U.S. Sexual Wellness Industry Overview

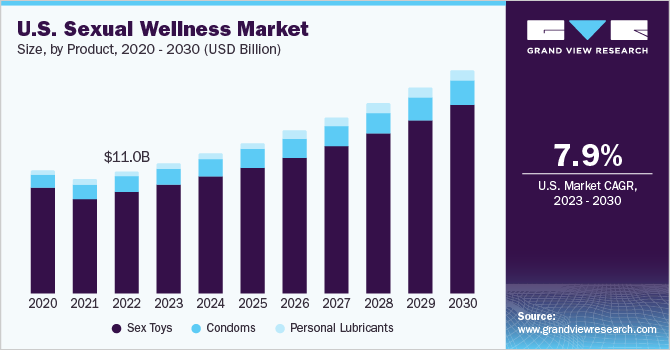

The U.S. sexual wellness market size was valued at USD 10.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.67% from 2022 to 2030. The market is anticipated to exhibit lucrative growth in the coming years due to the rising prevalence of Sexually Transmitted Diseases (STDs) and HIV infection. Increasing government initiatives and NGOs participating in promoting the use of contraceptives is expected to boost the market growth. The increasing childbearing population of women in the U.S. and ease of online shopping and e-commerce are expected to further facilitate the sales of sexual wellness products. The NYC Health Department recommended masturbation as the safest form of sexual activity to minimize contact with others and reduce the spread of COVID-19.

Since the pandemic has reduced the stigma around masturbation, an increasing number of customers in the country are opting for various sex toys to improve their sexual experience. The stigma attached to sexual activities & experimenting is reducing due to liberalization and growing acceptance of homosexuality. Sex-positive movements have helped clear the stereotypes related to gender, age, and social construct of people. The banks and investors who were reluctant to fund ventures in sexual wellness products are now investing in this space.

Gather more insights about the market drivers, restraints, and growth of the U.S. Sexual Wellness market

In recent times, the stereotypical perception has witnessed some change and angel investors are also increasingly investing with manufacturers. For instance, in March 2021, PLBY Group, Inc. spent USD 25 million to buy a TLA acquisition firm that sold sex toys through a subsidiary. Major brands in the U.S. market for sexual wellness are expected to witness lucrative demand due to the growing use of sex toys among both men and women.

U.S. government is also taking initiatives towards sexual wellness by promoting safe sex, further propelling the growth of the market. For instance, in June 2020, the New York health department started a home delivery service called “Door 2 Door” to promote the practice of safe sex. The service provides the delivery of condoms, lubricants, and HIV tests via an online platform.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Sex Toys Market - The global sex toys market size was valued at USD 32.7 billion in 2022. It is expected to expand at a compound annual growth rate (CAGR) of 8.50% from 2023 to 2030.

Condom Market - The global condom market size was valued at USD 10.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.57% from 2023 to 2030.

U.S. Sexual Wellness Market Segmentation

Grand View Research has segmented the U.S. sexual wellness market based on product, distribution channel and region:

U.S. Sexual Wellness Product Outlook (Revenue, USD Million, 2017 - 2030)

- Sex Toys

- Condoms

- Personal Lubricants

U.S. Sexual Wellness Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

- E-commerce

- Retailers

- Mass Merchandizers

Market Share Insights

August 2021: Wow Tech and Lovehoney announced a merger and the combined group will be led by Wow Tech with an aim of achieving new heights in sexual wellness.

Key Companies profiled:

Some of the prominent players in the U.S. sexual wellness market include:

- Church & Dwight Co., Inc.

- Reckitt Benckiser Group plc

- Veru Inc.

- Doc Johnson Enterprises

- Mayer Laboratories, Inc.

- LifeStyles Healthcare Pte Ltd

- BioFilm, Inc.

- LELO

- Trigg Laboratories Inc.

- Innovus Pharmaceuticals, Inc.

- Unbound

- CC Wellness

Order a free sample PDF of the U.S. Sexual Wellness Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment