Biopharmaceuticals Contract Manufacturing Industry Overview

The global biopharmaceuticals contract manufacturing market was valued at USD 17.0 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% during the forecast period. The success of the biopharmaceutical market can be majorly attributed to the contract manufacturers. Reduction in the overall investment required to bring a new drug product to market, providing access to expensive technologies, quick entry of products into the markets, and greater flexibility are some advantages offered by contract manufacturing organizations (CMOs), which have prompted the companies to outsource their biopharmaceutical manufacturing.

Due to the disruptions from COVID-19, many companies have had to bring on new contract manufacturers or ingredient suppliers due to increasing demands. Furthermore, with a perpetual expansion of the biopharmaceutical industry, the companies are facing production issues, such as lack of expertise and sophisticated equipment, while practicing in-house manufacturing. The maturity of biotechnology and the availability of external funding have resulted in the growth in a number of early-stage bio/pharma companies. These companies are recognized as core customers of CMOs, as these organizations lack the capabilities for the development of robust manufacturing operations.

Gather more insights about the market drivers, restraints, and growth of the Global Biopharmaceuticals Contract Manufacturing market

In order to fulfill the growing demand in the market, key players are going for capacity expansion. For instance, in 2020, Thermo Fisher Scientific announced an investment of USD 180.0 million for the construction of a new commercial manufacturing site in Plainville, Mass for viral vector development and manufacturing services. Also, in 2019, Boehringer Ingelheim invested USD 84 million for expansion in Mexico for increasing production. The customers and CMOs are engaged in standardizing agreement terms for making contract negotiations easy. This is to address the issues pertaining to the regulatory landscape and complexity of service delivery. IP rights, warranty & liabilities, prices & timelines are major issues cited by CMOs and clients which are making negotiations innately difficult.

Breakthrough technological advancements and innovations in bioprocessing have played a pivotal role in the progress of contract service providers by overcoming the manufacturing issues such as high production costs and the need for changeover with every batch. Single-use bioprocessing systems are one of the most significant innovations as it helps in reducing the overall production and scale-up costs. Furthermore, the fast turnaround offered by single-use products while limiting allied activities, such as changeover and cleaning validation, has supported the growth of CMOs to a major extent.

Mergers, acquisitions, and joint ventures are one of the common trends observed across the industry, as it helps CMOs offer integrated bioprocessing services to their clients, which, in turn, makes them a more reliable option for a rapid product launch for commercial use. However, large firms consider outsourcing perilous due to loss of strategic control and limited management oversight. As a result, large pharma companies opt to maintain their manufacturing operations in-house. This is expected to challenge the growth of CMOs to a certain extent.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Nutraceutical Contract Manufacturing Services Market - The nutraceutical contract manufacturing services market size was estimated at USD 133.34 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.04% from 2023 to 2030.

Generic Pharmaceuticals Contract Manufacturing Market - The global generic pharmaceuticals contract manufacturing market size was valued at USD 63.7 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2022 to 2030.

Biopharmaceuticals Contract Manufacturing Market Segmentation

Grand View Research has segmented the global biopharmaceuticals contract manufacturing market based on source, service, product, therapeutic area and region:

Biopharmaceuticals Contract Manufacturing Source Outlook (Revenue, USD Million, 2017 - 2030)

- Mammalian

- Non-mammalian

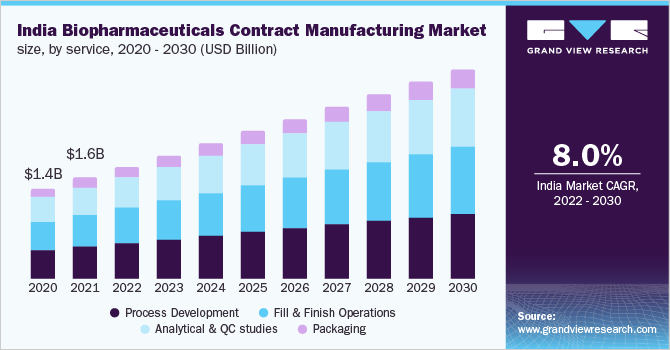

Biopharmaceuticals Contract Manufacturing Service Outlook (Revenue, USD Million, 2017 - 2030)

- Process Development

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

Biopharmaceuticals Contract Manufacturing Product Outlook (Revenue, USD Million, 2017 - 2030)

- Biologics

- Biosimilars

Biopharmaceuticals Contract Manufacturing Therapeutic Area Outlook (Revenue, USD Million, 2017 - 2030)

- Oncology

- Autoimmune Diseases

- Metabolic Diseases

- Cardiovascular Diseases

- Neurology

- Infectious Diseases

- Others

Biopharmaceuticals Contract Manufacturing Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Companies profiled:

Some prominent key players in the global biopharmaceuticals contract manufacturing market include:

- Boehringer Ingelheim GmbH

- Lonza

- Inno Biologics Sdn Bhd

- Rentschler Biotechnologie GmbH

- JRS PHARMA

- AGC Biologics

- ProBioGen

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- Toyobo Co. Ltd.

- Samsung BioLogics

- Thermo Fisher Scientific, Inc.

- Binex Co., Ltd.

- WuXi Biologics

- AbbVie, Inc.

- Novartis AG

- ADMA Biologics, Inc.

- Catalent, Inc

- Cambrex Corporation

- Pfizer Inc.

- Siegfried Holding AG

Order a free sample PDF of the Biopharmaceuticals Contract Manufacturing Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment