Protein Labeling Industry Overview

The global protein labeling market size was valued at USD 2.09 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2022 to 2030. An increase in R&D spending for proteomics research supports protein analysis, which propels the demand for protein labeling techniques. This increase in R&D spending has benefitted the proteomics field by broadening the application of mass spectrometry, protein microarray, and biochips in this field. In addition, improvements in mass spectrometry workflows and miniaturization of biochips also drive proteomics applications, consequently driving the organic revenue growth of the market. The COVID-19 outbreak has had a negative impact on almost every industry around the globe.

Significant disruptions in manufacturing and supply-chain operations have occurred as a result of various precautionary lockdowns and other restrictions imposed by governments around the world. Similarly, COVID-19 had adversely impacted the global protein labeling market. Furthermore, consumer demand has decreased as individuals focused on reducing non-essential expenses as the overall economic situation of most individuals has been badly impacted by the pandemic. Over the forecast period, the above-mentioned factors are expected to affect the global market. The industry is predicted to revive as individual governing authorities begin to lift these enforced lockdowns. Protein labeling is a useful tool for studying protein structure, function, and gene function. The market has been strengthened by the introduction of new technology.

Gather more insights about the market drivers, restraints, and growth of the Global Protein Labeling Market

Protein labeling is a secondary research approach for proteomic analysis that is utilized in the biotechnology and pharmaceutical industries for research and diagnostic purposes. Furthermore, as the prevalence of chronic diseases, such as cancer, rises, the demand for disease prevention, diagnosis, and treatment also rises. Lack of experienced specialists, limited uses of protein labeling goods, and high costs of reagents, kits, and other protein labeling services, are some of the potential roadblocks to market expansion. With an increase in the R&D expenditure, the proteomic content derived from large-scale proteomics & genomics research is accelerating the discovery of novel biomarkers. An increase in the number of drugs in the R&D pipeline also supplements the usage of proteomics research.

The number of drugs present in the R&D pipeline was around 16,181 drugs in 2019, which is an increase of nearly 2.7% compared with that in 2018. The adoption of modern molecular biology and bioengineering tools to enhance the knowledge of functional mechanisms on a subcellular scale, both under pathologic and physiologic conditions, leads to improvement in drug development, diagnosis, and therapy applications. With the use of bioengineering tools, the usage of labels in the detection & purification of proteins and diagnostic tests based on the detection of the presence of a particular protein has increased significantly. The use of non-canonical Amino Acids (ncAAs) followed by conjugation of labeled protein, with fluorophores, polymers, affinity reagents, peptides, or nanoparticles is proven to be effective in proteomics and biotechnology applications.

These labeled proteins with ncAAs are enriched with cells and tissues. These new bioengineered tools are expected to gain traction for temporal and spatial analysis of protein dynamics and engineering novel chemistries. The advancements in mass spectrometry with regards to biomarker identification and quantification for disease prognosis are expected to provide lucrative avenues for market progression. These advancements include Surface-Enhanced Laser Desorption/Ionization, which is an alternative version of Matrix-Assisted Laser Desorption/Ionization where the analyte binds to a surface before mass analysis. This can be applied to the detection of the progression rate of gastric cancer.

In addition, host cell proteins interfere with biopharmaceutical manufacturing and result in low yields in investigations. During such operations, it is critical to detect and eliminate the host cell protein. The introduction of 2D DIBE has proven to be a reliable method for detecting host cell protein, it uses Cy3, which is a fluorescent dye. This has offered a potential growth opportunity for the market. Smaller companies are entering the market with customized protein labeling kits, whereas larger companies are focusing on new product launches to cater to the needs of researchers. Furthermore, the leading players have been able to expand their product range and R&D operations in this market by acquiring individual and private organizations.

Larger organizations are using agreements as a significant strategy to expand their product portfolio. Furthermore, several novel solutions are launched into the market to address the high cost associated with the protein labeling process. Abcam, a U.K.-based manufacturer, and supplier of protein research tools, announced in January 2020 that it has agreed to buy Expedeon’s Proteomics and Immunology division, which includes Innova and TGR Biosciences. Enzymes, metals, oligos, and fluorescent proteins are among the labels supported by Expedeon technology.

Browse through Grand View Research'Biotechnology Industry Research Reports.

Protein Crystallization Market - The global protein crystallization market size was valued at USD 1.14 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 8.25% from 2023 to 2030.

Cell-free Protein Expression Market - The global cell-free protein expression market size was valued at USD 229.7 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.48 % from 2022 to 2030.

Protein Labeling Market Segmentation

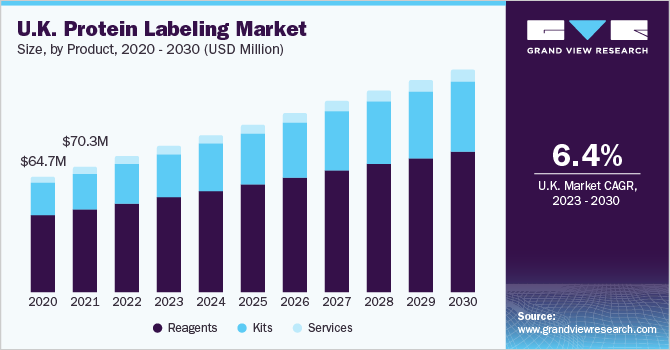

Grand View Research has segmented the global protein labeling market on the basis of product, application, method, end-user and region:

Protein Labeling Product Outlook (Revenue, USD Million, 2018 - 2030)

- Reagents

- Kits

- Services

Protein Labeling Application Outlook (Revenue, USD Million, 2018 - 2030)

- Cell-based Assays

- Fluorescence Microscopy

- Immunological Techniques

- Protein Microarray

- Mass Spectrometry

Protein Labeling Method Outlook (Revenue, USD Million, 2018 - 2030)

- In-vitro Labeling Methods

- In-vivo Labeling Methods

Protein Labeling End-user Outlook (Revenue, USD Million, 2018 - 2030)

- Academic & Research Institutes

- Hospitals and Diagnostic Centers

- Others

Protein Labeling Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

April 2019: Perkin Elmer completed the acquisition of Cisbio Bioassays to expand its DELFIA, Alpha, and LANCE assay technologies. The acquisition added Cisbio’s capabilities to PerkinElmer, which provided its researchers access to an expanded range of assay tools for small molecule and biologic drug discovery.

Key Companies profiled:

Some prominent players in the global Protein Labeling market include -

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Merck KGaA

- Perkin Elmer, Inc.

- Promega Corporation

- LGC Limited

- New England Biolabs

- LI-COR, Inc.

- GE Healthcare.

- Jena Bioscience GmbH

Order a free sample PDF of the Protein Labeling Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment