X-ray Systems Industry Overview

The global x-ray systems market size was valued at USD 6.7 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 2.3% from 2022 to 2030. Major factor driving the market is increase in the demand for early-stage diagnosis of chronic diseases. In addition, continuous technological advancements, rise in product development, improved fundings, and investments by the government, especially in developing countries, such as India and China, are also expected to contribute to the market growth. For instance, in June 2021 the government of India launched X-Ray Setu, a free Artificial Intelligence (AI) based platform to aid doctors for early Covid interventions.

Over the last few years, medical imaging has undergone a drastic evolution owing to digital radiology solutions. Diagnostic accuracy is at the core of the healthcare industry, and digital X-ray imaging plays a significant role in improving diagnostic accuracy. In addition, the integration of AI in these systems has contributed to market growth. For instance, in August 2021, GE Healthcare announced a partnership with Amazon Web Services (AWS) to provide AI and cloud-based imaging solutions to hospitals and healthcare providers. Furthermore, major market players are engaged in the development of advanced modalities such as multimodal/hybrid imaging systems.

Gather more insights about the market drivers, restraints, and growth of the Global X-ray Systems market

For instance, in October 2021, Siemens Healthineers launched Luminos Impulse, a 2-in-1 remote-controlled imaging device that integrates fluoroscopy and radiography for improved clinical productivity and efficiency. Increasing awareness and adoption of preventive healthcare and disease screening programs is expected to propel market growth. Improvement in the quality of image output is expected to enhance diagnostic accuracy in the early stages of various diseases. This can help with the faster diagnosis and treatment of a variety of life-threatening disorders, including cancer and a number of cardiovascular conditions. Thus, the growing usage of x-ray systems for diagnosing various diseases is expected to contribute to market growth.

The COVID-19 pandemic has posed challenges and changed healthcare systems globally. Radiology has considerably improved patient care in this crisis, owing to rapid advancements.The first imaging procedure that played an important role in the treatment of COVID-19 was chest radiography, since it plays a major role in the diagnosis of COVID-19. Furthermore, the demand for mobile x-ray systems has increased as a result of the COVID-19 pandemic. With the consumers being more aware of the benefits of mobile x-ray systems and the possibility of another pandemic in the future, healthcare facilities may consider switching to mobile diagnostic equipment owing to its faster image processing, workflow optimization, integrated AI, and other features.

Browse through Grand View Research's Medical Devices Industry Research Reports.

Medical X-ray Generators Market - The global medical X-ray generators market size was valued at USD 2.01 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030.

Teleradiology Market - The global teleradiology market size was valued at USD 2.17 billion in 2021 and is anticipated to expand at a CAGR of 12.5% from 2022 to 2030.

X-ray Systems Market Segmentation

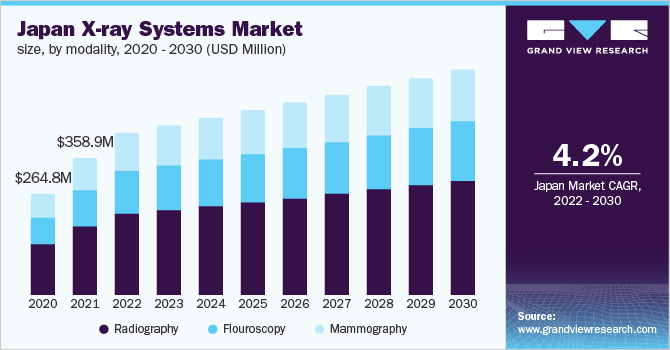

Grand View Research has segmented the global x-ray systems market report on the basis of modality, technology, mobility, end use, region:

X-ray Systems Modality Outlook (Revenue, USD Million, 2017 - 2030)

- Radiography

- Fluoroscopy

- Mammography

X-ray Systems Technology Outlook (Revenue, USD Million, 2017 - 2030)

- Digital radiography

- Computed radiography

X-ray Systems Mobility Outlook (Revenue, USD Million, 2017 - 2030)

- Stationary

- Mobile

X-ray Systems End-use Outlook (Revenue, USD Million, 2017 - 2030)

- Hospitals

- Diagnostic imaging centres

X-ray Systems Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

November 2021: GE Healthcare received FDA clearance for its artificial intelligence (AI) algorithm to help healthcare professionals evaluate Endotracheal Tube (ETT) placements.

March 2021: Siemens Healthineers introduced Mammovista B.smart, software that speeds up the reading process for breast imaging.

March 2021: Fujifilm Ltd., a leader in imaging and healthcare technologies, announced the launch of t FDR micro, a mobile digital radiology system, which provides high-resolution imaging with low X-ray doses.

Key Companies profiled:

Some of the prominent players in the X-ray systems market include:

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- GE Healthcare

- Canon Medical Systems

- Shimadzu Corporation

- FUJIFILM SonoSite, Inc.

- Carestream

- Mindray Medical International Limited

- Hologic, Inc

- New Medical Imaging

- AGFA

Order a free sample PDF of the X-ray Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment