U.S. Faucet Industry Overview

The U.S. faucet market size was valued at USD 3.2 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2021 to 2028. The rapid growth of the bathroom fittings industry is presenting lucrative opportunities for faucets as a result of the rising demand for modernized bathrooms and kitchens. In addition, the increasing prominence of multi-functionality features on plumbing fixtures, with due importance given to aesthetic appeal is boosting demand for a variety of faucets. The need for water conservation measures is also resulting in the greater penetration of new and efficient faucets across applications.

With a nationwide shortage of housing and record-high home prices, more homeowners prefer to stay on their existing properties versus moving or upgrading to newer ones. Rapidly rising costs associated with home prices and mortgage rates are resulting in consumers increasingly investing in home improvement or home remodeling projects to revamp their traditional household structure. The growing home values have doubled the homeowner equity in the past five years since 2019. This indicates the trend of homeowners feeling richer, who are, therefore, more disposed toward spending on home improvement. According to the American Housing Survey studied by Harvard’s Joint Center for Housing Studies, the home improvement industry was estimated at USD 383.3 million in 2017.

Gather more insights about the market drivers, restraints and growth of the U.S. Faucet market

The increasing growth rate of the industry across states is also indicating a surge in demand for home furnishings and fittings, which is expected to positively impact the growth of the market for faucets. According to the Leading Indicator for Remodeling Activity (LIRA), home improvement spending grew by 6.0% annually in 2019.

Faucets in the bathroom fittings segment have been undergoing a particularly modern transformation as an increasing number of U.S. consumers show an inclination for building luxurious bathroom settings to promote a spa-like experience at home. This ongoing demand for creating a modern and luxurious home is also the paving way for renovated kitchen settings, thereby fueling the demand for the product in kitchen applications. For instance, the Franke 3-in-1 faucet offered by Franke Kitchen Systems is designed to provide hot, cold, and distilled water to ensure the usage of pure and appropriate temperature water for various kitchen purposes.

Covid-19 has affected regions that are at the heart of many global supply chains. Wuhan is vital to many worldwide supply chains. While it has been a traditional base for manufacturing for decades, it has also become an area of advanced industrial change. Key industries comprise high technology (optoelectronic technology, pharmaceuticals, biology engineering, and environmental protection) and modern manufacturing (automotive, steel, and iron manufacturing). Concerns are growing over exhausting stock and companies worry that they will not convene contractual obligations on time. In the near time span, the cost of supplies from China is expected to surge, stemming from overtime and accelerated freight costs, along with paying premiums to buy up supply and hold capacity. Companies in the market are focusing on working via alternate sourcing approaches.

Nevertheless, most of the faucets manufactured by Kohler Co. that are marketed in the U.S. are manufactured in the U.S. at Kohler’s faucet manufacturing plant in Arkansas. The components and parts used in Kohler faucets were then manufactured mainly in the U.S. For the past few years, however, they have been manufactured in other countries, mainly in China and India. However, amidst the COVID-19 impact, the company is expected to resume its manufacturing facilities for faucet parts and components in the U.S. itself owing to logistics and supply chain disruptions.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Faucet Market - The global faucet market size was valued at USD 19.3 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.4% from 2022 to 2030.

Plumbing Fixtures Market - Increasing application of modern bathrooms and the kitchen at a global level is expected to drive the demand for plumbing fixtures in the coming years. This, in turn, is anticipated to have a strong impact on market growth.

U.S. Faucet Industry Segmentation

Grand View Research has segmented the U.S. faucet market on the basis of end-user, application, distribution channel, and region:

U.S. Faucet End-user Outlook (Revenue, USD Million, 2016 - 2028)

- Residential

- Commercial

U.S. Faucet Application Outlook (Revenue, USD Million, 2016 - 2028)

- Kitchen

- Bathroom

- Others

U.S. Faucet Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- E-commerce

- Multi-brand Retailers

- Local Plumbing Supply Stores

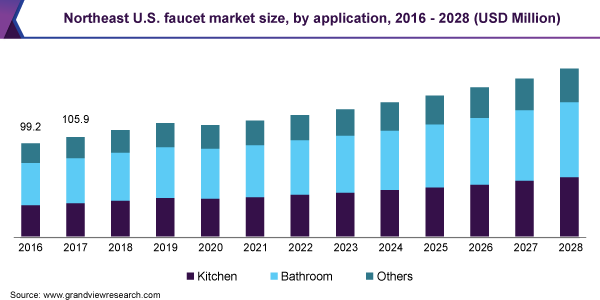

U.S. Faucet Regional Outlook (Revenue, USD Million, 2016 - 2028)

- Northeast

- Southwest

- Midwest

- West

- Southeast

Market Share Insights:

January 2020: Delta Faucet Company launched its new collections and technologies at the 2020 Kitchen and Bath Industry Show (KBIS) in Las Vegas, United States.

Key Companies profiled:

Some prominent players in the U.S. Faucet Industry include

- Kohler Co

- Kraus, USA

- American Standard Brands

- GROHE America Inc.

- Pfister

- Delta Faucet Company

- Moen Incorporated

- AquaSource Faucet

Order a free sample PDF of the U.S. Faucet Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment