Europe Data Center Colocation Industry Overview

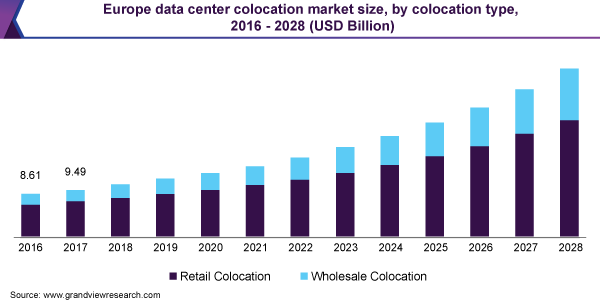

The Europe data center colocation market size was valued at USD 12.81 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 13.1% from 2021 to 2028. Building and operating a data center is an expensive affair and requires a large amount of capital. Small businesses often lack the budget to own a data center, which has led to the rising demand for data center colocation services across Europe. The deployment of colocation data centers helps enterprises in cutting down on maintenance costs while offering high bandwidth and scalability. Moreover, colocation presents an opportunity for data center providers to explore new strategic locations across Europe beyond the Frankfurt, London, Amsterdam, Paris (FLAP) markets.

The market is driven by the significant demand for colocation services by hyperscale data center consumers such as large internet businesses and public cloud service providers. Besides building massive data center campuses in remote areas, major cloud service providers such as Facebook, Microsoft Azure, and Google Cloud Platform have been leasing tons of capacity from colocation companies in densely populated areas across Europe. The rise in colocation services results from the increased network connectivity and rise in the number of localized data centers in compliance with the General Data Protection Regulation (GDPR) to ensure data does not cross-country borders. Additionally, Europe is also witnessing an increase in demand from the Chinese telcos and hyperscalers looking to expand their global networks.

Gather more insights about the market drivers, restraints and growth of the Europe Data Center Colocation market

The FLAP markets have been dominating the Europe data center colocation for many years. These markets are still critical to the data center ecosystem from the market entry point of view. However, the FLAP markets have become mature and face limitations related to physical spaces and lack of energy to power the data centers. Such constraints have propelled colocation providers to search for new locations such as Oslo, Berlin, Zurich, Reykjavik, Milan, Warsaw, Prague, and Vienna Madrid. These countries are regarded as potential hotspots for data center development across Europe. According to Cushman & Wakefield, the data center capacity across these countries is expected to rise to 937 MW by 2024 from 492 MW as of 2019.

The demand for high-capacity networks has experienced a surge with the emergence of edge computing solutions. The adoption of disruptive technologies such as autonomous vehicles, cloud computing, IoT, and advanced robotics has resulted in the rising demand for edge computing solutions in developed economies such as the U.K., Germany, and France. The growing adoption of these technologies has also led to the requirement of higher bandwidths and faster processing speeds. To cope with these challenges, it is essential to have low latency, which has increased the demand for data center colocation. Colocation allows cloud service providers to place the network architecture in proximity to the users and offer high bandwidth and reduced latency. The emergence of 5G has provided colocation service providers an opportunity to offer these services with improved connectivity across remote locations in Europe, thereby driving the market growth.

Factors such as stringent environmental regulations in Europe and regional diversity are expected to pose a challenge to the data center colocation market growth. With 23 languages spoken and 28 different currencies operating across Europe, colocation service providers may face contracting and multi-national product pricing complications. Furthermore, such diversity increases data sovereignty issues across borders as GDPR has added liability and complexity to the data management. However, these challenges can be overcome by companies by localizing their colocation services across European countries.

Browse through Grand View Research's Technology Industry Related Reports

Data Center Colocation Market - The global data center colocation market size was valued at USD 44.42 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 13.3% from 2021 to 2028.

Augmented Reality Market - The global augmented reality market size was estimated at USD 25.33 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 40.9% from 2022 to 2030.

Europe Data Center Colocation Industry Segmentation

Grand View Research has segmented the Europe data center colocation market based on colocation type, end-use, enterprise size, and region:

Europe Data Center Colocation Type Outlook (Revenue, USD Million, 2016 - 2028)

- Retail Colocation

- Wholesale Colocation

Europe Data Center Colocation End-use Outlook (Revenue, USD Million, 2016 - 2028)

- Retail

- BFSI

- IT & Telecom

- Healthcare

- Media & Entertainment

- Others

Europe Data Center Colocation Enterprise Size Outlook (Revenue, USD Million, 2016 - 2028)

- Small & Medium Enterprises

- Large Enterprises

Key Companies profiled:

Some prominent players in the Europe Data Center Colocation Industry include

- Equinix, Inc.

- Cyxtera Technologies, Inc.

- Interxion

- CyrusOne, Inc.

- NTT Limited

- Global Switch

- Verne Global

Order a free sample PDF of the Europe Data Center Colocation Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment