Australia Kids Scooter Industry Overview

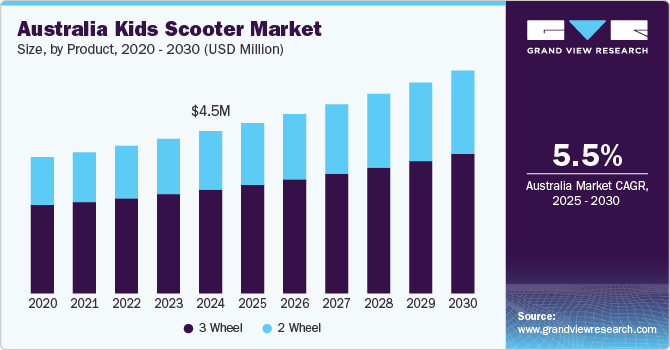

The Australia kids scooter market size was valued at USD 3.78 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2021 to 2028. The growing concerns among parents with regard to improving child health are expected to be one of the main factors driving the demand for kids' scooters. Various health experts have recommended that scooting can improve body functionalities, such as metabolism, cardiopulmonary health, and blood circulation. In addition, this activity helps in increasing height, mobility, and immunity, which aids in the prevention of several diseases, such as obesity and related disorders. Revised safety laws in different cities have also led to an increasing number of kids riding scooters. In December 2019, the Australian Capital Territory (ACT) Government announced the legalization of the use of electric scooters on footpaths and shared paths, following increased public demand. With the legalization in place, Canberra residents can now use their e-scooters at up to 15 km/h on footpaths and up to 25 km/h in all other permitted locations.

Companies in the market are launching new products in attractive colors and designs. A number of players are also introducing non-electric scooters in a variety of shapes, designs, and functionalities to gain market share. For instance, in November 2019, Bird, a micro-mobility company based in Santa Monica, California, announced the launch of its three-wheeled kids' scooter Birdie in three colors: jet black, dove white, and electric rose. The variants were available for purchase through the holiday season at USD 129.

Gather more insights about the market drivers, restraints and growth of the Australia Kids Scooter market

In order to gain a new customer base and boost revenue growth, several manufacturers are focusing on building innovative products, which are comfortable and safe and can be recognized by product experts and designers. Gaining experts’ and parents’ trust is one of the key factors to drive their sales in the years to come and establish their position in the market. For instance, in 2018, Globber’s EVO COMFORT all-in-one 3-wheel scooter for kids was voted as the best outdoor product by My Child during the Excellence Awards 2018. My Child is a renowned Australian magazine that aims to help parents by providing parenting tips and product information. Over 22,000 parents voted for their favorite product on My Child’s website and EVO COMFORT was voted as No1. This recognition helped elevate the company’s brand image and boost its revenue growth.

The recent outbreak of COVID-19 has impacted the growth of the market in Australia. With the local state's stay-at-home advisory and mandatory closure of nonessential businesses across Australia and the rest of the world, the delivery of kids' scooters is either halted or taking longer than usual. In addition, the industry is witnessing supply chain disruptions across the globe.

The demand for substitutes such as bicycles and skateboards has also increased, further challenging the growth of the market. According to Bicycles Online, the sales of bikes witnessed a 302% increase in sales in March 2020 compared to March 2019. With the trend continuing in April 2020, the company was estimated to sell 2,000 bikes that month. There has been a 267% increase in city (urban/commuter) bikes, 170% increase in mountain bikes, and 156% increase in kids' bikes sales in March 2020 compared to March 2019.

Browse through Grand View Research's Consumer Goods Industry Related Reports

Kids Scooter Market - The global kids scooter market size to be valued at USD 73.2 million by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 2.7% during the forecast period.

Electric Scooters Market - The global electric scooters market size was estimated at USD 20.78 billion in 2021, and the market is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2022 to 2030.

Australia Kids Scooter Industry Segmentation

Grand View Research has segmented the Australia kids scooter market on the basis of product, type, and distribution channel:

Australia Kids Scooter Product Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2016 - 2028)

- 2 Wheel

- 3 Wheel

Australia Kids Scooter Type Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2016 - 2028)

- Electric

- Non-electric/Kick

Australia Kids Scooter Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2016 - 2028)

- Online

- Offline

Key Companies profiled:

Some prominent players in the Australia Kids Scooter Industry include

- Micro Scooters Australia

- Razor USA LLC

- Globber

- Fuzion Scooter

- Radio Flyer

Order a free sample PDF of the Australia Kids Scooter Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment