Nicotine Replacement Therapy Industry Overview

The global Nicotine Replacement Therapy size was valued at USD 44.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 16.3% from 2021 to 2028. The growth can be attributed to the growing number of technological advancements and the increasing number of people undergoing nicotine replacement therapy (NRT). Increasing awareness about the ill-effects of smoking is expected to be a key factor driving the market. The number of people who smoke is rising globally and has surpassed 1.1 billion. Owing to government initiatives such as the “affordable care act”, insurance regulations, and programs for awareness regarding the negative impact of smoking on health by provision of counseling, people are opting for smoking cessation therapies. In 2018, out of the 34.2 million people that smoke in America, 55% tried smoking cessation.

May 31st is celebrated as the No Tobacco Day and organizations such as the American Lung Association and the CDC work toward increasing awareness about the medical conditions that arise due to smoking. As per the NHS, 70% cases of lung cancer cases are a result of smoking. Furthermore, smokers are more prone to getting heart attacks. Annually, 480,000 people in the U.S. die because of smoking. The CDC runs a paid national campaign called the Tips From Former Smokers (Tips) to encourage healthcare providers to tell patients about the effects of smoking and support them in quitting smoking in safe ways.

Gather more insights about the market drivers, restraints and growth of the Global Nicotine Replacement Therapy Market

Technological advancements in the nicotine replacement therapy segment are ongoing, which has led to a rise in the number of people switching to advanced products. Advancements like heat-not-burn products flavored chewing gums, and lozenges are expected to drive the adoption of NRT. The tobacco giants like British American Tobacco have come up with alternatives that are smokeless and less harmful. These advancements have a variable range of effectiveness and are accepted in society when compared to traditional cigarettes, thus driving their adoption and boosting the market growth.

However, the ban on e-cigarettes is one of the most crucial factors hindering the growth of the market. For instance, in September 2019, the Indian government banned the import, production, and sale of e-cigarettes. India is a nation with over 100 million smokers, and this could have been a great opportunity for market growth. In addition, other nations such as Mexico, Brazil, Malaysia, and Thailand have banned the use, import, and production of e-cigarettes in their countries. As of 2020, there are over 20 nations that have banned the use of e-cigarettes. This is expected to have a negative impact on the market growth.

Browse through Grand View Research's Healthcare Industry Related Reports

Smoking Cessation And Nicotine De-addiction Market - The global market for smoking cessation and the nicotine de-addiction market was valued at over USD 7.0 billion in 2015. The key driving factor for the market growth is the increasing prevalence of a plethora of target diseases such as respiratory disorders, cardiac diseases, and lung cancer stemming from smoking.

E-cigarette And Vape Market - The global e-cigarette and vape market size was valued at USD 18.13 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.0% from 2022 to 2030.

Nicotine Replacement Therapy Industry Segmentation

Grand View Research has segmented the global nicotine replacement therapy market by product, distribution channel, and region:

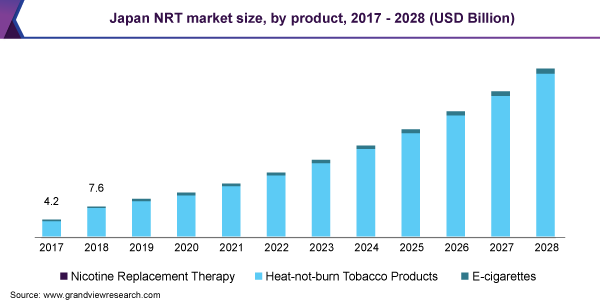

NRT Product Outlook (Revenue, USD Billion, 2017 - 2028)

- Nicotine Replacement Therapy

- E-cigarettes

- Heat-not-burn Tobacco Products

NRT Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2028)

- Offline

- Online

Nicotine Replacement Therapy Regional Outlook (Revenue, USD Million, 2017 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

May 2019: GlaxoSmithKline plc. introduced mint-flavored nicotine lozenges Nicorette under over-the-counter product.

January 2017: British American Tobacco acquired 57.8% stakes in Reynolds American, Inc., making it a wholly-owned subsidiary of the firm. This gave the firm complete access to the company’s portfolio, along with direct access to the U.S. market.

Key Companies profiled:

Some prominent players in the global Nicotine Replacement Therapy Industry include

- Philip Morris Products S.A. (Altria Group)

- British American Tobacco p.l.c.

- Japan Tobacco, Inc.

- Imperial Brands

- Glenmark

- Fertin Pharma

- Cipla Inc.

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

Order a free sample PDF of the Nicotine Replacement Therapy Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment