U.S. Practice Management Systems Industry Overview

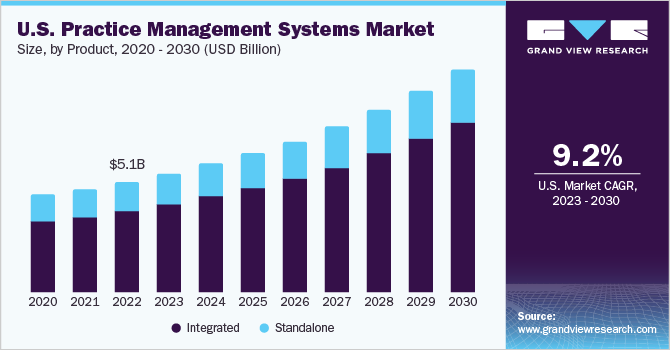

The U.S. practice management systems market size was valued at USD 7.39 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.5% from 2022 to 2030. The rising need to achieve operational efficiency, enhanced documentation with minimal errors, and financial viability for physicians' practice are the key facilitators for the adoption of practice management systems. Moreover, rapid penetration of IT and a rising number of supportive federal initiatives in the U.S. to amalgamate health records on a single platform are further anticipated to provide lucrative growth opportunities to the market.

Increasing pressure to curb healthcare costs along with changing dynamics of hospital/healthcare settings is fueling the demand for practice management systems in the U.S. Factors such as the rising focus on implementing cost-effective and high-quality care are also likely to contribute toward the market development. Healthcare institutes are witnessing a paradigm shift in the U.S. as a result of the changing dynamics of the business models.

Gather more insights about the market drivers, restraints, and growth of the U.S. Practice Management Systems market

The HITEC act implemented for improved healthcare delivery and for providing quality services to patients is further contributing to the growth of the market for practice management systems in the U.S. Adoption of healthcare IT solutions witnessed a surge during the COVID-19 pandemic is expected to provide this market with lucrative growth opportunities.

The COVID-19 pandemic accelerated transformational changes in how healthcare is delivered to patients and accessed while addressing issues such as providing cost-effective and personalized care. Various companies have upgraded their practice management solutions to provide suitable patient-centric services. For instance, Benchmark Systems Inc. in the U.S. offers fully integrated solutions to automate healthcare workflows. This company is acquired by CloudMD Software & Services Inc. in September 2020.

The partnership agreements, collaborations, and mergers by the key players to provide cloud-based solutions to their customers are expected to drive market growth. According to the M&A database of Mercom, companies operational in practice management solutions had completed around 173 deals in the past decade. Philips and Allscripts are amongst the top acquirers.

The development of new value-added services like integration of practice management systems with other healthcare IT solutions, such as Computerized Physician Order Entry (CPOE) and laboratory information systems, is anticipated to propel the market demand in the U.S. over the next few years.

Increasing cases of obesity and other chronic diseases are also expected to boost the market over the forecast period. According to a report by the Center for Disease Prevention and Control (CDC), around one-third population in the U.S. is obese. The geriatric population prone to diabetes and cardiovascular diseases further increases the rate of hospitalization. Moreover, growing incidences of drug resistance further increase the demand to maintain the medical history of patients, which is expected to propel the growth of the U.S. practice management systems market.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Physical Therapy Software Market - The global physical therapy software market size was valued at USD 1.09 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 10.1% throughout the forecast period.

Internet of Things in Healthcare Market - The global internet of things in healthcare market size was valued at USD 252.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.8% from 2023 to 2030.

U.S. Practice Management Systems Market Segmentation

Grand View Research has segmented the U.S. practice management systems market based on product, component, delivery mode, and end use:

U.S. Practice Management Systems Product Outlook (Revenue, USD Million, 2017 - 2030)

- Integrated

- Standalone

U.S. Practice Management Systems Component Outlook (Revenue, USD Million, 2017 - 2030)

- Software

- Services

U.S. Practice Management Systems Delivery Mode Outlook (Revenue, USD Million, 2017 - 2030)

- On-premise

- Web-based

- Cloud-based

U.S. Practice Management Systems End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Physician Back Office (Solo practitioners)

- Hospitals (Group practitioners)

- Pharmacies

- Diagnostic Laboratories

- Other Settings

Market Share Insights

July 2019: Henry Schein acquired Elite Computer Italia, which is a dental practice management software company, to improve its regional presence.

March 2019: McKesson Corporation collaborated with Navigating Cancer to improve the Patient Relationship Management (PRM) platform for community-based oncologists.

Key Companies profiled:

Some prominent players in the U.S. practice management systems market include:

- Henry Schein MicroMD

- Allscripts Healthcare Solutions, Inc.

- AdvantEdge Healthcare Solutions, Inc.

- Cerner Corporation

- GE Healthcare

- McKesson Corporation

- Athenahealth, Inc.

- EPIC Systems Corporation

- Accumedic Computer Systems, Inc.

- NextGen Healthcare Information System LLC

- eClinicalWorks LLC

- CareCloud

- Kareo

- AdvancedMD

- DrChrono, Inc

- CollaborateMD

- Office Ally

Order a free sample PDF of the U.S. Practice Management Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment