Medical Suction Devices Industry Overview

The global medical suction devices market size was valued at USD 1.0 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030. The growth of the market is attributed due to the growing prevalence of chronic respiratory disorders such as acute lower respiratory tract infections, Chronic Obstructive Pulmonary Disease (COPD), and asthma, and the increase in the number of procedures, such as in vacuum assisted deliveries, where suction devices are majorly used. In addition, the growing preference for home healthcare and the decreasing price is making these devices affordable thereby advancing the penetration of these products. Such factors are expected to bolster market growth over the forecast period.

In 2020, the outbreak of COVID- 19 disease caused by the novel coronavirus (SARS- CoV- 2) has led to the introduction of several novel products for vitalizing airflow and endotracheal suction to remove fluid secretions from COVID- 19 patients’ lungs and airways. Thus, COVID- 19 pandemic has shown a positive impact on market growth owing to its increased demand for critical care capacity and to support hospitals in the fight against COVID- 19. Moreover, an increasing number of regulatory product approvals for medical suction devices during the pandemic helped various market players to increase their product sales. For instance, in October 2020; Medela Healthcare launched mobile suction devices to support critical care capacity. This device was designed to provide suction and fluid removal during respiratory treatment provided with ventilators. With such increasing demand for these devices globally, the market for medical suction devices is projected to have significant growth during the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Medical Suction Devices market

The increasing prevalence of chronic respiratory diseases is one of the major factors driving the growth of the market. For instance, as per the WHO 2019 report, over 65 million people suffer from moderate or severe chronic obstructive pulmonary disease (COPD) and around 3.23 million people die from this disorder every year, Similarly, according to the same source, asthma is the most common chronic disease among children, accounting for nearly 262 million populations suffering from asthma in 2019. Thus, a medical suction device plays an important role in suctioning a patient with COPD, and asthma. Since COPD and asthma cause an increase in airway secretions that may occlude the airway. Thus, boosting the demand for the medical suction device over the forecast period.

Moreover, the rising elderly population is further promoting the growth of the market for medical suction devices. For instance, according to World Population Ageing 2020 report, there were an estimated 727 million people aged 65 years or over worldwide. The portion of the populace is projected to more than double by 2050, reaching over 1.5 billion persons. As the growing aging population is more susceptible to chronic respiratory conditions, therefore, are expected to bolster growth over the forecast period. In addition, the geriatric population is fueling the demand for compact and portable suction devices that can be used in home care settings. Furthermore, the growing number of surgical procedures is accelerating the sales of medical suction devices globally.

For instance, according to the International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO), worldwide nearly 580,000 people undergo bariatric surgery annually. Likewise, according to the Australian Institute of Health and Welfare (AIHW), hospital admission for weight loss surgeries in Australia increased to 22,713 from 2014 to 2015. The total number of weight-loss surgeries is more than doubled, from about 9,300 to 22,713. Medical suction devices perform a crucial role in a wide range of surgical procedures including bariatric surgery and help in removing blood and other fluids during the procedure. Thus, with the increasing number of surgical procedures, demand for these devices is likely to surge in the coming year.

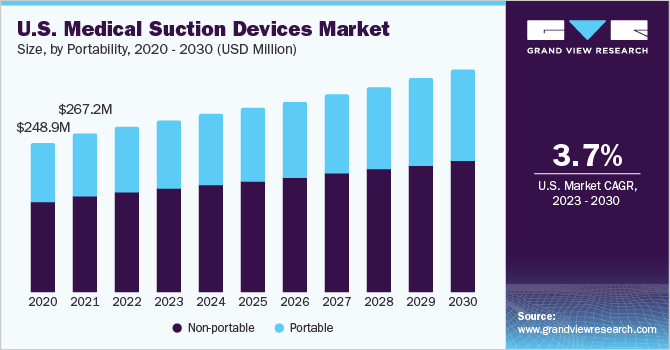

The U.S. dominated the market for medical suction devices and accounted for the highest revenue share of 87.8% in 2021. The growing prevalence of chronic respiratory diseases such as asthma, Chronic Obstructive Pulmonary Disease (COPD), lung cancer, cystic fibrosis, and the presence of established infrastructure are among the key factors driving the growth of the medical suction devices market in the U.S. For instance, according to the Asthma and Allergy Foundation of America, in 2018, 25 million Americans were living with asthma and accounted for 1.6 million emergency department visits. In addition, technological advancements, coupled with frequent launches of new and innovative products, are among the key factors fueling the market growth. Favorable reimbursement structure is also another major factor contributing to the growth of the market in the country.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Suction Catheters Market - The global suction catheters market size was valued at USD 374.5 million in 2021 and is anticipated to witness a compound annual growth rate (CAGR) of 8.2% from 2022 to 2030.

Liposuction Surgery Devices Market - The global liposuction surgery devices market size was valued at USD 272.08 million in 2021 and is expected to expand at a CAGR of 13.0% from 2022 to 2030.

Medical Suction Devices Market Segmentation

Grand View Research has segmented the global medical suction devices market based on portability, vacuum systems, end-use, and region:

Medical Suction Devices Portability Outlook (Revenue, USD Million, 2017 - 2030)

- Portable

- Non-Portable

Medical Suction Devices Vacuum Systems Outlook (Revenue, USD Million, 2017 - 2030)

- Manual

- Electrically Powered

- Venturi

Medical Suction Devices End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Respiratory

- Gastric

- Wound Suction

- Delivery Rooms

- Others

Medical Suction Devices Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

May 2019: Medela inaugurated its new manufacturing unit in the U.S. for its portable suction pumps that provide suction and fluid removal during respiratory treatment in COVID- 19 patients.

October 2017: Inscope Medical Solutions launched the first laryngoscope with integrated, controllable suction. This device is easy to use and provides controllable suction in the mouth while allowing professionals to provide a clear vision of the airway throughout the procedure.

Key Companies profiled:

Some prominent players in the global Medical Suction Devices market include -

- Allied Healthcare Products, Inc.

- Precision Medical, Inc.

- Integra Biosciences AG

- Medicop, Inc.

- ATMOS MedizinTechnik GmbH & Co. KG

- ZOLL Medical Corporation

- Welch Vacuum

- Laerdal Medical

- Labcoco Corporation

- Amsino International, Inc.

- Olympus Corporation

Order a free sample PDF of the Medical Suction Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment