicken. The large poultry population indicates a significant number of poultry that is susceptible to avian diseases, which can be prevented with timely vaccinations.

According to the OIE-WAHIS database, there were a total of 22 new outbreaks in birds across the globe. This number rose sharply to 836 new outbreaks in 2020 with cases estimated at 2.79 million. The increasing incidence of disease outbreaks in the avian population is thus a key driver for the market. One of the most recent disease notifications includes low pathogenic avian influenza reported in poultry in Italy and highly pathogenic avian influenza reported in Russia in October 2021.

Browse through Grand View Research's Animal Health Industry Related Reports

Rabies Veterinary Vaccines Market - The global rabies veterinary vaccines market size was valued at USD 584.8 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030.

Animal Wound Care Market - The global animal wound care market size was estimated at USD 1.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.92% over the forecast period.

Poultry Vaccines Industry Segmentation

Grand View Research has segmented the global poultry vaccines market on the basis of application, product, disease type, and region:

Poultry Vaccines Application Outlook (Revenue, USD Million, 2017 - 2030)

- Broiler

- Layer

- Breeder

Poultry Vaccines Product Outlook (Revenue, USD Million, 2017 - 2030)

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines

Poultry Vaccines Disease Type Outlook (Revenue, USD Million, 2017 - 2030)

- Infectious Bronchitis

- Infectious Bursal Diseases

- Infectious Laryngotracheitis

- Egg Drop Syndrome

- Adenovirus

- Duck Viral Enteritis

- Inclusion Body Hepatitis

- Coccidiosis

- Avian Influenza

- Marek's Disease

- Newcastle Disease

- Salmonella

- Avian Encephalomyelitis

- Fowl Cholera

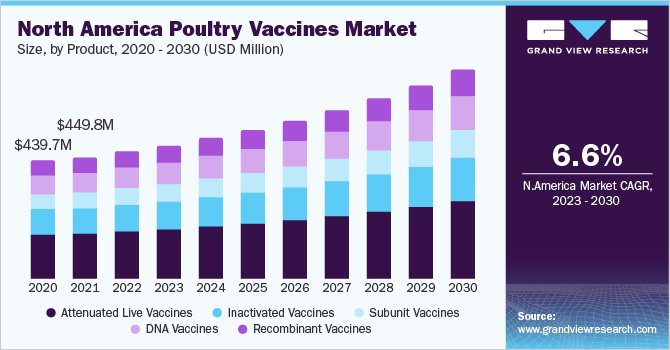

Poultry Vaccines Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

January 2020: Boehringer Ingelheim launched the VAXXITEK HVT+IBD+ND vaccine to protect poultry against Newcastle Disease, Marek’s Disease, and Infectious Bursal Disease (classic and variant types).

July 2019: Ceva acquired IDT Biologika GmbH’s veterinary biopharmaceutical as well as R&D business.

Key Companies profiled:

Some prominent players in the global Poultry Vaccines Industry include

- Boehringer Ingelheim International GmbH

- Ceva

- Zoetis

- Elanco

- Intervet Inc., a subsidiary of Merck & Co., Inc.

- Hester Biosciences Limited

- Vaxxinova International BV

- Venkys India

- Calier

- KM Biologics

- Phibro Animal Health Corporation

Order a free sample PDF of the Poultry Vaccines Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment