Parenteral Nutrition Industry Overview

The global parenteral nutrition market size was valued at USD 6.4 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 6.0% from 2022 to 2030. Development of technically advanced parenteral nutrition products with barcode assistance, growing preference for parenteral nutrition over enteral nutrition in patients with COVID-19, shorter hospital stays, along with the reduced risk of infection are factors expected to boost the product demand, thereby driving the market. According to the ASPEN20 Virtual Conference, providing appropriate nutrition to adults with COVID-19 remains a priority for optimizing outcomes. This includes overcoming various challenges amid the pandemic, such as a shortage of parenteral nutrition products due to a disrupted supply chain.

Moreover, the increasing prevalence of chronic conditions, majorly cancer & malnutrition, and the rapidly growing geriatric population and natality incidence are key high impact-rendering drivers for market growth. Increasing natality is expected to be another major market driver. Various benefits associated with parenteral nutrition cover easy usage, stimulating stomach blood flow, providing efficient nutrients, and preserving muscle catabolism. An increase in awareness about these benefits is likely to help boost the product demand. For instance, educational campaigns pertaining to health awareness particularly emphasizing nutrition and various initiatives have been undertaken to promote health & social care.

Gather more insights about the market drivers, restraints, and growth of the Global Parenteral Nutrition market

PN can be given to children and infants suffering from a disease or medical condition, thereby requiring special nutritional management. Specialized Nutrition Europe (SNE) estimated that nearly 300,000 EU children are anticipated to require medical nutrition for their special medical needs in early life stages, which supports growth and development. The study further reveals that about 40% of the hospitalized adult patients are malnourished and need medical nutrition to manage the disease-related malnutrition condition, thereby reducing the duration of hospital stay. Parenteral nutrition further lowers the infection risk and underdevelopment, thereby promoting its adoption worldwide.

Most of the premature babies suffer from low weight and undeveloped immunity, which puts them at risk. In addition, individuals and healthcare authorities are extensively focusing on limiting mortality due to early birth, thereby driving the use of parenteral lipid emulsions. In 2016, the premature birth rate in the U.S. was about 9.6% and national authorities are working toward reducing it to 8.1%, according to the National Center for Healthcare Statistics. Moreover, a rise in the number of hospitalizations for COVID-19 patients during this pandemic further boosted the product adoption in various hospitals, clinics, and Ambulatory Surgical Centers (ASCs).

Changing reimbursement scenarios coupled with other emerging trends to facilitate product adoption are projected to boost market growth in the near future. Various health plans are now available in the U.S. to cope with the problems caused by the COVID-19 pandemic. The immediate implementation of reforms in the Value-based Insurance Design (V-BID) model by the Centers for Medicare & Medicaid Services (CMS) ensures affordable and easy access to critical, clinical services. Thus, the COVID-19 pandemic is anticipated to positively impact the market and boost product adoption in the coming years.

Furthermore, the increasing prevalence of chronic conditions, such as cancer, is positively impacting the product usage worldwide. Parenteral nutrition helps in the administration of vital nutrients, which helps in maintaining strength, energy, and hydration levels in patients suffering from cancer at all stages, i.e., from diagnosis to recovery. According to the WHO, approximately 8.2 million deaths are recorded each year due to cancer, accounting for 13.0% of deaths worldwide. Moreover, there is expected to be a 70.0% increase in new cases of cancer in the next couple of decades. Thus, the increasing prevalence of cancer is one of the key factors contributing to the market growth.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

Oral Clinical Nutrition Market - The global oral clinical nutrition market size was valued at USD 15.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030.

Sports Nutrition Market - The global sports nutrition market size was valued at USD 42.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030.

Parenteral Nutrition Market Segmentation

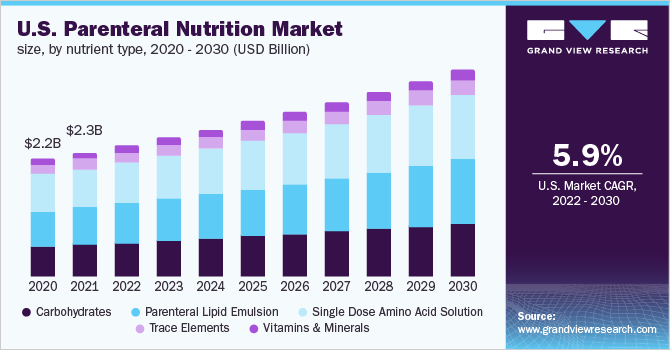

Grand View Research, Inc. has segmented the global parenteral nutrition market on the basis of nutrient type and region:

Parenteral Nutrition Nutrient Type Outlook (Revenue, USD Million, 2016 - 2030)

- Carbohydrates

- Parenteral Lipid Emulsion

- Single Dose Amino Acid Solution

- Trace Elements

- Vitamins & Minerals

Parenteral Nutrition Regional Outlook (Revenue, USD Million, 2016 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Market Share Insights:

January 2020: Fresenius Kabi completed its clinical trial for SmofKabiven. SmofKabiven is their new launch in the range of lipid emulsions. It is made of multiple oils (fish, soybean, & olive oils, and medium-chain triglycerides) along with a separate chamber for amino acids, glucose, and lipids.

Key Companies profiled:

Some prominent players in the global Parenteral Nutrition market include:

- Baxter

- Grifols, S.A.

- Allergan

- Otsuka Pharmaceutical Factory, Inc.

- Actavis Inc.

- B. Braun Melsungen AG

- Fresenius Kabi AG

- Vifor Pharma

- Sichuan Kelun Pharmaceutical Co., Ltd.

- Pfizer Inc. (Hospira Inc.)

Order a free sample PDF of the Parenteral Nutrition Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment