Contrast Media Industry Overview

The global contrast media market size was valued at USD 4.04 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 3.33% from 2022 to 2030. The growing prevalence of complex comorbidities and long-term diseases has led to an increase in diagnostic imaging tests, including ultrasound, X-rays, and advanced imaging technology such as MRI & CT scans. For instance, in November 2019, GE Healthcare received the U.S. FDA approval for Clariscan, a contrast agent used for macrocyclic MRI. These products help in identifying the need for perioperative scans prior to surgeries and treatment in interventional procedures, which is likely to boost the market growth. According to the National Health Council, in 2020, nearly 157 million people in the U.S. were affected by chronic diseases, out of which around 81 million had multiple conditions, which is indicative of a high incidence of chronic conditions.

The prevalence of chronic conditions with multiple comorbidities is higher among older adults. According to the National Council on Aging, nearly 80% of people aged 65 & above suffer from at least one chronic condition, with almost 70% of Medicare beneficiaries suffering from more than 2 chronic conditions, and nearly 77.0 million people in the U.S. are estimated to be aged 65 & above by 2034.

Gather more insights about the market drivers, restraints, and growth of the Global Contrast Media market

Furthermore, according to a report by the American Heart Association, the incidence of heart failure is increasing in the U.S., and it is one of the leading causes of death in the country. In 2020, approximately 659,000 people died due to cardiovascular diseases in the U.S. By 2030, the number of people with heart diseases is estimated to increase by 46%.

Leading to decreased patient visits to hospitals, the COVID-19 outbreak had a detrimental influence on the contrast media market. As a result of the pandemic, healthcare systems have been severely stressed. Healthcare providers and institutes were ordered to stop performing medical evaluations and elective surgical operations to conserve healthcare resources for COVID-19 patients and combat the spread of the disease. For instance, during the early months of the pandemic, diagnosis of heart illnesses fell by roughly two-thirds over the world, as countries and patients focused on COVID-19. Similarly, screenings for colon, breast, prostate, and lung fell by 75%, 85%, 75%, 74%, and 56%, indicating a revenue drop in 2020.

The American College of Radiology (ACR), which signifies over 40,000 radiologists in the U.S., has issued advice that X-rays and CT scans should not be used as a first-line approach to diagnose or test for COVID-19 since it is exceedingly contagious. As a result, several radiology departments saw a significant decrease in the number of imaging cases. Except for COVID diagnosis, all diagnostic procedures exhibited a considerable fall in 2020, affecting the growth of the contrast media market.

Market players adopt strategies such as mergers & acquisitions and indication extension. Acquisitions aid companies in increasing their presence with wider geographic reach and stronger portfolios. Disease indication extension is popular in this market as it enables firms to gain the confidence of select population subsets. With approvals for specific indications, companies target niche patient cohorts and boost the adoption of products. For instance, in March 2022, the initial single-source photon-counting computed tomography (CT) scanner with a single detector acquired FDA 510(k) approval, according to NeuroLogica Corporation. Additionally, the OmniTom Elite with PCD is capable of producing spectral CT pictures at various energy levels, which is anticipated to boost the market growth in the near future.

Furthermore, the introduction of digital solutions that aid in the management of contrast agent injection is anticipated to drive market growth. For instance, in 2018, Guerbet launched Contrast&Care 2.0, a digital solution that connects all CT, Cath laboratory, and MRI injectors and has smart reader & connectivity features, enabling users to scan and read data on their smartphones as well as computers.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Medical X-ray Generators Market - The global medical X-ray generators market size was valued at USD 2.01 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030.

Digital X-ray Devices Market - The global digital X-ray devices market size was valued at USD 3.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.0% from 2023 to 2030.

Contrast Media Market Segmentation

Grand View Research has segmented the global contrast media market based on modality, product type, application, route of administration, end use, and region:

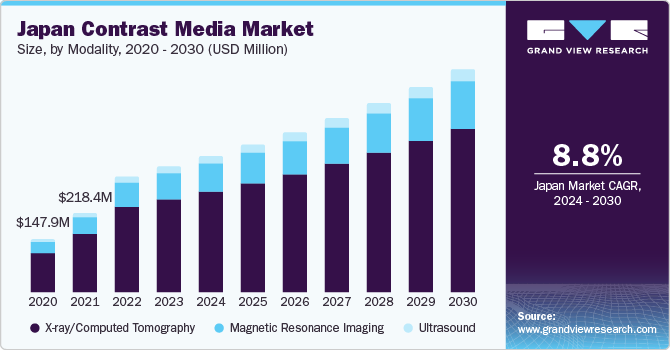

Contrast Media Modality Outlook (Revenue, USD Million, 2017 - 2030)

- X-ray/CT

- MRI

- Ultrasound

Contrast Media Product Type Outlook (Revenue, USD Million, 2017 - 2030)

- Iodinated

- Barium-based

- Gadolinium-based

- Microbubble

Contrast Media Application Outlook (Revenue, USD Million, 2017 - 2030)

- Cardiovascular Disorders

- Neurological Disorders

- Gastrointestinal Disorders

- Cancer

- Nephrological Disorders

- Musculoskeletal Disorders

- Others

Contrast Media Route of Administration Outlook (Revenue USD Million; 2017 - 2030)

- Intravascular Route

- Oral Route

- Rectal Route

- Other Route of Administration

Contrast Media End Use Outlook (Revenue USD Million; 2017 - 2030)

- Hospital, Clinics, & Ambulatory Surgery Centers

- Diagnostic Imaging Centers

Contrast Media Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

December 2021: The previously announced GE Healthcare acquisition of BK Medical has been finalized. With this acquisition, GE Healthcare enhances its pre-and post-operative ultrasound capabilities to encompass real-time surgical viewing, a fast-growing and relatively new discipline.

Key Companies profiled:

Some prominent players in the global contrast media market include:

- Bayer AG

- General Electric Company

- Guerbet

- Bracco Diagnostic, Inc.

- Nano Therapeutics Pvt. Ltd.

- Lantheus Medical Imaging, Inc.

- iMax

- Trivitron Healthcare

Order a free sample PDF of the Contrast Media Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment