Wearable Payments Devices Industry Overview

The global wearable payments devices market size was valued at USD 10.35 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 29.8% from 2021 to 2028. The market growth can be attributed to the increasing demand for Host Card Emulation (HCE) and the growing adoption of cashless transactions. HCE allows mobile or wearable devices to permit card imitation on NFC-enabled devices without depending on access to an authenticated element. Furthermore, the increasing demand for wearable payment devices owing to their fast payment capability is expected to fuel the market growth over the forecast period. Numerous e-banking platforms are adopting wearable payment devices. These platforms are focusing on integrating the Near Field Communication (NFC) technology into their transaction operations, which facilitates seamless payments. Furthermore, the decreasing costs for deploying NFC technology are encouraging the rise in demand for the technology. Businesses widely use this technology to transfer data from their devices to various contactless payment terminals, such as NFC tags and smartphones.

The rapid growth in the use of contactless payments is driven by the mandates of digital payment networks by the governments across the globe, which, as a result, has increased the adoption of payment-enabled devices. Wearable payments offer a quick and convenient way of making payments, specifically for small to medium-sized monetary transactions. Factors such as the increasing integration of NFC payment systems in mobile devices increased comfort with using contactless cards, and the rising adoption of contactless point-of-sale readers are expected to create growth opportunities for the market over the forecast period. Additionally, the growth in IoT globally acts as a major driver for invisible payments, thereby propelling the market growth over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Global Wearable Payments Devices market

The market is significantly driven by the increase in digitization, followed by the growing adoption of a cashless economy observed in several countries. The use of smart technologies, coupled with rising internet penetration, has resulted in the increased adoption of connected devices. Furthermore, the market growth is influenced by the presence of VR and AI technologies, which is driven by developments in mobile applications. Digitization in banks is expected to gain traction as banks are focusing on connecting card management systems with various token service providers.

The outbreak of COVID-19 is anticipated to favorably impact market growth over the forecast period. In this time of the pandemic, customers across the globe are preferring contactless payments as a mode of payment, which is expected to fuel the adoption of wearable payment devices. However, factors such as the limited battery life of the devices, high cost of the devices, and security concerns are expected to hamper the market growth. The high costs of devices impact the ability of manufacturers to launch their products in the market, thus resulting in limited production. These payment devices are costly, which restricts various consumers from purchasing these devices. Additionally, the rising competition in the market and low awareness about the product are further limiting the market growth.

Browse through Grand View Research's Technology Industry Related Reports

Contactless Payment Market - The global contactless payment market size was valued at USD 1.34 trillion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 20.3% from 2021 to 2028.

Digital Payment Market - The global digital payment market size was valued at USD 68.61 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 20.5% from 2022 to 2030.

Wearable Payments Devices Industry Segmentation

Grand View Research has segmented the global wearable payments devices market based on device type, technology, application, and region:

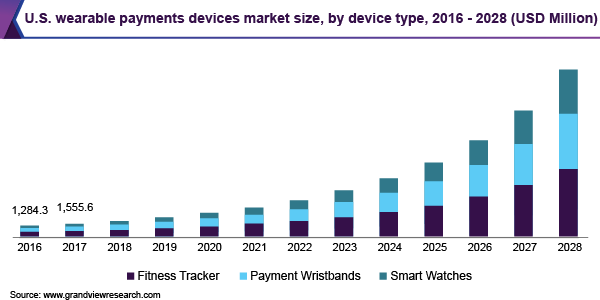

Wearable Payments Devices Type Outlook (Revenue, USD Million, 2016 - 2028)

- Fitness Tracker

- Payment Wristbands

- Smart Watches

Wearable Payments Devices Technology Outlook (Revenue, USD Million, 2016 - 2028)

- Barcodes

- Contactless Point of Sale (POS) Terminals

- Near Field Communication (NFC)

- Quick Response (QR) Codes

- Radio Frequency Identification (RFID)

Wearable Payments Devices Application Outlook (Revenue, USD Million, 2016 - 2028)

- Festival & Life Events

- Fitness

- Healthcare

- Retail

- Transportation

- Others

Wearable Payments Devices Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

April 2016: Jawbone, in collaboration with American Express, launched the NFC chip-enabled UP4 fitness band. This wristband allows users to pay directly from their devices.

Key Companies profiled:

Some prominent players in the global Wearable Payments Devices Industry include

- Apple, Inc.

- Barclays PLC

- Gemalto NV

- Google LLC

- Mastercard

- Nymi

- PayPal Holdings Inc.

- Samsung Electronics

- Visa Inc.

- Wirecard

Order a free sample PDF of the Wearable Payments Devices Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment