Endoscopes Industry Overview

The global endoscopes market size was valued at USD 13.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.4% from 2023 to 2030. The rise in prevalence of chronic disorders and the growing awareness of early detection of diseases through minimally invasive surgical procedures are some of the major factors anticipated to drive the market growth over the forecast years. In addition, favorable reimbursement policies, and increasing FDA approvals for endoscopic devices are also expected to boost the growth of the market over the years. For instance, in 2021, the United States Food and Drug Administration granted 510(k) clearance to EndoFresh’s disposable digestive endoscopy system, a device developed to reduce the chance of contamination in gastrointestinal procedures.

Furthermore, endoscopic procedures have been largely adopted to diagnose and treat functional gastrointestinal disorders. Functional gastrointestinal disorders can affect any part of the gastrointestinal tract, including the stomach, esophagus, and intestines. The growing prevalence of functional gastrointestinal disorders, such as Irritable Bowel Syndrome (IBS), functional constipation, or functional dyspepsia, is also expected to accelerate the adoption of endoscopy devices and boost the market growth over the forecast years. For instance, in 2021, a multinational study published in the Gastroenterology journal on 33 countries reported that, globally, over 40% of persons have functional gastrointestinal disorders.

Gather more insights about the market drivers, restraints, and growth of the Global Endoscopes market

In addition, obesity is a growing serious health problem globally due to unhealthy lifestyles and diets. It is associated with several gastrointestinal disorders, such as esophageal adenocarcinoma, erosive esophagitis, gastroesophageal reflux disease, colorectal polyps, and cancer. As per the Organization for Economic Co-operation and Development (OECD) data, the obesity rate is expected to grow at a significant rate by 2030. Nearly 47%, 39%, and 35% of the population in the U.S., Mexico, and England respectively are expected to be obese by 2030. Bariatric surgery is the most effective treatment option resulting in significant weight loss. However, the emergence of minimally invasive endoscopic sleeve gastroplasty procedures significantly reduces stomach volume.

It is performed through patients’ mouths unlike traditional bariatric surgery using a flexible endoscope. Hence, the increase in demand for minimally invasive endoscopic bariatric procedures is further anticipated to drive market growth over the years. Furthermore, the growing global burden of cancer all over the world is also driving the demand for endoscopes for early diagnosis and treatment. For instance, according to Globocan 2020 report, the estimated number of new cancer cases was 19.3 million in 2020 and the number of deaths that occurred due to cancer was about 10 million. Thus, increasing demand for endoscopic biopsy to diagnose cancer is anticipated to drive the market growth during the forecast years.

A decrease in the number of endoscopic procedures during the COVID-19 pandemic hampered the market growth in 2020. Due to the risk of cross-contamination and the chance of SARS-CoV-2 transmission, several endoscopic facilities have canceled or postponed the elective, and semi-urgent procedures, which is restraining the market growth during this period. Furthermore, supply chain disruption and changing regulations to curtail the infection are also some of the major factors that hindered the growth of the market in 2020. For instance, a study on the endoscopy unit of the Cancer Institute of the State of São Paulo (ICESP), published in Clinics (Sao Paulo) journal in 2021, stated that there is a 55% reduction in the endoscopic procedure during the pandemic and the colonoscopy is the most affected modality (-79%).

Browse through Grand View Research's Medical Devices Industry Research Reports.

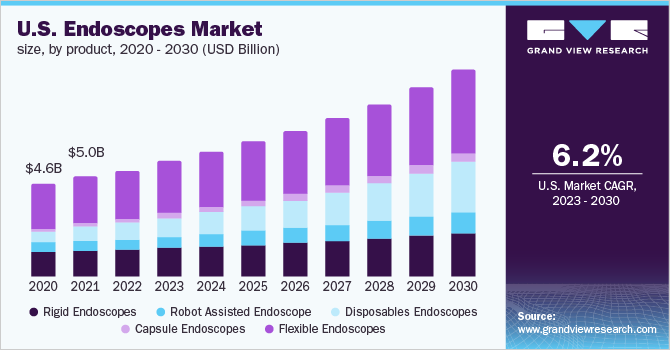

Rigid Endoscopes Market - The global rigid endoscopes market size was valued at USD 6.0 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030.

Flexible Endoscopes Market - The global flexible endoscopes market size was valued at USD 8.96 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030.

Endoscopes Market Segmentation

Grand View Research has segmented the global endoscopes market based on product, application, end use, and region:

Endoscopes Product Outlook (Revenue, USD Million, 2014 - 2030)

- Rigid Endoscopes

- Flexible Endoscopes

- Capsule Endoscopes

- Disposable Endoscopes

- Robot-assisted Endoscopes

Endoscopes Application Outlook (Revenue, USD Million, 2014 - 2030)

- Gastrointestinal (GI) Endoscopy

- Laparoscopy

- Obstetrics/Gynecology Endoscopy

- Arthroscopy

- Urology Endoscopy (Cystoscopy)

- Bronchoscopy

- Mediastinoscopy

- Otoscopy

- Laryngoscopy

- Other Applications

Endoscopes End-use Outlook (Revenue, USD Million, 2014 - 2030)

- Hospitals

- Ambulatory Surgery Centers/Clinics

- Other End Uses

Endoscopes Regional Outlook (Revenue, USD Million, 2014 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Market Share Insights

January 2021: Olympus Corp. acquired Quest Photonic Devices to strengthen its presence in the surgical endoscopy market.

Key Companies profiled:

Some prominent players in the global endoscopes market include:

- Olympus Corp.

- PENTAX Medical

- Ethicon US, LLC

- FUJIFILM Holdings Corp.

- Stryker

- Boston Scientific Corp.

- CONMED Corp.

- Karl Storz GmbH & Co., KG

- Richard Wolf Medical Instruments

- Medtronic

Order a free sample PDF of the Endoscopes Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment