DNA & RNA Banking Services Industry Overview

The global DNA and RNA banking services market size was valued at USD 6.09 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.46% from 2021 to 2027. Biobanking approaches have been identified as key areas in accelerating the discovery and development of new therapeutic interventions, especially in oncology. This multidisciplinary approach is applied in all aspects of disease prediction, prevention, therapy monitoring, drug discoveries, and optimization. Therefore, a rise in cancer cases globally is expected to drive the demand for DNA and RNA banking services for cancer research. Cancer is the second most common cause of death in the U.S. after heart disease. According to the American Cancer Society estimates, more than 1.8 million new cancer cases were identified by the end of 2020 in the U.S. In addition, approximately 606,520 Americans were estimated to die in 2020 due to cancer. This high prevalence rate of cancer subsequently increases the demand for cancer research, which further accelerates the usage of DNA and RNA banking services.

Gather more insights about the market drivers, restraints and growth of the Global DNA & RNA Banking Services market

The emergence of imaging biobanks is one of the recent evolutions where images collected from magnetic resonance, advanced computed tomography, and positron emission tomography are useful in validating and identifying non-invasive biomarkers (IBs). IBs help assess physiological processes and pharmaceutical responses to drugs. Oncologic-oriented imaging biobanks are the most existing types as IBs are used for oncologic purposes, such as tumor volume and glucose metabolism.

Funding and investment programs to expand the DNA and RNA banking approaches globally are expected to boost market growth in the near future. For instance, in July 2019, 54gene, a Nigeria-based startup, raised USD 4.5 million in seed funding for the development of Pan-African Biobank. The company planned to collect 40,000 samples and further expand its collection to gather around 200,000 samples by the end of 2020. This broadened the banking services in emerging nations.

Browse through Grand View Research's Healthcare Industry Related Reports

Biobanks Market - The global biobanks market size was valued at USD 66.7 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030.

Biomarkers Market - The global biomarkers market size was valued at USD 51.18 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 14.2% from 2021 to 2028.

DNA & RNA Banking Services Industry Segmentation

Grand View Research has segmented the global DNA and RNA banking services market on the basis of service type, specimen type, application, end-use, and region:

DNA & RNA Banking Service Type Outlook (Revenue, USD Million, 2016 - 2027)

- Transportation Service

- Processing Service

- Storage Service

- Quality Control Service

- Data Storage

- Others

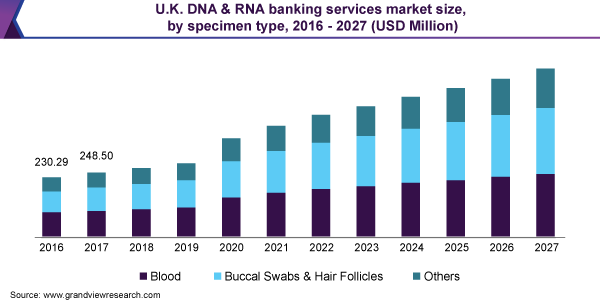

DNA & RNA Banking Services Specimen Type Outlook (Revenue, USD Million, 2016 - 2027)

- Blood

- Buccal Swabs & Hair Follicles

- Others

DNA & RNA Banking Services Application Outlook (Revenue, USD Million, 2016 - 2027)

- Therapeutics

- Drug Discovery & Clinical Research

- Clinical Diagnostics

- Other Applications

DNA & RNA Banking Services End-use Outlook (Revenue, USD Million, 2016 - 2027)

- Academic Research

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostic Centers

- Others

DNA & RNA Banking Services Regional Outlook (Revenue, USD Million, 2016 - 2027)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

January 2020: Brooks Life Sciences expanded its facilities to strengthen its expertise in sample management and biobanking. This expansion benefitted academic institutes and pharmaceutical companies to accelerate clinical trials and the development of effective treatments with a larger number of sample collection.

July 2019: 54gene, a Nigeria-based startup, raised USD 4.5 million in seed funding for the development of Pan-African Biobank. The company planned to collect 40,000 samples and further expand its collection to gather around 200,000 samples by the end of 2020. This broadened the banking services in emerging nations.

Key Companies profiled:

Some prominent players in the global DNA & RNA Banking Services Industry include

- EasyDNA

- DNA Genotek Inc.

- 23andMe, Inc.

- GoodCell

- US Biolab Corporation, Inc.

- Infinity Biologix

- Thermo Fisher Scientific, Inc.

- deCODE genetics

- Brooks Life Sciences

- LGC Biosearch Technologies

- PreventionGenetics

Order a free sample PDF of the DNA & RNA Banking Services Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment