High-frequency Trading Server Industry Overview

The global high-frequency trading server market size was valued at USD 387.9 million in 2020 and is expected to register a compound annual growth rate (CAGR) of 3.5% from 2021 to 2028. The need for Ultra-Low Latency (ULL) in the trading ecosystem and the advancements in quantum computing in financial services are expected to drive the market growth over the forecast period. Furthermore, a surge in the need for intent-based networking conducive to a high-frequency trading environment is expected to create opportunities for future growth. High-frequency trading (HFT) servers are based on mathematical algorithms and facilitate high-speed trading transactions in less than nanoseconds. One of the significant traits for such high-speed executions is high power computational analysis, which outperforms conventional stock trading servers.

In recent years, market participants have focused on increasing their investments to develop sophisticated technologies to reduce network latency. For instance, in 2019, Ciara, a brand of Hypertec, launched three low-latency servers, namely ORION HF210-G5, ORION HF610T-G4, and ORION HF310-G4, notably built for high-frequency transactions and reducing trading delays. Such types of servers are further responsible for garnering multi-billion profits for trading firms, creating opportunities for server Original Design Manufacturers (ODMs).

Gather more insights about the market drivers, restraints and growth of the Global High-frequency Trading Server Market

An HFT server is a subset of high-performance computing applications and implements Artificial Intelligence (AI) as well as deep learning capabilities. These servers allow traders to predict stock market trends and conduct trade in milliseconds. The demand for HFT applications is increasing in large investment banks and firms offering hedge funds, subsequently creating growth opportunities in the industry.

A high-frequency trading environment requires an ultra-low latency feed that helps manage multiple orders to perform rapid data analysis and correlation. Therefore, to provide faster feeds for trading applications, trading firms have located their data centers closer to the stock exchanges. Proximity to a stock exchange gives trading firms the advantage to gain high bandwidth networks with low latency connections with better results, thereby creating product demand.

Over the next few years, algorithmic-based trading in equity markets is likely to gain traction. Algo-based trading helps equity traders in implementing and modifying stop-loss strategies. Since stock markets are volatile as well as unpredictable it becomes challenging to manage large portfolios. Thus, integrating stop-loss strategies with HFT systems is expected to help trading firms in managing risks and preventing losses, further creating opportunities for servers supporting these applications.

Browse through Grand View Research's Technology Industry Related Reports

Deep Learning Market - The global deep learning market size was valued at USD 34.8 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) exceeding 34.3% from 2022 to 2030.

Artificial Intelligence Market - The global artificial intelligence market size was valued at USD 93.5 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

High-frequency Trading Server Industry Segmentation

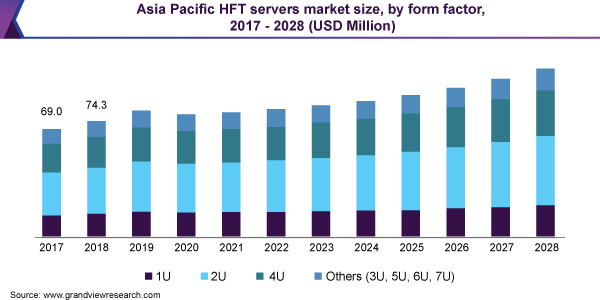

Grand View Research has segmented the global high-frequency trading server market on the basis of processor, form factor, application, and region:

HFT Servers Processor Outlook (Volume, Units; Revenue, USD Million, 2017 - 2028)

- X-86-based

- ARM-based

- Non-x86-based (MIPS, Imagination)

HFT Servers Form Factor Outlook (Volume, Units; Revenue, USD Million, 2017 - 2028)

- 1U

- 2U

- 4U

- Others (3U, 5U, 6U, 7U)

HFT Servers Application Outlook (Volume, Units; Revenue, USD Million, 2017 - 2028)

- Equity Trading

- Forex Markets

- Commodity Markets

- Others (Bonds and Other Derivatives)

High-frequency Trading Server Regional Outlook (Revenue, USD Million, 2017 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

February 2020: Cisco Systems, Inc. acquired Exablaze, an Australian manufacturer of advanced network devices. The acquisition helped Exablaze to strengthen its product portfolio in next-generation technologies, such as HFT.

Key Companies profiled:

Some prominent players in the global High-frequency Trading Server Industry include

- ASA Computers, Inc.

- Blackcore Technologies

- Business Systems International Ltd.

- CIARA

- Dell

- HP Enterprise Development LP

- Hypershark Technologies

- Lenovo

- Penguin Computing

- Super Micro

- Tyrone Systems

- XENON Systems Pty Ltd.

Order a free sample PDF of the High-frequency Trading Server Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment