Digital Therapeutics Industry Overview

The global digital therapeutics market size was valued at USD 4.20 billion in 2021 and is estimated to grow at a compound annual growth rate (CAGR) of 26.1% from 2022 to 2030. Increasing smartphone penetration in developed & developing countries, the cost-effectiveness of digital health technology for providers & patients, and increasing demand for integrated healthcare systems & patient-centric care are expected to drive the market. According to Kepios, in April 2021, there were 4.27 billion internet users globally, which is over 60% of the global population. As this number increases, the awareness about smart health tracking is expected to improve. Furthermore, the COVID-19 pandemic, supportive regulatory initiatives & early signs of reimbursement, and increasing prevalence of chronic diseases are also anticipated to fuel the market growth.

The COVID-19 pandemic significantly impacted the market. A major COVID-related driver is a rise in demand for convenient and accessible digital health solutions. The April 2020 guidelines released by the FDA stated that for the duration of the pandemic, it will allow the distribution and use of digital health therapeutic devices for mental health disorders. Providers can, thus, commercialize their solutions without complying with usual regulatory requirements, provided the devices do not create any undue public health emergency. Growing regulatory initiatives are anticipated to propel the standardization and R&D in the market over the forecast period.

Gather more insights about the market drivers, restraints, and growth of the Global Digital Therapeutics market

For instance, the Software Pre-Cert Pilot Program is part of the Digital Health Innovation Action Plan of the FDA, intended for a more efficient regulatory oversight of Software-based Medical Devices (SaMD) developed by manufacturers. The program is aimed at developing an efficient regulatory oversight for assessing organizations to establish trust that they can develop high-quality SaMD products. As per the CDC’s National Center for Chronic Disease Prevention and Health Promotion, 6 in 10 American adults suffer from a chronic disease, while 4 out of 10 adults have 2 or more chronic diseases. Cardiovascular diseases, cancer, diabetes, chronic kidney disease, chronic lung disease, and Alzheimer’s have been identified as the leading causes of death and disability in the country.

Poor nutrition, use of tobacco, alcoholism, and lack of physical exercise further increase the risk of developing a chronic disease. Healthcare costs are impacted exponentially as most chronic diseases do not exist in isolation and a patient often suffers from co-morbidities. Smartphone ownership is even becoming essential with improving global interconnectivity, economically and socially. Smartphone penetration is an important factor related to the growth of the market.

Browse through Grand View Research's Healthcare IT Industry Research Reports.

Cardiovascular Digital Solutions Market - The global cardiovascular digital solutions market size was valued at USD 102.2 billion in 2022 and is estimated to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030.

Healthcare Cloud Infrastructure Market - The global healthcare cloud infrastructure market size was valued at USD 56.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.7% from 2023 to 2030.

Digital Therapeutics Market Segmentation

Grand View Research has segmented the Digital therapeutics market on the basis of application, end user, and region:

Digital Therapeutics Application Outlook (Revenue, USD Million, 2017 - 2030)

- Diabetes

- Obesity

- CVD

- Respiratory Diseases

- Smoking Cessation

- CNS Diseases

- Others

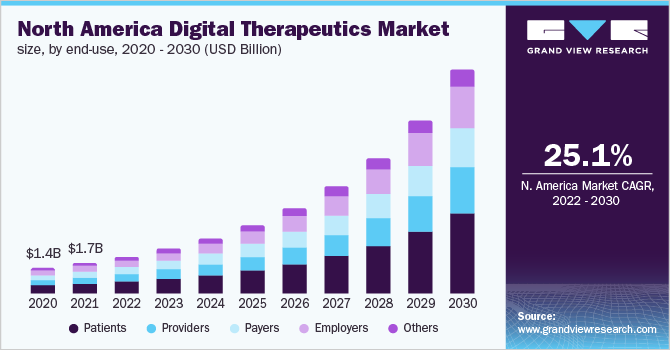

Digital Therapeutics End-user Outlook (Revenue, USD Million, 2017 - 2030)

- Patients

- Providers

- Payers

- Employers

- Others

Digital Therapeutics Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Market Share Insights

December 2021: Teladoc expanded its partnership with the National Labor Alliance for offering its full suite of virtual care products and services. These products and services included specialty care, general medical, expert medical services, mental health, virtual primary care programs, and chronic condition management.

Key Companies profiled:

Some of the key players in the global digital therapeutics market include:

- OMADA HEALTH, INC.

- Welldoc, Inc.

- 2Morrow, Inc

- Teladoc Health, Inc.

- Propeller Health (ResMed)

- Fitbit LLC

- CANARY HEALTH

- Noom, Inc.

- Pear Therapeutics, Inc.

- Akili Interactive Labs, Inc.

- HYGIEIA

- DarioHealth Corp.

- BigHealth

- GAIA AG

- Limbix Health, Inc.

Order a free sample PDF of the Digital Therapeutics Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment