Integrated Workplace Management System Industry Overview

The global integrated workplace management system market size was valued at USD 3.42 billion in 2020. It is expected to expand at a compound annual growth rate (CAGR) of 12.8% from 2021 to 2027. The continuous adoption of digital workplace solutions and automation of facility management processes are expected to drive market growth. Organizations are increasingly shunning conventional approaches and switching to digital solutions for activities such as lease management, facilities and space management, asset and maintenance management, and project management. Along with this, the rising demand for efficient and improved operational solutions, which is leading to the increased sophistication of solutions and services, is anticipated to drive the demand for integrated workplace management systems (IWMSs). Furthermore, advantages offered by these systems, such as integrated processes, real-time tracking, less energy consumption, disaster recovery, safety and security, and data center consolidation, are anticipated to drive the market over the forecast period.

The adoption of technologies such as advanced analytics, advanced sensors, Software as a Service (SaaS), and mobility is gaining momentum across the globe, driving the demand for enterprise integration. This, in turn, is leading to the increased deployment of IWMS across organizations. Organizations across the globe lack transparency and insight in their facilities and corporate processes as well as the related data. Deployment of an IWMS offers organizations transparency across all relevant aspects by forming a structured and standardized data repository for all corporate processes. As organizations become more aware of the several benefits of IWMS, their demand is further anticipated to rise over the forecast period.

Gather more insights about the market drivers, restraints and growth of the Global Integrated Workplace Management System market

Intense competition across several industries has necessitated that businesses make quick and right decisions to stay competitive. Mergers and acquisitions, budget constraints, reorganizations, and other economic factors put pressure on businesses. This increases the demand for integrated and reliable management information to support decision-making processes. An IWMS supports strategic, tactical, and operational decision-making with analysis, reports, and dashboards, and allows businesses to create specific analysis or output based on historical trends and future forecasts.

IWMS vendors are facing challenges in the wake of the COVID-19 pandemic. The pandemic has compelled organizations across several industries to temporarily stop spending on new automation initiatives. However, this spending is expected to accelerate from 2021 onwards. Additionally, market players are expected to witness a significant decline in their revenues in 2020, which is likely to put additional pressure on them to reduce costs. Moreover, the market is likely to benefit from the potential increase in the demand for advanced IWMS solutions with social distancing benefits and risk management capabilities, best suited to new regulations and guidelines regarding workforce safety, post the pandemic.

However, lack of awareness about IWMS and its importance in organizations is anticipated to hamper the market growth to a certain extent. Furthermore, myths such as high implementation costs and the requirement of extensive training for the implementation of IWMS are also restricting the market growth. Several IWMS vendors license software and technologies from third-party providers. These third-party providers may not continue to partner on commercially reasonable terms, thus software and technologies may not be appropriately maintained or supported by the licensors, which may result in delays in the development process.

Browse through Grand View Research's Technology Industry Related Reports

Asset Management Market - The global asset management market size was valued at USD 216.98 billion in 2019. It is expected to expand at a compound annual growth rate (CAGR) of 25.9% from 2020 to 2027.

Advanced Analytics Market - The global advanced analytics market size was valued at USD 34.56 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 21.1% from 2022 to 2030.

Integrated Workplace Management System Industry Segmentation

Grand View Research has segmented the global integrated workplace management system market based on solution, service, deployment, enterprise size, end-use, and region:

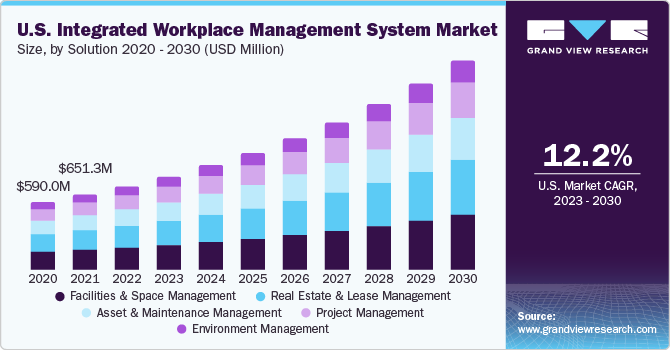

Integrated Workplace Management System Solution Outlook (Revenue, USD Million, 2016 - 2027)

- Real Estate & Lease Management

- Facilities & Space Management

- Asset & Maintenance Management

- Project Management

- Environment Management

Integrated Workplace Management System Service Outlook (Revenue, USD Million, 2016 - 2027)

- Professional Services

- Managed Services

Integrated Workplace Management System Deployment Outlook (Revenue, USD Million, 2016 - 2027)

- On-premise

- Cloud

Integrated Workplace Management System Enterprise Size Outlook (Revenue, USD Million, 2016 - 2027)

- Large Enterprises

- Small & Medium Enterprises

Integrated Workplace Management System End-use Outlook (Revenue, USD Million, 2016 - 2027)

- Public Sector

- IT & Telecom

- Manufacturing

- BFSI

- Real Estate & Construction

- Retail

- Healthcare

- Others

Integrated Workplace Management System Regional Outlook (Revenue, USD Million, 2016 - 2027)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Market Share Insights

June 2020: SAP SE entered into a partnership with Honeywell International Inc. to jointly create cloud-based a solution to improve smart building operations. The solution is based on Honeywell Forge and SAP Cloud Platform to combine and streamline business and operational data for better decision-making.

May 2020: Trimble Inc. introduced ManhattanONE, a software suite for centralizing portfolio, workplace, building, and finance lease information, which enables data monitoring of real-estate data and facilitates the evidence-based decision-making process.

Key Companies profiled:

Some prominent players in the global Integrated Workplace Management System Industry include

- Accruent

- ARCHIBUS, Inc.

- FM:Systems

- FSI (FM Solutions) Limited

- International Business Machines Corporation

- MRI Software LLC

- Nemetschek Group (Spacewell)

- Planon

- SAP SE

- Trimble Inc.

Order a free sample PDF of the Integrated Workplace Management System Market Intelligence Study, published by Grand View Research.

No comments:

Post a Comment