U.S. Vegetable Puree Industry Overview

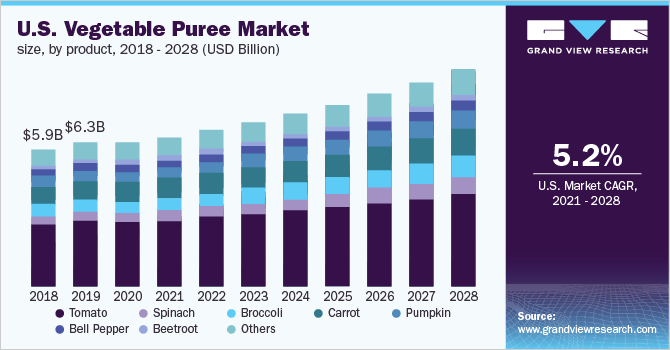

The U.S. vegetable puree market size was valued at USD 6.22 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2021 to 2028. Shifting consumer preference toward packaged convenience foods for cooking is expected to drive the demand for vegetable puree over the next few years. In addition to this, the increasing application of the product in several food processing sectors, including bakery products and beverages, is expected to boost the market growth. The COVID-19 pandemic has had a direct and indirect impact on the U.S. market for vegetable puree. The coronavirus outbreak has affected the raw material as well as application industries of the market. Vegetable puree companies have also witnessed transportation delays. The pandemic has had an adverse impact on the supply chain of the fruit and vegetable industry in the U.S., with lower prices and reduced production emerging as the key problems within the industry.

Over the past few years, the demand for the product has increased significantly in the U.S. with the increasing awareness of healthy food and lifestyle. According to the U.S. Department of Agriculture (USDA), a healthy diet requires the consumption of adequate fruits and vegetables as they help in preventing several diseases, such as heart disease, cancer, diabetes, and obesity.

Gather more insights about the market drivers, restraints and growth of the U.S. Vegetable Puree market

One of the key factors driving the market in the U.S. is the increasing consumer awareness about the daily requirement of nutrition, which can only be fulfilled by the consumption of all-natural vegetables and fruits. A shift has been observed toward healthier diets resulting in changing food preferences.

The high penetration of food and beverage companies has widened the scope of the market in the U.S. Companies have been incorporating vegetable puree in new and innovative ways to launch exciting products. For instance, in May 2019, Hunt's, a brand owned by Conagra Brands, launched a new tomato sauce with a thicker texture and rich taste. The product is 100% all-natural and does not contain fructose corn syrup. Such new product launches increase the sales of vegetable puree products in the U.S.

The growing trend of organic food and beverages in the U.S. is expected to widen the growth opportunities for the market in the upcoming years. This is attributed to the increasing awareness about the harmful effects of pesticides, chemicals, and additives on human health. Furthermore, the growing number of health-conscious consumers and the rising awareness regarding the health benefits associated with organic vegetables and clean label products are likely to drive the organic vegetable puree market.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Vegan Food Market - The global vegan food market size was valued at USD 12.69 billion in 2018 and is projected to expand at a CAGR of 9.6% from 2019 to 2025.

Sauces, Dressings & Condiments Market - The global sauces, dressings, and condiments market size were valued at USD 130.4 billion in 2018. Shifting consumer diet preferences and consumption patterns towards healthy and nutritional food is a major factor for industry growth.

U.S. Vegetable Puree Industry Segmentation

Grand View Research has segmented the U.S. vegetable puree market on the basis of product and application:

U.S. Vegetable Puree Product Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Tomato

- Spinach

- Broccoli

- Carrot

- Pumpkin

- Bell Pepper

- Beetroot

- Others

U.S. Vegetable Puree Application Outlook (Volume, Kilotons; Revenue, USD Million, 2016 - 2028)

- Beverages

- Bakery

- Snacks

- Baby Food

- Desserts

- Others

Market Share Insights:

March 2019: Döhler acquired a majority stake in Zumos Catalano Aragoneses S A (Zucasa), a producer of juices, purees and sweet fruit concentrates, vegetables, and plants, located in the region of Fraga (Huesca), Spain.

February 2019: SVZ Industrial Fruit & Vegetable Ingredients USA announced that it would increase its production capacity in Othello, Washington by adding an aseptic puree processing and packaging line to meet the growing demand for vegetable and fruit purees.

Key Companies profiled:

Some prominent players in the U.S. Vegetable Puree Industry include

- Döhler

- Grünewald International

- Dennick FruitSource, LLC

- Les vergers Boiron

- SVZ Industrial Fruit & Vegetable Ingredients

- F&S Produce Co, Inc.

- Ingredion Incorporated (Kerr Concentrates)

- Encore Fruit Marketing, Inc.

Order a free sample PDF of the U.S. Vegetable Puree Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment