Cancer Supportive Care Drugs Industry Overview

The global cancer supportive care drugs market size was valued at USD 14.03 billion in 2021 and is expected to decline with a compound annual growth rate (CAGR) of -1.57% from 2022 to 2030. The approval and uptake of targeted drugs, which have lesser side effects than traditional chemotherapy drugs, and the launch of biosimilars are expected to impede the market growth. Factors supporting the market include the rising prevalence of cancer, increase in the geriatric population, and high adoption of chemotherapy in low- and middle-income regions. The global COVID-19 pandemic has had a significant impact on cancer care. According to the American Society of Clinical Oncology, there was a substantial decline in visits, cancer screenings, surgeries, and therapy amid the pandemic.

In addition, hospital outpatient evaluation & management (E&M) visits (74%), new patient E&M visits (70%), and existing patient E&M visits (60%) all saw a significant decrease. However, in most regions, around the second quarter of 2021, the overall condition returned to normal. Rising cancer prevalence coupled with the increasing geriatric population is among the most prominent factors driving the market growth. According to Globocan, the number of new cancer cases is anticipated to reach 28.4 million within the next two decades, with a rise of 47% from 2020. Moreover, the geriatric population is more susceptible to cancer; in developing economies, life expectancy is now exceeding 80 years.

Gather more insights about the market drivers, restraints, and growth of the Global Cancer Supportive Care Drugs market

According to the U.S. National Cancer Institute’s SEER Database, around two-thirds of all new cancer cases are diagnosed in people aged 65 years and above, showing that aging can make people more vulnerable to such disease. With the rise in technological advancements, major players are primarily focusing on the development of novel targeted therapies for the treatment of cancer. It has lesser adverse effects than traditional treatments, such as chemotherapy. These factors can impede the market growth over the forecast period. For instance, in April 2020, Gilead Sciences, Inc. received accelerated approval for Trodelvy (sacituzumab govitecan-hziy) from the U.S. FDA.

It is indicated for the treatment of patients with triple-negative breast cancer. It is an antibody-drug conjugate that targets and kills specific infectious cells through its toxic chemical molecule, hence having lesser side effects than chemotherapy and other traditional treatments. Furthermore, biosimilars and generic drugs gaining traction is another factor hampering the market growth. Companies are launching biosimilars of key drugs, impeding the growth of branded drugs. For instance, in June 2020, Pfizer received the approval for its NYVEPRIA, a biosimilar for Amgen’s NEULASTA.

Browse through Grand View Research's Pharmaceuticals Industry Research Reports.

Erythropoietin Drugs Market - The global erythropoietin drugs market size was valued at USD 6.87 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 1.5% from 2023 to 2030.

Radiation Oncology Market - The global radiation oncology market size was valued at USD 8.65 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030.

Cancer Supportive Care Drugs Market Segmentation

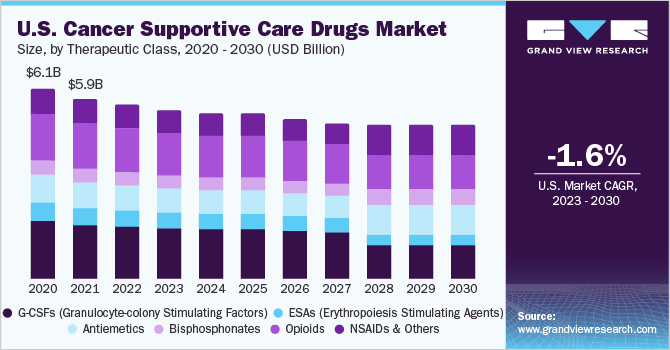

Grand View Research has segmented the global cancer supportive care drugs market based on therapeutic class and region:

Cancer Supportive Care Drugs Therapeutic Class Outlook (Revenue, USD Million, 2017 - 2030)

- G-CSFs (Granulocyte-colony Stimulating Factors)

- ESAs (Erythropoiesis Stimulating Agents)

- Anti-emetics

- Bisphosphonates

- Opioids

- NSAIDs & Others

Cancer Supportive Care Drugs Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights

June 2020: Pfizer Inc. received the U.S. FDA approval for NYVEPRIA (pegfilgrastim-apgf), a biosimilar to Neulasta. It reduces the incidence of febrile neutropenia in patients with non-myeloid malignancies undergoing myelosuppressive anticancer medications.

November 2019: Novartis AG received the FDA approval for Ziextenzo, its biosimilar version of pegfilgrastim. The product was commercialized in Europe in 2018.

Key Companies profiled:

Some of the prominent companies operating in the global cancer supportive care drugs market include:

- Amgen, Inc.

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- Heron Therapeutics, Inc.

- Novartis AG

- GlaxoSmithKline plc (GSK)

- F. Hoffmann-La Roche Ltd.

- Helsinn Healthcare SA

Order a free sample PDF of the Cancer Supportive Care Drugs Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment