Anti-money Laundering Industry Overview

The global anti-money laundering market size was valued at USD 1.03 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 15.6% from 2021 to 2028. The promising growth prospects of the market can be attributed to the rise in money laundering instances across the globe. Companies use anti-money laundering software to detect suspicious transactions and customer data. Compliance professionals also use the software to comply with corporate policies and government regulations such as the Bank Secrecy Act of the U.S. aimed to prevent money laundering-related crimes. An anti-money laundering software uses data gathered from multiple solutions used to manage financial transactions, such as accounting software and ERP systems for reducing money laundering activities.

Anti-money laundering solutions deliver users high performance in visualizing, monitoring, and resolving money laundering incidents. The benefits of anti-money laundering solutions include robust data analysis, improved risk protection, faster processing, and improved efficiency in resolving these cases.

Gather more insights about the market drivers, restraints and growth of the Global Anti-money Laundering market

Various government bodies across the world have enacted regulations and laws to counterterrorism funding and combat money laundering incidents. The Financial Action Task Force, an inter-government body, helps countries update and develop laws to combat money laundering. Anti-money laundering laws differ across countries, making it crucial for financial institutes to ensure that their business is compliant with the policies specific to the country of operation. These policies help financial organizations design a framework of processes to be followed to prevent illicit funds from entering their financial systems.

Financial institutions are expected to comply with certain rules, framed by government bodies worldwide, considered critical in mitigating money laundering instances. For instance, the Bank Secrecy Act of the U.S. requires banks to develop an effective compliance program as well as establish customer due diligence programs and systems. Additionally, banks are also expected to establish an effective ‘suspicious activity reporting and monitoring process to screen against the Office of Foreign Assets Control sanctions.

The COVID 19 pandemic has positively impacted market growth due to a steep rise in online sales coupled with the increasing use of online payment solutions. The rise in non-cash payments via internet payments, prepaid cards, and mobile payments has created new gateways for money laundering in recent days. The high speed at which transactions can be executed, coupled with minimal face-to-face interaction between the person initiating the transaction and the service provider, has increased the vulnerability of these relatively new payment methods to money laundering activities.

This creates the need for financial services institutions to strictly monitor all their transactions to mitigate money laundering activities and avoid the penalties framed by regulatory bodies. According to the statistics provided by Tookitaki Holding Pte. Ltd., a software company, in 2019, USD 6.2 billion in anti-money laundering-related penalties were paid by banks globally. These penalties were mainly imposed by the regulators of countries such as Hong Kong, India, France, Belgium, and the Netherlands.

Browse through Grand View Research's Technology Industry Related Reports

Artificial Intelligence Market - The global artificial intelligence market size was valued at USD 93.5 billion in 2021 and is projected to expand at a compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

Machine Learning Market - The global machine learning market size was valued at USD 6.9 billion in 2018 and is anticipated to register a CAGR of 43.8% from 2019 to 2025. Emerging technologies such as artificial intelligence are changing the way industries and humans work.

Anti-money Laundering Industry Segmentation

Grand View Research has segmented the global anti-money laundering market on the basis of component, product type, deployment, end-use, and region:

Anti-money Laundering Component Outlook (Revenue, USD Million, 2016 - 2028)

- Software

- Services

Anti-money Laundering Product Type Outlook (Revenue, USD Million, 2016 - 2028)

- Compliance Management

- Currency Transaction Reporting

- Customer Identity Management

- Transaction Monitoring

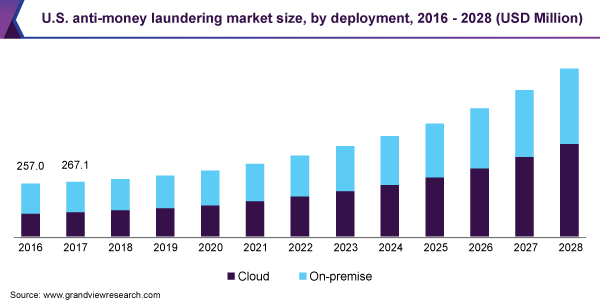

Anti-money Laundering Deployment Outlook (Revenue, USD Million, 2016 - 2028)

- Cloud

- On-premise

Anti-money Laundering End-use Outlook (Revenue, USD Million, 2016 - 2028)

- BFSI

- Government

- Healthcare

- IT & Telecom

- Others

Anti-money Laundering Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- MEA (Middle East & Africa)

Market Share Insights:

November 2020: Computer Services, Inc., a provider of end-to-end regtech and fintech solutions, announced a partnership with Featurespace, an enterprise financial crime prevention software provider. Through this partnership, the companies launched the WatchDOG AML, which uses machine learning capabilities to identify suspicious activities on a real-time basis.

May 2019: Tata Consultancy Services Limited launched TCS BaNCS for Payments solution in Canada, which supports real-time payment processing.

Key Companies profiled:

Some prominent players in the global Anti-money Laundering Industry include

- NICE Actimize

- Tata Consultancy Services Limited

- Trulioo

- Cognizant Technology Solutions Corporation

- ACI Worldwide, Inc.

- SAS Institute Inc.

- Fiserv, Inc.

- Oracle Corporation

- BAE Systems

- Accenture

Order a free sample PDF of the Anti-money Laundering Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment