Telecom Services Industry Overview

The global telecom services market size was valued at USD 1,657.7 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 5.4% from 2021 to 2028. Rising spending on the deployment of 5G infrastructures due to the shift in customer inclination toward next-generation technologies and smartphone devices is one of the key factors driving this industry. An increasing number of mobile subscribers, soaring demand for high-speed data connectivity, and the growing demand for value-added managed services are the other potential factors fueling the market growth. The global communication network has undoubtedly been one of the prominent areas for continued technological advancements over the past few decades.

The industry’s product offering evolved in the late 19th century from only voice and visual signals in terms of facsimile or telegraphs over wired infrastructure to the current scenario of exchanging audio, video, and text content over numerous wireless infrastructures. The market for telecom services has also witnessed significant improvements in data speeds, from Global System for Mobile communications (GSM) and Code Division Multiple Access (CDMA) to Third Generation (3G), Fourth Generation (4G), and now the commercialization of Fifth Generation (5G) networks. The advent of data connectivity has made possible the reduction in the duration of transferring large chunks of data from days to hours and now to a few seconds.

Gather more insights about the market drivers, restraints and growth of the Global Telecom Services market

In today’s digital age, customers favor Over-The-Top (OTT) channels for a variety of reasons, among which the number of viewing options, and the pricing offered are the most prominent ones. The OTT solution providers offer video, audio, and other media content over the internet. Usually, they are not bound to price agreements with limited viewing choices to pick from. Common instances of OTT applications are Netflix, Amazon Video, Roku, Hotstar, HBO, and others.

Consumers and marketers alike are getting more acquainted with OTT applications and content. Furthermore, smartphone display and sound quality, open-source platforms, and super-fast Internet Protocol (IP) networks among other innovative services act as mobilizing factors to draw more consumers to the OTT providers 'freemium-based' business models, thus witnessing an ever-growing adoption rate and boosting the market growth.

As people worldwide struggle with the realities of the COVID-19 pandemic, digital entertainment platforms as well as the global telecom service providers have benefitted from the current scenario due to their industry type and business model. In a current worldwide lockdown scenario, a shift among masses to remote working will fuel the demand for network connectivity and infrastructure. Similarly, the temporary shutdown of multiplexes and other outdoor entertainment avenues due to strict social distancing has shot up the usage of various digital platforms, including social media, gaming, and OTT applications. The mobile voice traffic has also witnessed an upsurge during this period with prominent communication operators reporting an enormous escalation in their voice traffic since the outbreak of the pandemic.

However, the escalating consumption of digital media platforms by global customers has resulted in the sudden demand for higher bandwidths with high-speed connectivity. With the upsurge in the consumption of these platforms, the telecom service companies are urging OTT providers to reduce the streaming resolution of their media content. In fact, the Cellular Operators Association of India (COAI) has requested video streaming providers to reduce their content quality from High Definition (HD) to Standard Definition (SD). To avoid the congestion in internet traffic, especially when most people are working from home and require high bandwidth, some governments are also helping the market for telecom services to ensure the smooth functioning of their data and voice carriers.

For instance, Ireland’s Commission for Communications Regulation (ComReg) has released an extra radio spectrum within the 700 MHz to 2.6 GHz bands to enable mobile network operators to cater to their customers accessing 3G as well as 4G technologies. Similarly, the Federal Communications Commission (FCC) has allocated an additional spectrum to the communication network service providers ensuring continuity of broadband in the U.S.

Moreover, several leading telecom operators such as AT&T Inc.; Verizon Communications Inc.; and NTT have shown declining revenue growth in 2020 owing to the slow demand for telecom services for corporate and business applications. Furthermore, the significant decline in the global economy has resultantly reduced the per capita income of consumers. This has led to the minimized spending on non-essential products and services. Thus, it has moderately affected the market growth in 2020.

Browse through Grand View Research's Technology Industry Related Reports

5G Infrastructure Market - The global 5G infrastructure market size was valued at USD 4.75 billion in 2021. It is expected to expand at a compound annual growth rate (CAGR) of 34.2% from 2022 to 2030.

Managed Services Market - The global managed services market size was valued at USD 239.71 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.4% from 2022 to 2030.

Telecom Services Industry Segmentation

Grand View Research has segmented the global telecom services market on the basis of service type, transmission, end-use, and region:

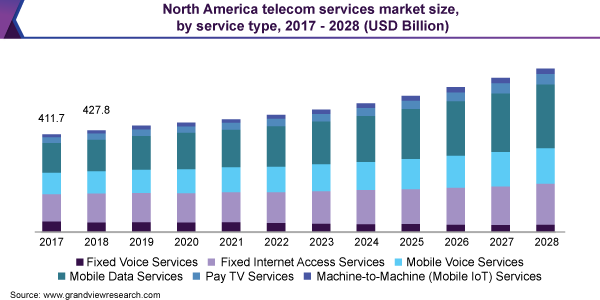

Telecom Services Type Outlook (Revenue, USD Billion, 2017 - 2028)

- Fixed Voice Services

- Fixed Internet Access Services

- Mobile Voice Services

- Mobile Data Services

- Pay-TV Services

- Machine-to-Machine (Mobile IoT) Services

Telecom Services Transmission Outlook (Revenue, USD Billion, 2017 - 2028)

- Wireline

- Wireless

Telecom Services End-use Outlook (Revenue, USD Billion, 2017 - 2028)

- Consumer/Residential

- Business

Telecom Services Regional Outlook (Revenue, USD Million, 2017 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights:

Feb 2021: AT&T Inc. and Verizon Communications spent around USD 70 billion combinedly on the 5G spectrum to provide improved network connectivity to their customers.

April 2020: T-Mobile US, Inc. acquired Sprint Corporation, a U.S.-based telecommunication company. The strategic merger was aimed to build robust 5G network infrastructure in the U.S. and capture the maximum market in rural as well urban areas.

Key Companies profiled:

Some prominent players in the global Telecom Services Industry include

- AT&T Inc.

- Verizon Communications Inc.

- Nippon Telegraph and Telephone Corporation (NTT)

- China Mobile Ltd.

- Deutsche Telekom AG

- SoftBank Group Corp.

- China Telecom Corp Ltd.

- Telefonica SA

- Vodafone Group

- KT Corporation

- Bharati Airtel Limited

- Reliance Jio Infocomm Limited,

- KDDI Corporation

- Orange SA

- BT Group plc

- Comcast Corporation

Order a free sample PDF of the Telecom Services Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment