U.S. E-cigarette & Vape Industry Overview

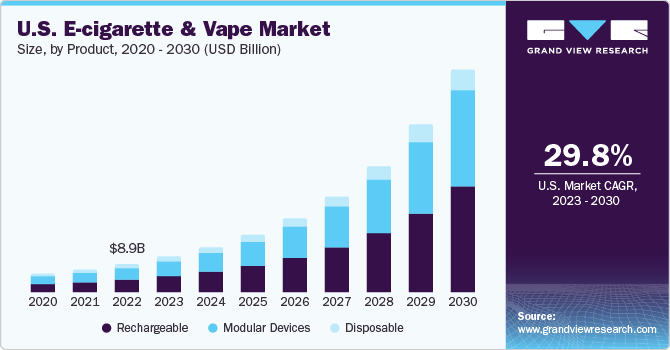

The U.S. e-cigarette & vape market size was valued at USD 6.09 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 27.3% from 2021 to 2028. The market growth can be attributed to the increasing awareness of safer tobacco alternatives. Electronic cigarettes and vape mods, which are an alternative to tobacco products, have been gaining popularity. These sophisticated mechanical devices are designed to deliver the same addictive nicotine, which is in tobacco cigarettes, without the harmful effects of tobacco smoke. Users are focusing on adopting personalized vaporizers. These vaporizers provide the best user experience in vaping and effectively cater to the needs of the regular and most active vapers. Health concerns related to smoking have considerably increased in the past few years as individual organizations and governments are treating this issue with high priority. Increasing awareness about health concerns is anticipated to propel the market growth over the forecast period.

E-cigarettes and vape mods usage are rapidly increasing because these devices don’t include any tobacco. Most of the U.S. population is considering these devices as a gateway for quitting smoking. Some of the population is shifting to an e-cigarette and vape mod as an alternative to smoking. Furthermore, these products are being offered in non-nicotine as well as nicotine forms, due to which many of the population is considering these devices to be a better alternative.

Gather more insights about the market drivers, restraints and growth of the U.S. E-cigarette & Vape market

Numerous studies conducted by medical association states that e-cigarettes and vape mods are safer than traditional cigarettes. Also, the market growth is being characterized by the increasing awareness among the young population. Moreover, vendors' focus on customizing options as well as continuous development in the new products is expected to fuel the market growth over the forecast period. Furthermore, the cost-efficiency of these devices has also increased customer acceptance.

Stringent government regulations in the U.S. are expected to hamper the market growth. Both the U.S. Centers for Disease Control and Prevention and the U.S. Food and Drug Administration are working continuously to investigate the distressing incidents of severe breathing illness associated with the usage of vaping products. Moreover, the outbreak of COVID-19 is anticipated to hinder the growth. Vendors in the market are temporarily stopping production due to the COVID-19 lockdown, and logistics providers are no longer transporting goods within and across the borders.

Browse through Grand View Research's Technology Industry Related Reports

E-cigarette And Vape Market - The global e-cigarette and vape market size was valued at USD 18.13 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 30.0% from 2022 to 2030.

E-liquid Market - The global e-liquid market size was valued at USD 1.4 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 13.4% from 2021 to 2027. The rising adoption of safer alternatives to smoking across the globe is anticipated to drive the demand for e-cigarettes over the forecast period.

U.S. E-cigarette & Vape Industry Segmentation

Grand View Research has segmented the U.S. e-cigarette and vape market based on product, component, and distribution channel:

U.S. E-cigarette & Vape Product Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

- Disposable

- Rechargeable

- Modular Devices

U.S. E-cigarette & Vape Component Outlook (Volume, Million Units; Revenue, USD Million, 2016 - 2028)

- Atomizer

- Vape Mod

- Cartomizer

- E-liquid

U.S. E-cigarette & Vape Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

- Online

- Retail Store

Market Share Insights:

October 2018: Philip Morris International launched the next generation of IQOS-heated tobacco products. Through this initiative, the company aims at encouraging a large number of smokers to switch to e-cigarettes.

Key Companies profiled:

Some prominent players in the U.S. E-cigarette & Vape Industry include

- Reynolds American Inc.

- Imperial Brands

- Altria Group, Inc.

- Japan Tobacco Inc.

- Philip Morris International

- International Vapor Group

- British American Tobacco

- Nicquid

- Shenzhen IVPS Technology Co., Ltd.

- Shenzhen KangerTech Technology Co., Ltd.

Order a free sample PDF of the U.S. E-cigarette & Vape Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment