Data Center Colocation Industry Overview

The global data center colocation market size was valued at USD 44.42 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 13.3% from 2021 to 2028. Data centers have emerged as an inseparable part of modern business practices responsible for running critical business applications. IT infrastructure over the years has emerged as a necessity for enterprises that seek to run their businesses effectively. As the demand for data centers surged through the last couple of years, cloud and colocation became a vital asset for several businesses that need to scale up their IT capabilities. Colocation data centers were a boon for enterprises that needed quick IT upscaling; however, they lacked the expertise or monetary resources required to do so.

Therefore, high costs associated with owning and maintaining a data center, particularly for companies that generate inconsistent data volumes, are expected to be a key factor favoring the market growth. Apart from capital expenditure savings, data center colocation offers several other benefits to customers. Research studies suggest that owning or constructing a data center facility can cost over USD 300 per square foot, which is in addition to the cost incurred for laying the required fiber cabling. In situations like these, in-house handling of an entire data center facility is a high-cost component for SMEs, whereas large-scale organizations can easily absorb this cost. Data center colocation is one such solution that supports SMEs with a viable and affordable alternative of renting data center space, which is expected to drive the market growth over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Global Data Center Colocation market

The growing volume of data from social media and Over-The-Top (OTT) platforms has augmented the demand for data centers and colocation services. The number of active users on social media is rising exponentially and, thus, contributing to the growing data from these platforms. For instance, the total number of monthly active Facebook users in 2020 rose to approximately 2.74 billion as compared to 2.38 billion in 2019. The number of social media users is estimated to rise even more in the coming years, which, in turn, is anticipated to drive the demand for colocation centers. Furthermore, the Covid-19 pandemic has resulted in the growing usage of OTT and streaming services leading to increased data volumes, which is expected to fuel the market growth.

The emergence of technologies, such as the Internet-of-Things (IoT), cloud computing, autonomous vehicles, and advanced robotics, has resulted in the increased demand for higher bandwidths and faster data processing. The successful usage of these technologies requires lower latency and faster network connectivity. Colocation data centers are suitable to fulfill such requirements as the operators can locate their data center facilities in proximity to the users, thereby offering enhanced storage and networking services. In addition, the emergence of 5G is expected to boost the deployment of colocation services as it provides an opportunity for colocation providers to offer services in remote locations.

The rising adoption of cloud data centers, owing to their lower costs is expected to act as an inhibitor to market growth. Smaller organizations are increasingly adopting cloud services as they offer scalable low costs, eliminate the need for IT staff, and have lesser overheads. Colocation centers offer cost benefits in the long run along with flexibility in terms of total server control. Owing to these features, enterprises are widely opting for colocation services.

Browse through Grand View Research's Technology Industry Related Reports

Data Center Construction Market - The global data center construction market size was valued at USD 207.2 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2020 to 2027.

Europe Data Center Colocation Market - The Europe data center colocation market size was valued at USD 12.81 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 13.1% from 2021 to 2028.

Data Center Colocation Industry Segmentation

Grand View Research has segmented the global data center colocation market on the basis of colocation type, enterprise size, end-use, and region:

Data Center Colocation Type Outlook (Revenue, USD Million, 2016 - 2028)

- Retail

- Wholesale

Data Center Colocation Enterprise Size Outlook (Revenue, USD Million, 2016 - 2028)

- SMEs

- Large Enterprises

Data Center Colocation End-use Outlook (Revenue, USD Million, 2016 - 2028)

- Retail

- BFSI

- IT & Telecom

- Healthcare

- Media & Entertainment

- Others

Data Center Colocation Regional Outlook (Revenue, USD Million, 2016 - 2028)

- North America

- Europe

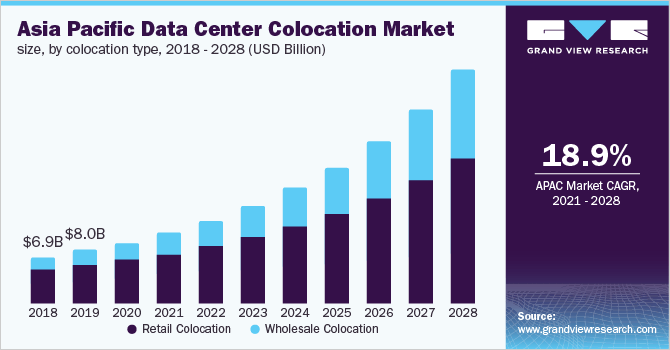

- Asia Pacific

- Latin America

- Middle East & Africa

Market Share Insights:

March 2020: Digital Realty Trust, Inc. announced the acquisition of InterXion with an aim to meet the demands for colocation and hyperscale requirements in the Americas, EMEA, and Asia Pacific regions.

February 2020: Equinix, Inc. announced the launch of its data center in Melbourne, Australia, to support the demand from the government’s smart city development plans and the interconnection requirements of local customers.

Key Companies profiled:

Some prominent players in the global Data Center Colocation Industry include

- China Telecom Corp. Ltd.

- CoreSite Realty Corp.

- CyrusOne, Inc.

- Cyxtera Technologies, Inc.

- Digital Realty Trust, Inc.

- Equinix, Inc.

- Global Switch

- NaviSite

- NTT Communications Corp.

- Telehouse

Order a free sample PDF of the Data Center Colocation Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment