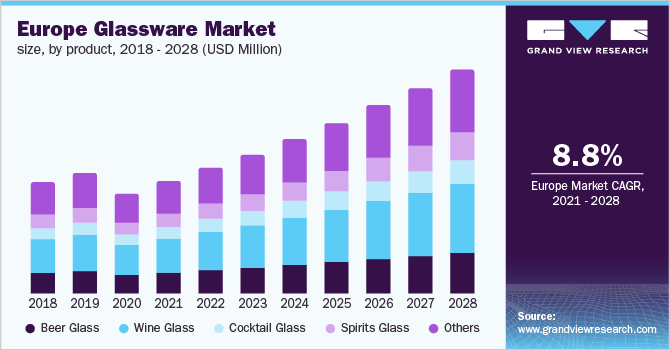

Europe Glassware Industry Overview

The Europe glassware market size to be valued at USD 4.01 billion by 2028 and is expected to grow at a compound annual growth rate (CAGR) of 8.8% during the forecast period. The expansion of residential and commercial places, rising disposable income, and changing lifestyles are expected to drive the product demand over the forecast period. The growing commercial sectors, especially the hospitality sector, are influencing market growth. As per Horwath HTL, Germany has witnessed a 9% increase in hotel brand, Poland has witnessed a 12% increase in hotel brand, and Croatia has witnessed a 115% increase in hotel brand, among others. This has prompted other players in the hospitality sector to upgrade their products and services to gain a competitive advantage over new entrants. This factor is expected to majorly contribute to the demand for glassware in the hospitality sector over the coming years.

Moreover, numerous bars and pubs in the region are acting as a major driver for the market. Royal wedding, heatwave, and football world cup in 2018 saw a significant increase in the demand for bars and pubs. Consumers have continued to be resilient, despite the uncertain political and economic environment that we currently live in, and actual spending in pubs and bars increased in 2019.

Gather more insights about the market drivers, restraints and growth of the Europe Glassware market

Wine consumption at pubs and bars has grown strongly over the past five years and is expected to generate 11% of industry revenue in 2018-19. As a more sophisticated approach to wine drinking has become a trend, pubs and bars have responded by increasing their range of wines available, resulting in an increase in wine sales. 71% of the adult drinking population drinks wine, which is around 30 million wine drinkers in the U.K. (WSTA).

Stringent government regulations pertaining to the use of lead in glassware are increasing the transparency of the products among consumers in the market. Under Glazed Ceramics and Glassware Regulations (GCGR), the government protected the public by setting legal limits on the amount of leachable lead or cadmium in all glazed ceramic or glass food ware products.

The regulations apply to all the glazed ceramic and glass products imported, advertised, or sold that are intended to be used or may be used in storing, preparing, or serving food and drinks. However, glass drinking vessels that are not coated with a glaze but have exterior decorative glazing within 20 millimeters of the lip or rim must meet the leachable lead and cadmium limits.

The growing popularity of the direct-to-consumer business model is supporting the growth of new entrants in the market. Companies are focusing on this sales channel in order to increase profit margins. For instance, in 2017, Kathryn Duryea, a Stanford MBA graduate, launched Year & Day, a direct-to-consumer tableware and wine glasses, tall glasses, and short glasses company. As per Forbes, Year & Day has witnessed approximately 300% year-to-date revenue growth in 2019 over 2018. In order to increase penetration among consumers, manufacturers are increasingly spending on advertising and marketing. Social media and e-commerce are likely to create and open new opportunities for companies operating in the market for glassware.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Commercial Tabletop Kitchen Products Market - The global commercial tabletop kitchen products market size was valued at USD 9.93 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2021 to 2028.

Beer Glassware Market - The global beer glassware market size was valued at USD 375.5 million in 2018. Rising consumption of beer among youth population, particularly among females coupled with rise of after-work drinking culture is driving the market growth.

Europe Glassware Industry Segmentation

Grand View Research has segmented the Europe glassware market on the basis of product, distribution channel, branding, and country:

Europe Glassware Product Outlook (Revenue, USD Million, 2016 - 2028)

- Beer Glass

- Wine Glass

- Cocktail Glass

- Spirits Glass

- Others

Europe Glassware Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Supermarkets & Hypermarkets

- Specialty Stores

- Online Retail

- Others

Europe Glassware Branding Outlook (Revenue, USD Million, 2016 - 2028)

- Branded Glassware

- Non-branded Glassware

Market Share Insights:

October 2021: Oneida Consumer LLC was acquired by Lenox Corporation, along with its line of tabletop items such as flatware, tableware, and cutlery. The alliance was formed in order to advertise a significant portfolio of brands and advanced products with excellent client awareness through a variety of retail channels

October 2020: Libbey Inc. declared the approval of a reorganization plan, aiming to finish its court-supervised restructure and emerge with a stronger balance sheet. This announcement was issued by the corporation in order to prosper in the present business operating climate

Key Companies profiled:

Some prominent players in the Europe Glassware Industry include

- ÅžiÅŸecam Glassware

- Villeroy & Boch AG

- Fiskars Group

- Lifetime Brands, Inc.

- Ritzenhoff AG

- Steelite International

- Alessi S.p.A.

- Arc International

- Oertel & Co. Kristallglas

- Bormioli Rocco S.p.A.

Order a free sample PDF of the Europe Glassware Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment