U.S. Durable Medical Equipment Industry Overview

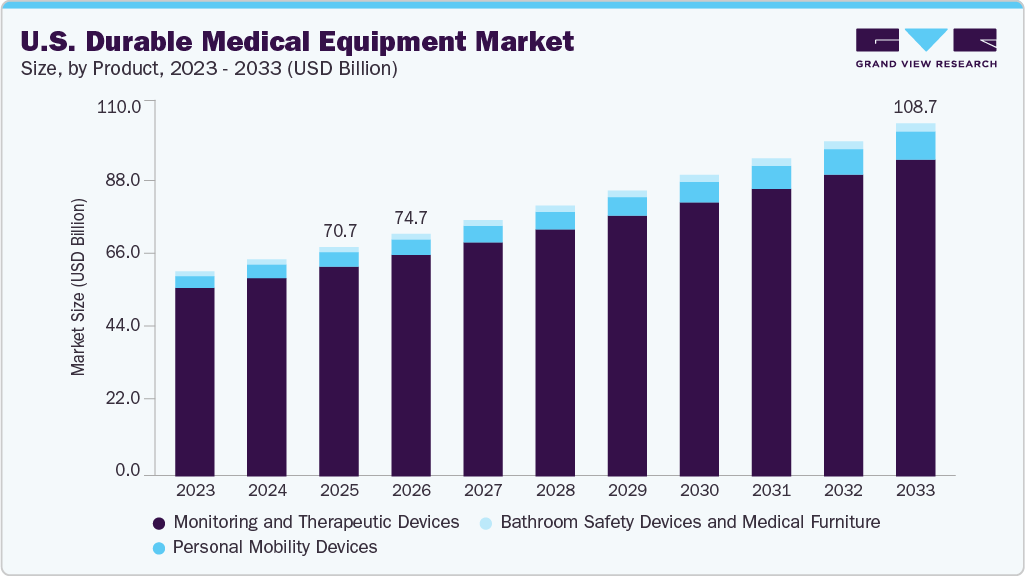

The U.S. durable medical equipment market size was valued at USD 59.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. The COVID-19 pandemic has affected the supply chain of durable medical equipment (DME). The market is majorly driven by the rising product demand due to the growing geriatric population that is susceptible to various chronic diseases, such as cancer, diabetes, Cardiovascular Diseases (CVDs), neurological disorders, and mobility disorders.

The COVID-19 pandemic has initially disrupted the market due to the lack of accessibility of the products to the customers. The pandemic has affected the operations and financial condition of various market players. The DME suppliers have encountered interruptions in the supply chain, such as significant delays and order cancellations, as a result of public health and economic emergencies related to the COVID-19 pandemic.

Gather more insights about the market drivers, restraints, and growth of the U.S. Durable Medical Equipment market

The durable medical equipment suppliers are facing numerous challenges in serving patients requiring respiratory support and other DME-related services. Cancer is a leading cause of death globally accounting for 10 million deaths in 2020. As per the National Cancer Institute Report 2018, approximately 1.7 million people in the U.S. were diagnosed with cancer.

It is predicted that there will be a 70.0% rise in the new cases of cancer over the next couple of years (about 1.1 million people). The rising prevalence of neurological diseases, such as Alzheimer’s, Parkinson’s, and Epilepsy, is also expected to fuel the product demand. As per the statistics of the Centers for Disease Control and Prevention, in 2020, 5.8 million Americans were living with Alzheimer’s disease. The rising prevalence of diseases is expected to result in an increase in demand for DME over the forecast period. In addition, an increase in healthcare spending across the country is expected to boost market growth.

The demographic shifts underlie the projected growth in the U.S. healthcare expenditure from USD 3.5 trillion in 2017 to USD 6.2 trillion in 2028 and account for 20% of the GDP. The anticipated growth in the annual spending for Medicare (7.9%) is projected to contribute significantly to the increase in the national health expenditure over the forecast period. Since its inception, Medicare has accounted for an increasing proportion of the total healthcare expenditure. Medicare has covered 18.4% of U.S. Americans in 2020 and in 2021, more than 26 million people enrolled in Medicare Advantage Plan.

Browse through Grand View Research's Medical Devices Industry Research Reports.

U.S. Home Healthcare Market - The U.S. home healthcare market size was valued at USD 142.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.48% from 2023 to 2030.

Personal Mobility Devices Market - The global personal mobility devices market size was valued at USD 14.9 billion in 2021 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.3% from 2022 to 2030.

U.S. Durable Medical Equipment Market Segmentation

Grand View Research has segmented the U.S. durable medical equipment market based on product and end-use:

U.S. Durable Medical Equipment Product Outlook (Revenue, USD Million, 2018 - 2030)

- Personal Mobility Devices

- Bathroom Safety Devices and Medical Furniture

- Monitoring and Therapeutic Devices

U.S. Durable Medical Equipment End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Diagnostic Centers

- Home Healthcare

- Others

Market Share Insights

December 2020: Arjo completed the acquisition of AirPal, which is likely to strengthen Arjo’s Patient Handling portfolio.

Key Companies profiled:

Some prominent players in the U.S. durable medical equipment include:

- Invacare Corp.

- Sunrise Medical

- Arjo

- Medline Industries, Inc.

- GF Healthcare Products, Inc.

- Carex Health Brands, Inc.

- Cardinal Health

- Drive DeVilbiss Healthcare

- NOVA Medical Products

- Kaye Products, Inc.

Order a free sample PDF of the U.S. Durable Medical Equipment Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment