Europe Computer Numerical Control Machine Industry Overview

The Europe computer numerical control machine market size was valued at USD 21.50 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2021 to 2028. The growth of the market can be attributed to the increasing demand for computer numerical control (CNC) machines from automotive manufacturers. The growing preference for automation to reduce overall operating costs also bodes well for the growth of the market. However, the outbreak of the COVID-19 pandemic and the subsequent lockdowns and restrictions being imposed as part of the efforts to arrest the spread of coronavirus are expected to take their toll on the market. Operations at manufacturing units, factories, offices, and stores, among other establishments, have been suspended temporarily, thereby disrupting the supply chains and trading activities, and subsequently affecting the revenue streams.

The strong emphasis incumbents of various industries and industry verticals, including aerospace and defense and automotive, are putting on mass production is driving the adoption of automatic machines. Advances in technology, which can potentially help in reducing the machining time, are also expected to contribute to the growth of the market. The growing energy industry, particularly in France, which is driving the need for precision and accuracy while manufacturing parts, such as rotor shafts and turbines, is expected to play a vital role in the growth of the market. At the same time, advances in wireless communication technology have added IoT compatibility to computer numerical control machines, thereby adding to the convenience to the end-users and contributing to the growth of the market.

Gather more insights about the market drivers, restraints and growth of the Europe Computer Numerical Control Machine market

The growing preference for automation and the aggressive adoption of the latest technologies and computer-aided manufacturing (CAM) and CNC techniques are expected to drive the demand for CNC machines in Europe. Research funding schemes being announced by various governments in collaboration with universities are also encouraging companies to pursue R&D activities, thereby ensuring greater prospects for the growth of the market. The presence of various technology developers and manufacturers of high-end machining centers required for milling, boring, pressing, bending, cutting, and several other operations, also bodes well for the growth of the CNC machines market in Europe.

Manufacturers of CNC machines are focusing on the latest advances in the field of software to enhance the connectivity of machines as part of the efforts to add to the convenience of operators and improve the flexibility on machining shop floors. Several companies are investing aggressively in R&D activities to improve the machine design to reduce the floor space machines occupy and allow multiple operations to be carried out by the same machine, thereby improving the productivity of the machining shop. For instance, Biesse Group, a manufacturer of CNC machines, invested around USD 35 million in research and development activities, including technology upgrades, new product development, and updates to existing products, in 2020.

However, despite the advantages CNC machines can offer over conventional machines, the high purchasing and maintenance costs associated with CNC machines are expected to restrain the growth of the market over the forecast period. The safety regulations for such machines, such as mandatory dry runs of the machines, are also expected to hinder the growth of the market to a certain extent. The significant investments required for training the existing machine operators to operate the modern CNC machines are also emerging as another potential market restraint. Nevertheless, CNC machine vendors, such as The Shoda Company; Haas Automation, Inc.; and SCM Group; are responding to the situation by offering various training programs.

Browse through Grand View Research's Semiconductors & Electronics Industry Related Reports

Computer Numerical Control Machines Market - The global computer numerical control machines market size was valued at USD 56.40 billion in 2021 and is expected to expand a compound annual growth rate (CAGR) of 10.2% from 2022 to 2030.

Milling Machine Market - The global milling machine market size was valued at USD 63,156.5 million in 2018 and is expected to register a CAGR of 7.0% from 2019 to 2025.

Europe Computer Numerical Control Machine Industry Segmentation

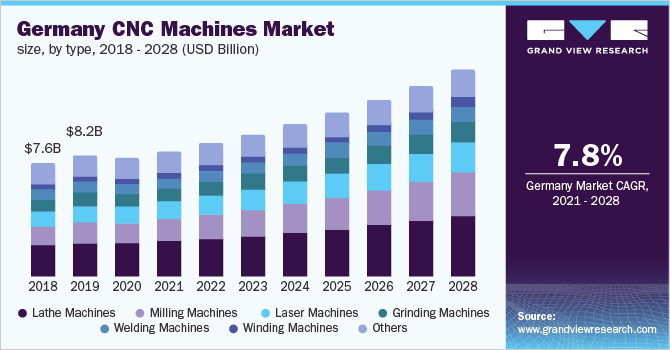

Grand View Research has segmented the Europe computer numerical control machine market based on type, end-use, and country:

Europe CNC Machines Type Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2028)

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

Europe CNC Machines End-use Outlook (Volume, Thousand Units; Revenue, USD Billion, 2018 - 2028)

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

Europe Computer Numerical Control Machine Country Outlook (Revenue, USD Million, 2018 - 2028)

- Germany

- Italy

- France

Market Share Insights:

November 2020: AXYZ Automation Group announced the addition of the new AXYZ Innovator Router to its CNC machine lineup.

November 2020: Hurco Companies Inc. introduced three models of CNC turning centers, include TM10Mi XP, TM8Mi XP, and M12Mi XP, as part of the efforts to expand its existing product range.

Key Companies profiled:

Some prominent players in the Europe Computer Numerical Control Machine Industry include

- Amada Machine Tools Co., Ltd.

- Amera-Seiki

- DMG Mori Co., Ltd.

- Dalian Machine Tool Group Corporation

- FANUC Corporation

- Haas Automation, Inc.

- Hurco Companies, Inc.

- Okuma Corporation

- Shenyang Machine Tool Co., Ltd.

- Yamazaki Mazak Corporation

Order a free sample PDF of the Europe Computer Numerical Control Machine Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment