Laboratory Informatics Industry Overview

The global laboratory informatics market size was valued at USD 3.21 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2022 to 2030. An increase in demand for laboratory automation is expected to fuel the adoption in the coming years. Data generated by laboratories has dramatically risen in the past few decades owing to the rising technological advancements in molecular genomics and genetic testing practices. In addition, the shift of preference toward personalized medicine, cancer genomics studies, and increasing patient engagement requirements is expected to upsurge the demand for lab automation systems.

Software solutions are becoming more user-friendly, data is moving to the cloud, and the number of startups in the field of laboratory informatics is on the rise. The cloud is becoming the norm for laboratory informatics software. Informatics providers must now have a cloud and SaaS strategy. In addition, the number of research laboratories implementing cloud, mobile, and voice technologies is increasing over time, which is boosting the demand for lab automation solutions.

Gather more insights about the market drivers, restraints, and growth of the Global Laboratory Informatics market

The outbreak of the Coronavirus has turned the spotlight on the healthcare sector. Shortages of critical medical supplies during this pandemic have severely impacted the overall market. Almost half of the laboratories around the world were shut down and an estimated 14% of the laboratories were fully functional. Subsequently, government measures like stay-at-home orders, social distancing norms, movement restrictions, and supply chain disruptions have created a logistical problem for companies, leading to the shortages of on-premise delivery of the product in the worldwide marketplace.

On the other hand, with an unprecedented demand for COVID-19 testing worldwide, clinical labs have scaled up their operations and faced new challenges comprising development, standardization, and validation of the new methods for testing and administration of large volumes of patient specimens and test data, besides rapid and reliable reporting of test outcomes. To speed up the high demand for COVID-19 tests in clinical labs, a LIMS plays an essential role, which led to the adoption of the product.

Moreover, laboratory information systems are gaining popularity in biobanks, academic research institutes, and Contract Research Organizations (CROs) owing to the associated benefits. The benefits of using these systems include process optimization, improved regulatory compliance, intellectual property rights protection, and reduced throughput time. Paperless information management reduces labor costs and offers improved data quality through the elimination of errors and faster and effective data analytics.

Laboratories are critical to both manufacturing and research organizations across the life sciences and medical research industries. The primary objective of a laboratory is to ensure the generation of high-quality and reliable experiment data that conforms to the regulatory guidelines of the industry. Advances in technology combined with stringent regulatory needs and increasing commercial pressures have led to the rapid generation of vast amounts of data from various aspects comprising research and development, quality assurance, and manufacturing.

Furthermore, an increasing burden from the regulatory authorities for the implementation of lab automation systems is expected to serve this market with lucrative growth opportunities. The increasing adoption of robotics and process automation in healthcare has rendered operations reproducible and repeatable. It is now possible to set up, run, and analyze the experimental results in a shorter time. Rising penetration of high throughput systems has enabled efficient evaluation of experimental results, which increases the overall efficiency of laboratory operations.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Laboratory Information Management System Market - The global laboratory information management system market size was valued at USD 2.07 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030.

Digital Pathology Market - The global digital pathology market size was valued at USD 926.9 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030.

Laboratory Informatics Market Segmentation

Grand View Research has segmented the global laboratory informatics market by product, delivery mode, component, end use, and region:

Laboratory Informatics Product Outlook (Revenue, USD Million, 2017 - 2030)

- Laboratory Information Management Systems (LIMS)

- Electronic Lab Notebooks (ELN)

- Scientific Data Management Systems (SDMS)

- Laboratory Execution Systems (LES)

- Electronic Data Capture (EDC) & Clinical Data Management Systems (CDMS)

- Chromatography Data Systems (CDS)

- Enterprise Content Management (ECM)

Laboratory Informatics Delivery Mode Outlook (Revenue, USD Million, 2017 - 2030)

- On-premise

- Web-hosted

- Cloud-based

Laboratory Informatics Component Outlook (Revenue, USD Million, 2017 - 2030)

- Software

- Services

Laboratory Informatics End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Life Science

- CROs

- Chemical Industry

- Food & Beverage and Agriculture Industries

- Petrochemical Refineries and Oil & Gas Industry

- Others (Forensics and Metal & Mining Laboratories)

Laboratory Informatics Regional Outlook (Revenue, USD Million, 2017 - 2030)

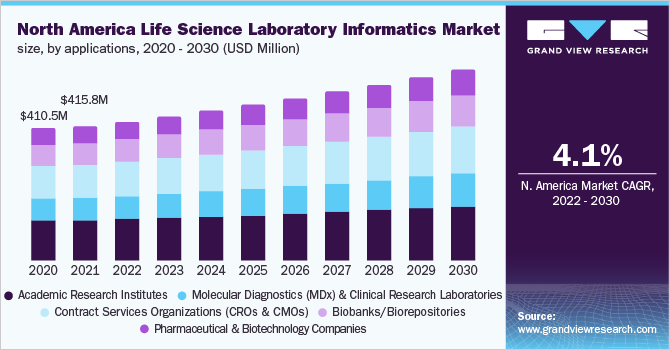

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

August 2021: Abbott Informatics released STARLIMS Laboratory Execution System v1.1. This is built on the latest STARLIMS Quality Manufacturing QM 12.2.

July 2021: GoMeyra has introduced GoMeyra MD, a next-generation health care management platform.

Key Companies profiled:

Some of the prominent players in the global Laboratory Informatics market include:

- LabWare

- Core Informatics

- Thermo Fisher Scientific, Inc.

- PerkinElmer Inc.

- LabVantage Solutions, Inc.

- Abbott Laboratories

- LabLynx, Inc.

- Agilent Technologies

- Waters Corporation

- Cerner Corporation

- ID Business Solutions Ltd.

- McKesson Corporation

Order a free sample PDF of the Laboratory Informatics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment