Varicose Veins Treatment Devices Industry Overview

The global varicose veins treatment devices market size was valued at USD 1.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.32% from 2023 to 2030. Increasing demand for minimally invasive procedures to treat varicose veins, along with growing investments by the market players to develop innovative and effective products, is likely to boost the market growth. According to a study published by the Institute of Quality and Efficiency in Healthcare, Germany, it is expected that approximately 20% of all adults will develop varicose veins at some point during their life span. The elderly population is more prone to spider veins although they can also affect the young population.

Moreover, the increasing geriatric population is expected to foster the growth of the market. According to World Population Prospects 2019, the number of people aged 65 years and more accounted for 703 million and is expected to double, which is 1.5 billion by 2050 globally. Varicose veins are more common among older adults and women. For instance, according to an article published in the Journal of American Heart Association, approximately 23% of U.S. adults are estimated to have varicose veins. This is anticipated to favor market growth.

Gather more insights about the market drivers, restraints, and growth of the Global Varicose Veins Treatment Devices market

Varicose veins can be aesthetically displeasing. They become problematic only in case they cause pain, aching, swelling, and considerable discomfort. In severe cases, they may rupture and can lead to ulcers. Available options for the treatment of this condition have evolved over the last few years. The majority of private healthcare providers are offering improved minimally invasive techniques.

The elderly population is more prone to the development of varicose veins. The effect of aging on the structure and functions of the veins is found to be considerable. Over the age of 50, one out of every two people is affected by varicose veins. Overweight people and pregnant women are also susceptible to developing this condition. Some of the treatments available in the market include sclerotherapy, laser therapy, and radiofrequency ablation. Sclerotherapy is preferred as a first-line of treatment for varicose, spider, and reticular veins.

Varicose veins surgical procedures are likely to undergo significant changes. Surgery has been largely replaced by noninvasive options. Due to the risk of infections associated with invasive surgeries, preference for noninvasive surgeries has increased in recent years. This factor is projected to drive the market during the forecast period. In addition to the risk of infection, noninvasive methods also involve minimum hospital stays, thus saving time and cost. More surgeons are adopting sclerotherapy, endovenous laser treatment, and radiofrequency ablation over conventional surgical practices.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Dermatology Devices Market - The global dermatology devices market size was valued at over USD 12.5 billion in 2021 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.9% over the forecast period.

Stereotactic Surgery Devices Market - The global stereotactic surgery devices market size was valued at USD 25.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030.

Varicose Veins Treatment Devices Market Segmentation

Grand View Research has segmented the global varicose veins treatment devices market based on type, end use and region:

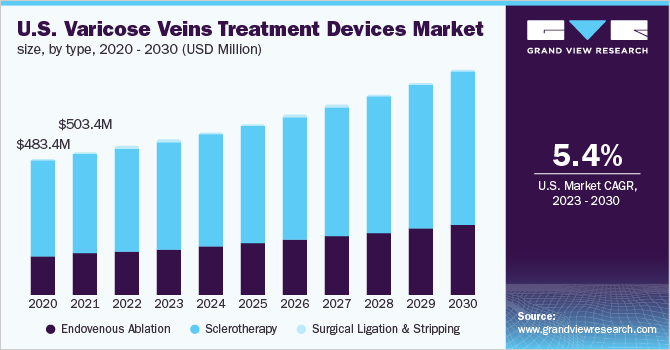

Varicose Veins Treatment Devices Type Outlook (Revenue, USD Million, 2017 - 2030)

- Endovenous Ablation

- Sclerotherapy

- Surgical Ligation & Stripping

End Use Outlook (Revenue, USD Million; 2017 - 2030)

- Vein Clinics

- Hospitals

- Ambulatory Care Unit

Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Market Share Insights

December 2021: Becton, Dickinson, and Company (BD) acquired Venclose Inc. for the expansion of its business in the treatment of Chronic Venous Insufficiency.

March 2021: Medtronic launched an Investigation Device Exemption (IDE) study to determine the effectiveness and safety of the Abre venous self-expanding stent system to be used in the treatment of deep venous diseases. Around 200 subjects are likely to be enrolled in this study across 35 locations throughout the U.S. and Europe.

Key Companies profiled:

Some prominent players in the global varicose veins treatment devices market include:

- AngioDynamics

- Medtronic

- Teleflex Incorporated

- Sciton, Inc.

- Dornier Medtech

- Merit Medical Systems

- Alma Lasers

- Biolitec AG

- Boston Scientific Corporation

Order a free sample PDF of the Varicose Veins Treatment Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment