Veterinary Software Industry Overview

The global veterinary software market size was valued at USD 494.0 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 9.0% from 2022 to 2030. Increasing demand for Practice Management Systems (PMS) from veterinary practitioners is a key contributor to the market growth. In addition, growing awareness regarding the benefits of the use of software solutions and an increasing number of clinical visits by pet owners are expected to boost the adoption of software solutions in veterinary practices in the coming years. The animal health industry is impacted by an increase in companion pet ownership and concerns over pet health. A growing focus on the efficiency and safety of livestock production is also another growth propeller.

Developers of PMS systems offer complete solutions for the management of a veterinarian’s office including maintaining schedules and records. As per the data published by the American Veterinary Medical Association, approximately 68,000 veterinarians in North America and around 22,000 in the United Kingdom are practicing privately. This number is further expected to increase over the forecast period. This increase in the number is anticipated to propel the demand for these solutions for managing operations in clinics and reference laboratories.

Gather more insights about the market drivers, restraints, and growth of the Global Veterinary Software market

The outbreak of COVID-19 is estimated to have a considerable impact on the growth of the market. In most regions, veterinary services are considered essential services and remained functional even during the lockdown. This has contributed notably to the continuation of revenue generation across veterinary practices, in turn, leading to the growth of this market. The COVID-19 pandemic brought drastic changes to patients’ normal routine with lockdown and social distancing measures across the world. Understandably due to loneliness and disturbed mental health experienced by most of the population during the pandemic, the adoption of companion animals witnessed an upsurge.

Citing an example, according to the Japan Pet Food Association survey, there has been a 15% increase in dog and cat ownership in 2020, as compared to the previous year. There were an estimated 8.49 million dogs and 9.64 million cats being kept as pets in Japan as of October 2020. This thereby resulted in an increase in the demand for virtual pet care visits during the pandemic and thus high adoption of veterinary software solutions. Over the years, the number of pet owners has increased significantly, and this trend is expected to continue in the coming years. According to the American Pet Products Association, approximately 33% of the owners owned a dog and 27% of the pet owners owned cats. Overall, it was estimated around 59% in 2021. Hence, the increasing adoption of pets further accelerates market growth.

Browse through Grand View Research's Animal Health Industry Research Reports.

Veterinary MRI Market - The global veterinary MRI market size was valued at USD 205.93 million in 2022 and is expected to expand at a lucrative compound annual growth rate (CAGR) of 7.38% from 2023 to 2030.

Livestock Monitoring Market - The global livestock monitoring market size was valued at USD 4.62 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 17.63% from 2022 to 2030.

Veterinary Software Market Segmentation

Grand View Research has segmented the global veterinary software market on the basis of product, delivery mode, practice type, end use, and region:

Veterinary Software Product Outlook (Revenue, USD Million, 2017 - 2030)

- Practice Management Software

- Imaging Software

Veterinary Software Delivery Mode Outlook (Revenue, USD Million, 2017- 2030)

- On-premise

- Cloud/Web-based

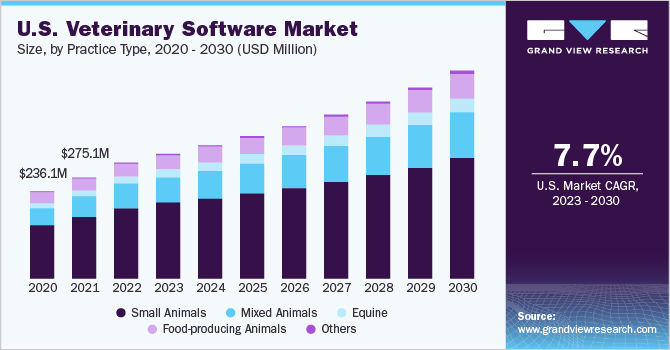

Veterinary Software Practice Type Outlook (Revenue, USD Million, 2017 - 2030)

- Small Animals

- Mixed Animals

- Equine

- Food-producing Animals

- Others

Veterinary Software End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals/Clinics

- Reference Laboratories

Veterinary Software Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Market Share Insights

August 2021: Petabyte Technology proclaimed a partnership to advance the lives of veterinarians, their teams, and pet parents through innovative software. Together, the two corporations proposed to advance the next development of Petabyte's software to revolutionize animal hospital operations and transform the pet parent experience.

June 2021: The Veterinary Hospitals Association has entered a partnership contract with PetDesk. This agreement is to offer all Veterinary Hospitals Association members special access to enhanced, simplified client communication solutions.

Key Companies profiled:

Some prominent players in the global veterinary software market include:

- IDEXX Laboratories, Inc.

- Hippo Manager Software, Inc.

- VetZ Limited

- Esaote SpA

- Henry Schein, Inc.

- Patterson Companies, Inc.

- ClienTrax

- VIA Information Systems

- Onward Systems, Inc.

- Animal Intelligence Software

- ezyVet

- Provet Cloud

- VitusVet

- DaySmart Software

- NaVetor

Order a free sample PDF of the Veterinary Software Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment