Artificial Pancreas Device Systems Industry Overview

The global artificial pancreas device systems market size was valued at USD 207.27 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 18.94% from 2022 to 2030. The increasing prevalence of diabetes, intensive R&D efforts by industry players, and rising demand for automated systems for glycemic control are the factors driving the industry growth. Artificial pancreas device systems (APDS) control the blood glucose level in diabetes patients, and industry players are conducting numerous researches for better diabetes management. These devices are less invasive and hence, are largely adopted by the patient pool. The growth of the market is majorly attributed to the increasing geriatric population, growing incidence of diabetes, and the rising prevalence of obesity.

Bionic Pancreas system, technological developments, such as in-home use of Bionic Pancreas system are also anticipated to create significant growth opportunities in the near future. Furthermore, increasing awareness about APDS and their use has also led to market growth in both developed and developing countries.

Gather more insights about the market drivers, restraints, and growth of the Global Artificial Pancreas Device Systems market

The outbreak of COVID-19 is estimated to contribute to the market growth in the times to come. However, disturbed logistics and changed equation in international trading have significantly affected the business growth. As many parts of different economies have started to ease the lockdowns and have started construction of a strong distribution network to regain losses and avoid discontinuation in business market players, the market demand for APDS is expected to surge. Moreover, hyperglycemia and obesity are linked to COVID-19 mortality in persons with diabetes. Additionally, COVID-19 recovered diabetes patients have developed resistance to insulin, and the traditional injections fail to provide proper management. APDS can replace the need for frequent sugar level checks. Furthermore, globally increased activities in teleconsultancy for follow-up and routine check-ups during the pandemic are likely to improve market growth for point of care technologies such as APDS. Thus, the trends are expected to have a significant impact on the adoption of APDS in upcoming years.

The increasing incidence of diabetes due to aging, obesity, and an unhealthy lifestyle is one of the key factors contributing to the growth of artificial pancreas device systems market. Risk factors, such as obesity and overweight, are leading to an increase in the incidence of diabetes. According to WHO, in 2016, over 1.9 billion adults were overweight, of which, around 650 million people were obese. These factors are expected to boost the prevalence of diabetes, thus fueling the need for APDS. Additionally, as per the same source, the total number of people with diabetes is likely to rise from 171 million in 2000 to 366 million in 2030. Moreover, the prevalence of diabetes is increasing in low and middle-income counties, which is anticipated to create huge growth opportunities for market players in these untapped markets. Furthermore, the increasing dependency of type 2 diabetes on insulin is expected to create opportunities for the artificial pancreas devices market during the forecast period.

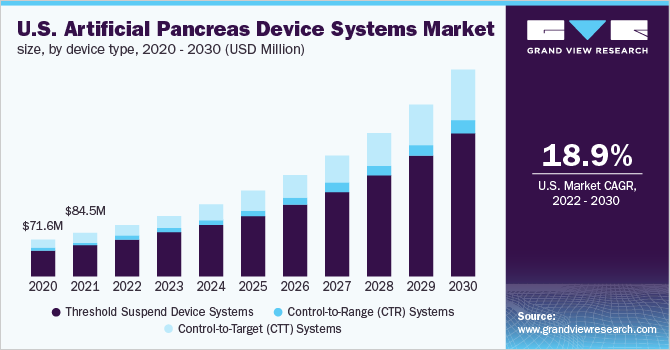

The U.S. dominated the artificial pancreas device systems market with the highest shares of 88.50% in 2021. High per capita income and increasing healthcare spending are among the key factors likely to drive the global artificial pancreas device systems market growth. According to the American Diabetes Association, in 2019, the average estimated cost of diabetes-specific treatments per person was USD 9,505.60. In the U.S., a diabetic patient can incur an overall medical expenditure of nearly USD 16,750 per year. Furthermore, the adoption of smart devices and technological advancements such as the use of AI & data analytics are propelling the industry growth. According to International Diabetes Federation, one in eight adults suffer from impaired blood glucose tolerance. This ratio is expected to increase further during the forecast period.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Artificial Organ And Bionics Market - The global artificial organ and bionics market size was valued at USD 25.3 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 9.3% from 2022 to 2030.

Insulin Pump Market - The global insulin pump market size to be valued at USD 8.3 Billion By 2028 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% during the forecast period.

Artificial Pancreas Device Systems Market Segmentation

Grand View Research has segmented the global artificial pancreas device systems market based on device type and region:

Artificial Pancreas Device Systems Device Type Outlook (Revenue, USD Million, 2017 - 2030)

- Threshold Suspend Device Systems

- Control-to-Range (CTR) Systems

- Control-to-Target (CTT) Systems

Artificial Pancreas Device Systems Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

September 2020: The U.S. FDA approved a next-generation hybrid closed-loop insulin delivery system for children aged 2 to 6 years with type 1 diabetes.

June 2020: Medtronic received CE-Mark for its MiniMed 780G. The device automatically adjusts basal insulin rates after every five minutes and is suitable for diabetic patients between 7 to 80 years of age.

Key Companies profiled:

Some of the prominent players in the global artificial pancreas device systems market include:

- Medtronic Plc

- Bigfoot Biomedical

- Johnson & Johnson Services Inc.

- Tandem Diabetes Care, Inc.

- Pancreum, Inc.

- TypeZero Technologies, LLC

- Beta Bionics

Order a free sample PDF of the Artificial Pancreas Device Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment