Fraud Detection And Prevention Industry Overview

The global fraud detection and prevention market size was valued at USD 20.98 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 15.4% from 2021 to 2028. The growing concerns regarding digital frauds, despite technological advancements facilitating ease of payment options or data access, calls for the deployment of fraud detection solutions. Sophistication in digital frauds, financial crimes, and cyberattacks are challenging the growth of several businesses worldwide. With the increasing popularity of e-banking, digital payment apps, and cross-border transactions, the number of fraudulent cases involving identity thefts, data breaches, and payment frauds is also increasing. All these aforementioned factors are creating avenues for market growth.

The ever-evolving technology landscape has amplified cybercrimes and cyber frauds over time. Hackers continue to evolve and have become skilled in finding vulnerabilities and loopholes in systems. The resulting action increases the risk of a corporate data breach, and its consequent impact increases economic losses for a business. Therefore, the need to curb losses from data breaches has compelled enterprises to opt for proactive fraud prevention solutions, a trend expected to continue over the next few years.

Gather more insights about the market drivers, restraints and growth of the Global Fraud Detection And Prevention market

Incumbents from industries, such as BFSI, healthcare, and e-commerce, are proactive in recognizing the need to update outdated tools and existing strategies to combat digital fraud. However, certain businesses still use and follow conventional fraud investigation methods, which are complex and time-consuming. Sophistication in Advanced Persistent Threats (APTs) and fraudsters continuously modify their intruding techniques and remain undetected using traditional concepts. Thus, with the adoption of analytical and authentication tools, real-time detection in fraudulent behaviors becomes easy and is subsequently expected to favor the adoption of fraud detection and prevention (FDP) solutions.

As such, proactive measures have become one of the top priorities among industries. Customer-centric fraud prevention techniques have become a part of business security strategy. Adoption of such techniques and measures bridges the gap between improved payment experience and security. For instance, financial institutes adopt voice recognition technologies across their contact centers to reduce identity fraud attempts. In addition, the application of fraud authentication technologies, such as device fingerprinting and geolocation, adds another layer in identity theft security and enhances customer verification.

The rising adoption of web applications and digital payment applications has resulted in an increased number of online frauds and scams. Cyber threat agents target such vulnerable applications to gain personal data. These fraudulent activities surged in 2020, during the COVID-19 pandemic. According to the F5, Inc., a U.S.-based security solution provider’s 2020 phishing report, a 15% growth in phishing incidents was observed. Furthermore, the report also highlighted a significant rise in phishing attacks accounting for 220% yearly average during the peak of the pandemic in comparison to the previous year.

Browse through Grand View Research's Technology Industry Related Reports

Digital Transformation Market - The global digital transformation market size was evaluated at USD 608.72 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 23.1% from 2022 to 2030.

Mobile Payment Market - The global mobile payment market size was valued at USD 40.59 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 35.3% from 2022 to 2030. The market growth can be attributed to factors such as the rising m-commerce industry and the surge in the penetration of smartphones across the globe.

Fraud Detection And Prevention Industry Segmentation

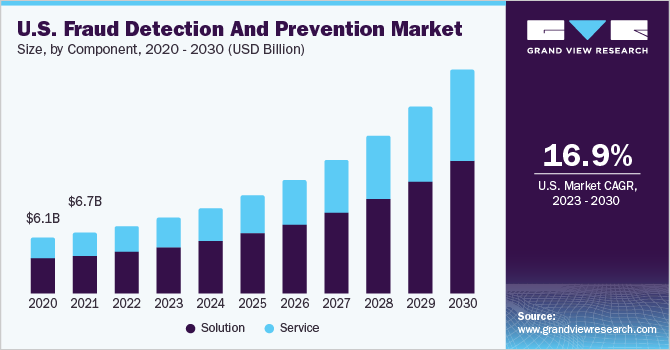

Grand View Research has segmented the global fraud detection and prevention market on the basis of component, solutions, services, application, organization, vertical, and region:

Fraud Detection & Prevention Component Outlook (Revenue, USD Million, 2016 - 2028)

- Solutions

- Services

Fraud Detection & Prevention Solutions Outlook (Revenue, USD Million, 2016 - 2028)

- Fraud Analytics

- Authentication

- Governance, Risk, and Compliance

Fraud Detection & Prevention Services Outlook (Revenue, USD Million, 2016 - 2028)

- Professional Services

- Managed Services

Fraud Detection & Prevention Application Outlook (Revenue, USD Million, 2016 - 2028)

- Identity Theft

- Money Laundering

- Payment Fraud

- Others

Fraud Detection & Prevention Organization Outlook (Revenue, USD Million, 2016 - 2028)

- SMEs

- Large Enterprises

Fraud Detection & Prevention Vertical Outlook (Revenue, USD Million, 2016 - 2028)

- BFSI

- Government & Defense

- Healthcare

- IT & Telecom

- Industrial & Manufacturing

- Retail & E-commerce

- Others

Fraud Detection And Prevention Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Key Companies profiled:

Some prominent players in the global Fraud Detection And Prevention Industry include

- Total System Services, Inc.

- Software AG

- SAS Institute, Inc.

- SAP SE

- Oracle

- IBM

- Fiserv, Inc.

- Experian plc

- Equifax, Inc.

- BAE Systems

- ACI Worldwide, Inc.

Order a free sample PDF of the Fraud Detection And Prevention Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment