Telecom Power Systems Industry Overview

The global telecom power systems market size was valued at USD 3.28 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 8.8% from 2021 to 2028. These power systems are designed for fixed-line applications and wireless broadband access. The factors such as the growing penetration of telecom towers in remote locations as well as the increasing deployment of cell power systems used for LTE networks are expected to fuel the market growth over the forecast period. Telecom power systems are designed to support telecommunication services by controlling and monitoring the flow of power in case there are any disruptions or grid power fluctuations in the network. The market has evolved in recent years due to the largescale adoption of digital disruptive technologies and their integration in telecom infrastructure.

The significant rise in cellular data traffic has encouraged the expansion of mobile networks even in remote and rural vicinities. Moreover, the rapid increase in the adoption of a range of connected devices has stimulated the deployment of picocells and femtocells, which require power systems. This continuous expansion of cellular networks for improving connectivity infrastructure is creating opportunities for the market globally. To cater to the rising demand for faster connections, telecom operators are integrating their products with next-generation Wi-Fi-6, 5G networks, and other advanced wireless technologies. Telecom operators are also offering products equipped with increased data capacities, lower latency, precise location sensing, and greater device density. For instance, Robert Bosch GmbH, an industrial technology conglomerate, collaborated with Nokia and launched a new private 5G network at its Industry 4.0 central plant in Stuttgart-Feuerbach, Germany.

Gather more insights about the market drivers, restraints and growth of the Global Telecom Power Systems market

The rising focus of businesses on reducing the environmental impact and carbon footprint of their operations could create growth avenues for renewable energy-powered telecom power systems in the future. The global telecom power system market can benefit from renewable power by allowing businesses to significantly reduce operational costs while also meeting carbon emission targets. Several regulatory bodies worldwide are favoring the establishment of hybrid power plants to ensure the viability of power systems in locations with more consumption requirements. For instance, the directives issued by the Department of Telecommunication (DoT), India, recommended that 33% of the telecom towers in India’s urban areas and 75% of telecom towers in its rural areas be hybrid powered by 2020.

The COVID-19 pandemic and subsequent restrictions imposed by the government of various countries have compelled a large share of the global population to spend more time in their homes and work remotely. This has resulted in a sudden increase in data consumption and a significant rise in demand for faster internet, overloading the existing telecom infrastructure and boosting the demand for advanced telecom power systems worldwide. Furthermore, leading telecom service providers are leveraging advanced telecom power systems to maintain the continuous power supply without any outages and fluctuation issues in the IT sector.

Browse through Grand View Research's Technology Industry Related Reports

Telecom Services Market - The global telecom services market size was valued at USD 1,657.7 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2021 to 2028.

5G Services Market - The global 5G services market size was valued at USD 47.3 billion in 2021 and is expected to expand at a CAGR of 52.0% from 2022 to 2030. 5G wireless mobile services enable a fully mobile and connected environment by delivering a wide range of use cases and business models to consumers.

Telecom Power Systems Industry Segmentation

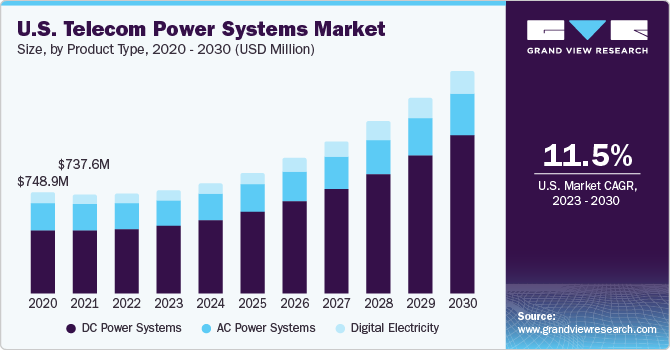

Grand View Research has segmented the global telecom power systems market based on product, grid type, power source, and region:

Telecom Power Systems Product Outlook (Revenue, USD Billion, 2018 - 2028)

- AC Power Systems

- DC Power Systems

- Digital Electricity

Telecom Power Systems Grid Type Outlook (Revenue, USD Billion, 2018 - 2028)

- On-Grid

- Off-Grid

- Bad Grid

Telecom Power Systems Power Source Outlook (Revenue, USD Billion, 2018 - 2028)

- Diesel-Battery

- Diesel-Solar

- Diesel-Wind

- Other Sources

Telecom Power Systems Regional Outlook (Revenue, USD Million, 2018 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights:

October 2020: Cummins Inc. introduced two new digital master controls, DMC2000 and DMC6000, in its portfolio of power systems. These control equipment provide faster delivery time at an economical cost.

March 2020: Corning Incorporated partnered with US Conec Ltd., a manufacturer of a range of industry connectors, to deploy MDC connector solutions that would significantly enhance carrier distribution networks, hyper-scale data centers, and other high-density patching solutions.

Key Companies profiled:

Some prominent players in the global Telecom Power Systems Industry include

- Alpha Technologies, Services, Inc.

- Ascot

- Eaton

- General Electric

- Huawei Technologies Co., Ltd.

- Schneider Electric

- ZTE Corporation

Order a free sample PDF of the Telecom Power Systems Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment