Equipment As A Service Industry Overview

The global equipment as a service was valued at USD 1,091.2 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 49.9% from 2023 to 2030. The relatively new concept of "Equipment as a Service" is comparable to the already well-known "Software as a Service" or “Machine as a Service” business model. In this strategy, the vendor rents out equipment while also monitoring, maintaining, or repairing it as needed to keep it in better operating order and increase client uptime. During the projection period, it is predicted that increasing consumer adoption of cutting-edge technologies, together with increased equipment uptime and efficiency provided by equipment as a service (EaaS), will fuel the market expansion.

The main objective of Industry 4.0 is to maximize machine uptime, which is done by adopting EaaS models. EaaS increases equipment uptime and efficiency, lowering costs and labor for planned and unexpected maintenance and providing consumers with cutting-edge technologies and pricing structures while also fostering the market growth. For instance, Advantech's Machine APM/M2I-31A is an end-to-cloud intelligent equipment management solution for industrial infrastructure equipment. Air compressors, injection molding machines, electric motors, pumps, vulcanizing equipment, and steam turbines are modified using this approach. Moreover, it enables edge device connectivity, data collecting, and equipment monitoring.

Gather more insights about the market drivers, restraints, and growth of the Global Equipment As A Service market

In several industries in the U.S., it has been a common procedure to switch from one-time sales of capital goods (CapEx) to recurring income streams created on equipment usage or output (OpEx). One outstanding example is the widely recognized Rolls-Royce design that has completely changed the way the business sells aircraft turbines. This model is referred to as "power-by-the-hour" since customers are only charged for the actual hours that the aircraft turbine is actually in use. Due to the numerous advantages offered by OpEx, the aforementioned factors will increase demand for EaaS in the U.S.

For instance, EaaS allows Volvo CE to maintain ownership of the equipment, streamlining the entire fleet acquisition and administration process. One of the major benefits of EaaS is that it is considered as an operating cost (OpEx). Additionally, they will benefit from Volvo CE's vast customer service operation taking full responsibility for equipment maintenance and availability. This enables customers to concentrate on their primary use while leaving other tasks to the manufacturers.

IIoT, 5G, Cloud, Big Data, and AI technological advancements have given rise to a number of digital service solutions that are either implementing EaaS models or enabling them from the start. Various IIoT solutions that allow equipment to automatically exchange asset performance data and provide transparency on asset usage are great examples of EaaS. For instance, Siemens provides the sensors and controllers required to link machines to the edge utilizing digital transformation technology through its equipment-as-a-service approach for the edge's hardware and software.

In addition, product innovation has also contributed to the rise of EaaS models. The focus of new equipment is on the entire production process used by the customer. For instance, laser manufacturers can improve the customer's overall process by giving them the opportunity to draw or categorize produced products. Hence, optimizing the entire flow is more important than concentrating on specific process phases. Owing to this, providers can scale these processes as they accumulate more performance data, which benefits the customer by significantly increasing process stability.

Browse through Grand View Research's Advanced Interior Materials Industry Research Reports.

Material Handling Equipment Market - The global material handling equipment market size was valued at USD 213.35 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030.

Air Compressor Market - The global air compressor market size was valued at USD 32.02 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.4% from 2021 to 2028.

Equipment As A Service Market Segmentation

Grand View Research has segmented the global equipment as a service market based on equipment, end-use, financing models, and region:

Equipment As A Service Equipment Outlook (Revenue, USD Million; 2018 - 2030)

- Air Compressor

- Pump

- Power Tools

- Ground Power Units

- Laser Cutting Machines

- Printing Machines

- CNC Machines

- Material Handling System

- Packaging Machine

- Excavators

- Cranes

- Others

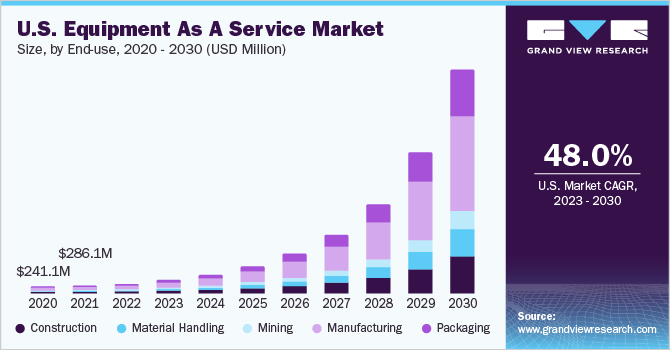

Equipment As A Service End-use Outlook (Revenue, USD Million; 2018 - 2030)

- Construction

- Material Handling

- Mining

- Manufacturing

- Packaging

Equipment As A Service Financing Models Outlook (Revenue, USD Million; 2018 - 2030)

- Subscription-based

- Outcome-based

Equipment As A Service Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- Europe

- Asia Pacific

- Central & South America

- Middle East and Africa (MEA)

Market Share Insights

May 2020: Equipment Financing Group, Milacron's exclusive finance partner, introduced a new leasing option for machinery upgrades.

Key Companies profiled:

Some of the prominent players in the global Equipment As A Service market include:

- TRUMPF

- Atlas Copco

- KAESER KOMPRESSOREN

- Heidelberger Druckmaschinen AG

- SMS group GmbH

- Arnold Machine

- Uteco

- AB Volvo

- Exone

- Siemens

- Heller Maschinenfabrik GmbH

- DMG MORI

- Hilti

- SK LASER

- Tamturbo turbo compressors

- Metso Outotec

Order a free sample PDF of the Equipment As A Service Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment