Semi-trailer Industry Overview

The global semi-trailer market size to be valued at USD 29.36 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% during the forecast period. Rising urbanization, increasing manufacturing activities, and the need for effective transportation are anticipated to be the major factors driving the demand for semi-trailers. Moreover, the growth of the end-use industries, along with the expanding cold chain industry, is likely to surge the demand for semi-trailers in the coming years. Besides, the offering of custom-built semi-trailers by the manufacturers to meet consumer demand is anticipated to create significant growth opportunities in the coming years.

Logistics is one of the key end-use industries for semi-trailers. The use of trailers and trucks for the transportation of goods is increasing rapidly. With the changing lifestyles and urbanization, people are more inclined towards getting the goods and products delivered to them. Fast Moving Consumer Goods (FMCG), e-commerce retailers, physical retailers, and suppliers are all involved in providing delivery to the customers. Road transportation is the most utilized mode of transportation in the logistics sector as it offers better cost advantages over other modes. Thus, with the improved road infrastructure, the demand for road transport has arisen, subsequently benefiting the semi-trailer industry.

Gather more insights about the market drivers, restraints and growth of the Global Semi-trailer market

Besides, the economic strengthening of the middle-class has surged the demand for several cold chain goods, such as pharmaceutical products, poultry, fresh flowers, fish, dairy products, and fruits and vegetables. Moreover, increasing disposable income in developing countries has allowed people to spend more on fresh, organic, and prime quality products. Thus, the increasing number of QSR, the general push for healthier, fresh products, and higher disposable income are positively impacting every aspect of the cold chain industry. Hence, the expanding cold chain industry across the developed and emerging economies is expected to surge the demand for refrigerated trailers.

Moreover, manufacturers are investing significant amounts in enhancing semi-trailer designs in order to meet the growing demand for fuel-efficient vehicles. In addition, increasing preference for packaged food is contributing to market growth. Furthermore, increasing awareness among fleet operators regarding benefits offered by semi-trailers with respect to efficiency and productivity has led to the greater adoption of such vehicles.

The COVID-19 pandemic has affected the demand for semi-trailers in 2020. The implementation of lockdown and social distancing regulations across the globe has, subsequently, led to losses for industries, such as manufacturing, logistics, automobile, entertainment, restaurant, and hospitality. Additionally, the pandemic has negatively impacted the production and sales of semi-trailers across the globe. Similar to players operating across different industry verticals, semi-trailer manufacturers have also suffered from losses due to the pandemic. However, some companies have also reported an increase in the unit sales of semi-trailers in 2020 as compared to 2019. For instance, China International Marine Containers (Group) Ltd., a China-based manufacturer of semi-trailers, witnessed an increase in the unit sales of semi-trailers by over 11% in 2020.

Browse through Grand View Research's Technology Industry Related Reports

Third-party Logistics Market - The global third-party logistics market size was valued at USD 956.80 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 8.6% from 2022 to 2030.

Cold Chain Market - The global cold chain market size was valued at USD 210.49 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 14.8% from 2021 to 2028.

Semi-trailer Industry Segmentation

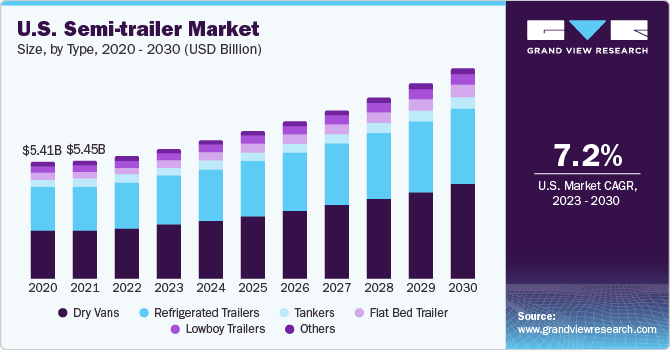

Grand View Research has segmented the global semi-trailer market based on type and region:

Semi-trailer Type Outlook (Volume, ‘000 Units; Revenue, USD Million, 2016 - 2028)

- Flat Bed Trailer

- Dry Vans

- Refrigerated Trailers

- Lowboy Trailers

- Tankers

- Others

Semi-trailer Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights:

June 2021: Schmitz Cargobull, a European manufacturer of semi-trailers, announced the opening of its new factory in Manchester. Through this expansion, the company aims to build customized vehicles for the U.K. and Irish operators.

Key Companies profiled:

Some prominent players in the global Semi-trailer Industry include

- China International Marine Containers (Group) Ltd.

- Fontaine Commercial Trailer, Inc.

- Great Dane

- Kogel Trailer GmbH & Co.KG

- Krone Commercial Vehicle Group

- Lamberet SAS

- Polar Tank Trailer, LLC

- Schmitz Cargobull

- Utility Trailer Manufacturing Company

- Wabash National Corporation

- HYUNDAI TRANSLEAD

Order a free sample PDF of the Semi-trailer Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment