5G Chipset Industry Overview

The global 5G chipset market size was valued at USD 1.29 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 69.1% from 2021 to 2028. The growing demand for high-speed data networks with a latency of less than 1ms to ensure seamless connectivity for mission-critical applications, such as Machine-to-Machine (M2M) communication, is expected to propel market growth over the forecast period. A 5G chipset component happens to be an essential component for 5G-enabled smartphones, laptops, routers, and telecom base stations. This 5G chipset module allows the users of these devices to access the next-generation networks and enjoy an enhanced experience.

Several leading telecom operators across the globe, including AT&T, Inc.; Verizon Communications; and China Telecom Corporation Limited; are aggressively investing in deploying a 5G network infrastructure to provide high-speed connectivity to their customers. For instance, in November 2018, Nokia Corporation reached an agreement worth around USD 2.2 billion with three key telecom operators in China, namely China Telecom Corporation Limited, China Mobile Limited, and China United Network Communications Group Co., Ltd., to deploy high-speed network infrastructure in China. Such investments in building next-generation network infrastructure are expected to encourage the adoption of 5G-enabled devices across the globe, which would subsequently drive the demand for 5G chipset components over the forecast period. The growing need for high-speed chipset components for applications, such as Vehicle to Everything (V2X) and drone connectivity, which require ultra-reliable low-latency connectivity, is also expected to boost market growth over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Global 5G Chipset market

Meanwhile, the Internet of Things (IoT) continues to proliferate throughout the globe as several smart cities, smart infrastructure, and smart grid projects are being undertaken in different parts of the world. The global IoT connections are anticipated to exceed 3 billion by 2028. Several manufacturing companies have started deploying IoT devices to monitor machine performance in real-time to reduce overall downtime and enhance operational efficiency. The subsequent increase in demand for IoT devices is expected to drive the demand for 5G new chipset modules over the forecast period.

The continued emphasis on developing new and innovative chipset modules for telecom base stations to reduce the overall size and power consumption is expected to open new opportunities in the market for 5G chipsets over the forecast period. For instance, in February 2019, Samsung Electronics Co., Ltd. introduced two new 5G chipset components for telecom base stations, namely Radio Frequency Integrated Circuits (RFIC) and Application Specific Integrated Circuit (ASIC) chipsets. These 5G chipset components are capable of operating within the mmWave band of frequencies. They are designed to reduce the base station power consumption, size, and weight by 25.0%.

The exponential spread of COVID-19 worldwide has had an adverse impact on the 5G chipset manufacturing facilities in the Asia Pacific, which have been temporarily shut, leading to a significant slowdown in production. The outbreak could result in several supply chain participants shifting their production facilities outside China. For instance, according to the data released by the customs department in China, China’s exports have shown a rapid decline of nearly 17.0% in the first two months of 2020 as compared to the last year. In addition, it has been analyzed that currently, the overall manufacturing sector in Asia Pacific has been severely impacted due to the outbreak of COVID-19; therefore, the market for 5G chipset is also hampered in the region. For instance, various leading players including Huawei Technologies Co., Ltd., and Samsung Electronics Co., Ltd. have showcased a slowdown in their 5G chipset production and exports in the region, foreseeing the decline in the global demand for 5G chipsets. Therefore, a decline in the production of these 5G chipsets, coupled with the temporary bans on international trades in China, the U.S., and South Korea, is estimated to hinder the overall market growth over the coming years.

However, data security and information privacy concerns can potentially impede the adoption of the 5G chipset components over the forecast period. Concerns over the security of the data being exchanged over next-generation networks are rising all over the world. Several governments have responded to these concerns by drafting favorable policies and stringent regulations to ensure data security and information privacy. The growing trade conflicts between the U.S. and China are also expected to restrain the growth of the market for 5G chipset.

Browse through Grand View Research's Technology Industry Related Reports

5G Services Market - The global 5G services market size was valued at USD 47.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 52.0% from 2022 to 2030.

5G System Integration Market - The global 5G system integration market size was valued at USD 7.88 billion in 2021 and is expected to exhibit a CAGR of 27.3% from 2022 to 2030. 5G system integration is a process of integrating both virtual and physical components of any enterprise with new upgraded systems or applications to work over the new 5G network.

5G Chipset Industry Segmentation

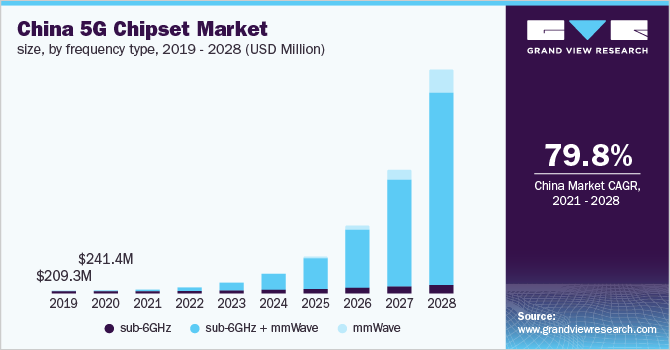

Grand View Research has segmented the global 5G chipset market on the basis of frequency type, processing node type, deployment type, vertical, and region:

5G Chipset Frequency Type Outlook (Revenue, USD Million, 2019 - 2028)

- sub-6GHz

- mmWave

- sub-6GHz + mmWave

5G Chipset Processing Node Type Outlook (Revenue, USD Million, 2019 - 2028)

- 7 nm

- 10 nm

- Others

5G Chipset Deployment Type Outlook (Revenue, USD Million, 2019 - 2028)

- Telecom Base Station Equipment

- Smartphones/Tablets

- Connected Vehicles

- Connected Devices

- Broadband Access Gateway Devices

- Others

5G Chipset Vertical Outlook (Revenue, USD Million, 2019 - 2028)

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- IT & Telecom

- Transportation & Logistics

- Healthcare

- Others

5G Chipset Regional Outlook (Revenue, USD Million, 2019 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

February 2019: Samsung Electronics Co., Ltd. introduced two new 5G chipset components for telecom base stations, namely Radio Frequency Integrated Circuits (RFIC) and Application Specific Integrated Circuit (ASIC) chipsets.

February 2019: Qualcomm Incorporated introduced the Snapdragon X55 5G modem. The new modem supports sub-6GHz as well as mmWave bands.

Key Companies profiled:

Some prominent players in the global 5G Chipset Industry include

- Qualcomm Incorporated

- Intel Corporation

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- MediaTek Inc.

- Infineon Technologies AG.

- Unisoc Communications, Inc.

- Xilinx Inc.

- Qorvo, Inc.

Order a free sample PDF of the 5G Chipset Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment