Off-highway Vehicle Lighting Industry Overview

The global off-highway vehicle lighting market size was estimated at USD 974.3 million in 2021. It is anticipated to expand at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030. This market growth can be accredited to the high demand for mining and construction equipment worldwide. Furthermore, the growing adoption of LED lighting due to its capability to deliver enhanced performance will also drive the industry growth by 2030. Government regulations toward vehicle lights and workspace safety are also projected to support the adoption of the product. Additionally, the growing demand for enhanced comfort, safety, and convenience in automobiles, particularly in developing and mature economies, is also expected to propel market growth over the forecasted period.

The world economy has been hit hard by the rate at which the coronavirus pandemic has escalated. The market is most vulnerable to the current COVID-19 crisis owing to its reduced demand for heavy off-highway equipment. Efforts to contain the coronavirus pandemic has resulted in supply chain disruptions, with several production facilities coming to a halt. The outbreak has also taken a toll on the sale of heavy off-highway equipment, subsequently impacting the demand for off-highway vehicle lighting. As per the U.S. federal government, nearly more than 50% of construction site accidents involve heavy equipments. Between 2003 and 2010, more than 37% of the accidents were caused by dump trucks. In 2016, there was a 9% increase in crashes that involved dump trucks. To ensure labor safety, the governments of numerous countries are adopting standard rules and regulations regarding vehicle lighting. The growing demand for heavy construction equipment, including loaders and excavators, particularly in India and China, owing to heavy investments in public infrastructure development is also expected to support industry growth.

Gather more insights about the market drivers, restraints, and growth of the Global Off-highway Vehicle Lighting Market

For instance, the Indian construction equipment market was valued at around USD 2.8 billion in 2019 and is expected to double by 2030. Such a significant rise in the demand for construction equipment is likely to bolster the need for vehicle lighting. Government initiatives aimed at encouraging the adoption of LEDs for decreasing energy consumption, coupled with the plummeting prices of LED products, are increasing the demand for LED lights.

While the proposed ban on incandescent and HID bulbs in several countries, including Japan, U.K., Canada, and India, has had a moderate effect on the market, both the lighting types remain significant for the automotive and off-highway vehicle lighting market. Furthermore, the government of Canada is laying emphasis on developing a strategy to mitigate the country’s Greenhouse Gas (GHG) emissions and encourage the adoption of zero-emission vehicles.

Europe is one of the world’s most prominent manufacturers of off-highway vehicles and has also been observing a sharp decline in the sales of equipment. In the region, the production of forestry and agricultural machinery declined by around 10% in April 2021. Additional fall is projected due to changing consumer demand, labor disruptions, and COVID-19 shutdowns impacting the industry and reducing demand for new machinery. Furthermore, new orders for construction machinery in the U.S. were down by around 12% in April 2021 compared to the previous year.

Browse through Grand View Research's Automotive & Transportation Industry Related Reports

Automotive Infotainment Market - The global automotive infotainment market was valued at USD 7.42 billion in 2022 and is expected to witness a CAGR of 9.7% from 2023 to 2030.

On-highway Vehicle Lighting Market - The global on-highway vehicle lighting market size was valued at USD 26.98 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030.

Off-highway Vehicle Lighting Market Segmentation

Grand View Research has segmented the global off-highway vehicle lighting market based on the product, application, end use, vehicle type, and region:

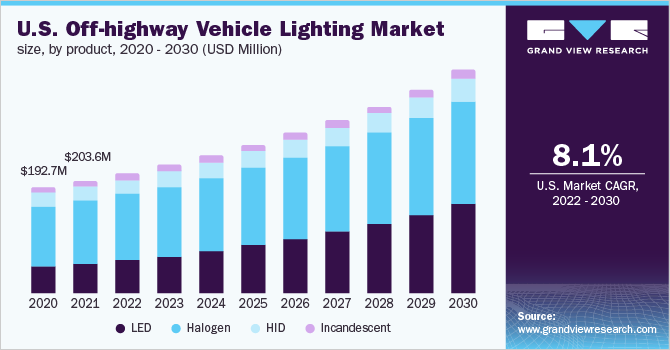

Off-highway Vehicle Lighting Product Outlook (Revenue, USD Million, 2018 - 2030)

- LED

- Halogen

- HID

- Incandescent

Off-highway Vehicle Lighting Application Outlook (Revenue, USD Million, 2018 - 2030)

- Head Lamp

- Tail Lamp

- Work Light

- Others

Off-highway Vehicle Lighting End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Construction

- Agriculture/Farming/Forestry

Off-highway Vehicle Lighting Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

- Excavator

- Loader

- Crane

- Dump Truck

- Tractor

- Other

Off-highway Vehicle Lighting Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights:

February 2021: Truck-Lite announced the launch of high-output LED work lamps and a full line of heated turn/stop/tail lamps.

May 2020: Grote Industries, an off-highway vehicle lighting manufacturer, announced the launch of new tri-color LED directional warning lights, an addition to its warning & hazard product lineup. The new tri-color LED directional warning lights to offer SAE Class I performance.

Key Companies profiled:

Some prominent players in the global Off-highway Vehicle Lighting market include

- Truck-Lite

- APS Lighting and Safety

- Grote Industries

- ECCO Safety Group

- Hamsar Diversco Inc.

- J.W. Speaker Corporation

- WESEM

- HELLA GmbH & Co. KGaA

- ABL Lights Group

- Peterson Manufacturing Co.

Order a free sample PDF of the Off-highway Vehicle Lighting Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment